See Debt Consolidation Loan options online in minutes…

Easily compare the latest debt consolidation loan deals available to you from all the leading UK lenders with DirectQuote, our industry leading, secure online loan comparison.

![]()

Your home is at risk if you do not keep up repayments on a mortgage or other loan secured on it.

Easily compare the latest debt consolidation loan deals available to you from all the leading UK lenders with DirectQuote, our industry leading, secure online loan comparison.

![]()

We’ll show you the best debt consolidation loan deals available to you from the secured loan market. You can even change the loan amount and term in real time to ensure the monthly payments are right for you and see how much difference consolidating could make to your finances each month.

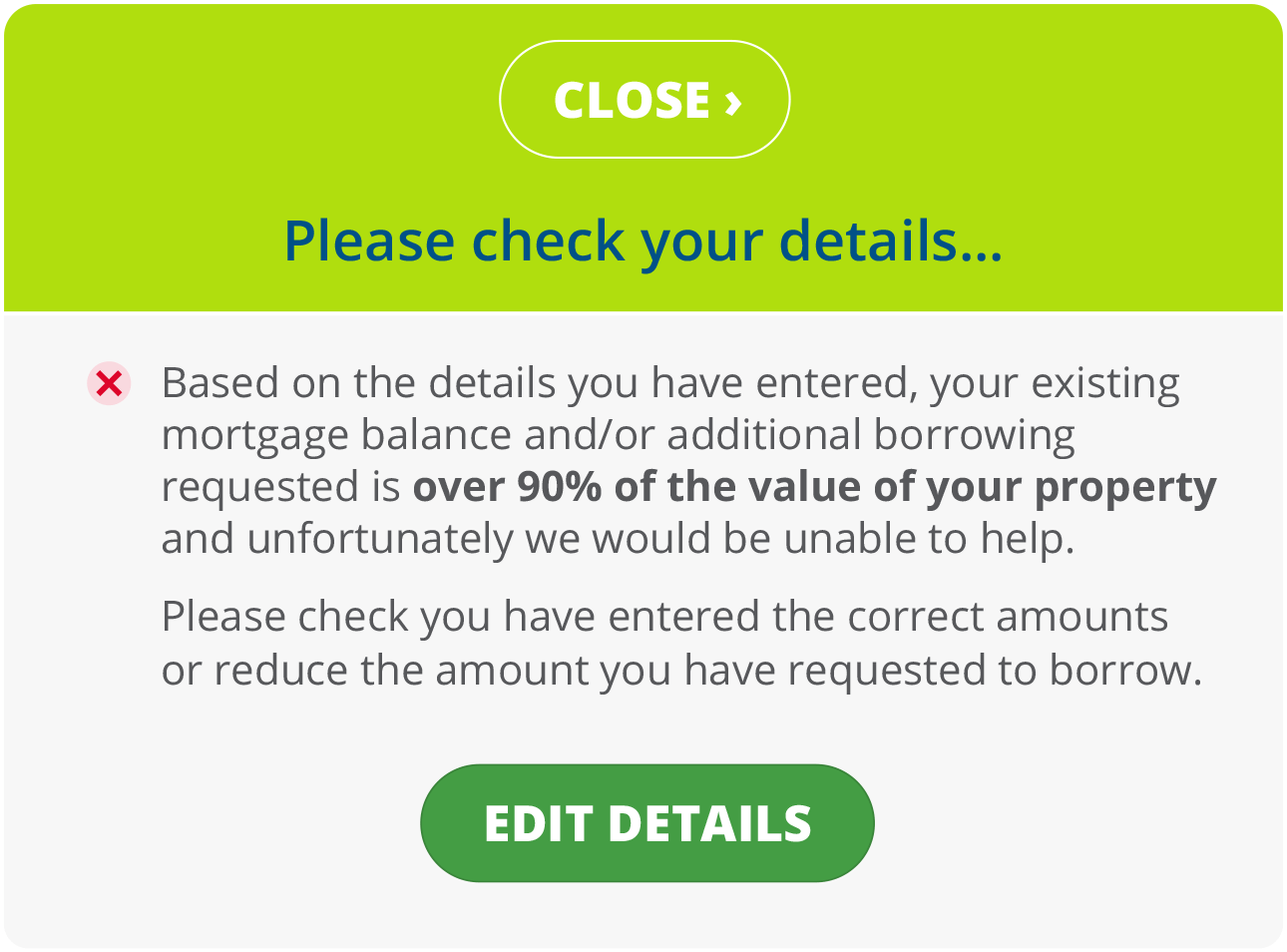

Our online quote form will check the affordability of the loan (with no affect to your credit score) so you can be confident that you’ll be accepted. And, if you don’t qualify for the full loan amount – we’ll show you the maximum debt consolidation loan amount you could be accepted for.

Simply apply online or call us on 0800 029 1671 for a fast loan quote.

If you’re unsure which Debt Consolidation Loan option is right for you – call today to speak with one of our loan experts or talk with us via our live advisor help chat.

1

Calculate total amounts owed on credit cards, loans, and other borrowing.

2

Borrow enough to pay off all existing debts completely.

3

Use loan funds to clear all outstanding balances.

4

Replace multiple payments with one manageable amount.

5

Benefit from potentially lower rates and simplified finances.

Find the right debt consolidation loan option for your needs and circumstances.

| Loan Type | Amount Range | Typical Rates | Best For |

| Secured consolidation | £10,000-£500,000 | 4.5%-15% APR | Large debt amounts, homeowners |

| Unsecured consolidation | £1,000-£50,000 | 6%-35% APR | Smaller amounts, good credit |

| Bad credit consolidation | £5,000-£100,000 | 8%-25% APR | Poor credit histories |

| Guarantor loans | £1,000-£15,000 | 9.9%-49.9% APR | Limited credit, need guarantor |

Find the right debt consolidation loan option for your needs and circumstances.

| Debt Type | Balance | Rate | Monthly Payment |

| Credit Card 1 | £8,000 | 22.9% | £240 |

| Credit Card 2 | £5,500 | 19.9% | £165 |

| Personal Loan | £12,000 | 14.9% | £280 |

| Store Card | £2,000 | 29.9% | £80 |

| Total | £27,500 | - | £765 |

A monthly saving in credit outgoings of £287 and an annual saving of £3,444.

| New secured loan | Balance | Rate | Monthly Payment |

| Secured loan over 7 years | £30,000 | 8.9% | £478 |

Imagine consolidating and doing the same with your finances.

Ideal scenarios

Consider alternatives if:

Debt consolidation calculator

Compare your current costs against what a new loan could offer.

Affordability checker

Ensure new payments fit your budget and see what you could be accepted for.

Secured Consolidation Benefits:

Secured Consolidation Risks:

Initially it may dip slightly, but consistent payments on the new loan should improve your score over time.

Yes, secured consolidation loans are often available even with poor credit histories.

Consider keeping them open but unused to maintain available credit, which can help your credit score.

This is a common risk – ensure you have a budget and financial discipline before consolidating.

Get a free debt consolidation assessment – see how much you could save with expert guidance.