Introducing the new flexible credit loan for homeowners

Have you ever thought it would be great to apply for a loan amount that covers your needs, but only charges interest on the amount you actually borrow?

A Flexible Credit loan (sometimes referred to as a HELOC loan) through Deal Direct could be the perfect answer. It combines all the benefits of an affordable secured loan, but you pay less interest if you don’t draw the full amount you arranged.

Find the right loan to suit your needs

Using our industry leading DirectQuote system your best secured loan rate options are just a few clicks away. It’s a real-time process that’s fast, secure, accurate and won’t affect your credit score

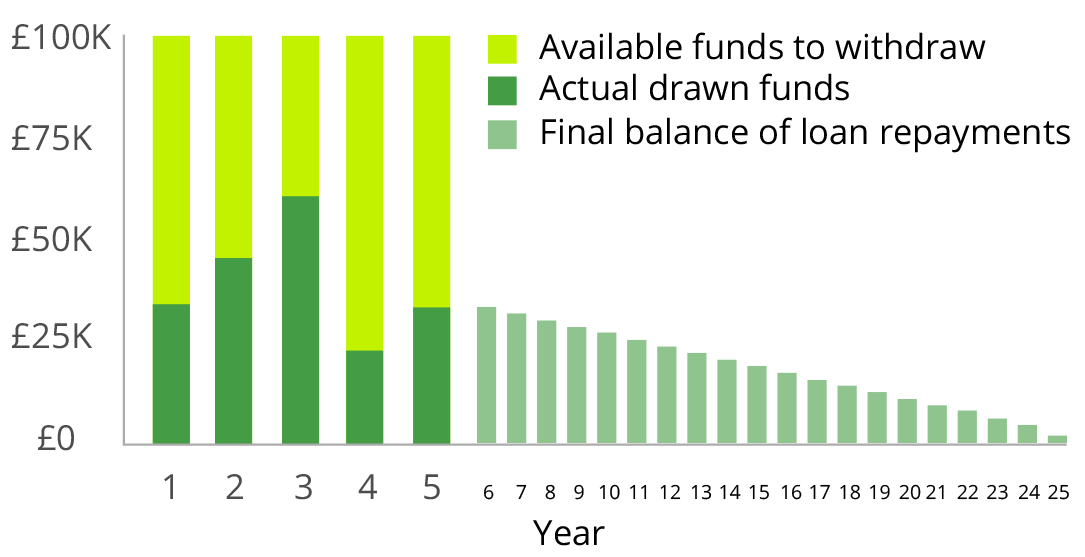

Example of a £100,000 flexible credit loan over 25 years

Flexible credit loans – 3 key points

There are a few simple things to consider when applying for a Flexible Credit Loan…

1

Consider how much you might want to borrow

First, think about how much you may need to borrow and for how long. For example if it is for home improvements, there could be unexpected costs that accrue as the project unfolds. It’ll be easier to anticipate this by arranging the right loan amount at the outset, instead of dealing with the hassle and possible expense of having to arrange additional finance at a later stage.

2

Flexible borrowing could mean lower interest charges

For the first 5 years you can draw down your loan funds, which may be significantly less than the full loan amount that was arranged for you. This means your interest payments during this period will be appropriate to the reduced borrowing. Conversely, if you borrowed the full amount initially, but wanted to clear some of that borrowing at a later date to reduce interest payments, you can.

After the initial 5 year period, the amount you repay over the remaining term is determined by the amount you used in the initial 5 year period.

3

A flexible credit facility means peace of mind

By choosing a Flexible Credit Loan, you can comfortably manage your borrowing needs, up or down, for the whole of the first 5 years. It can make life so much easier, knowing you can access funds for anything you need, all pre-arranged and available the instant you need it. As long as you don’t exceed the amount you initially arranged, you can draw funds at any time.

Speak to a secured loan expert

If all this sounds a little daunting, don’t worry, our loan experts are on hand to answer any questions you may have and help you find the right secured loan for you.

Call 0800 029 1671

Why choose a secured loan?

There are many reasons for choosing a secured loan – maybe you don’t want to remortgage as you have a great deal with your mortgage provider that you don’t want to lose, or you want to avoid costly early repayment charges that remortgaging could bring, or maybe you want to consolidate expensive loans and credit cards with one simple monthly repayment?

Whatever the reason, we’re here to help make sure you get the right secured loan for you, with all the help and expert advice you need. And what’s more – it’s a FREE service.

3 possible reasons for a secured loan

Borrow a large amount

With a secured loan you can usually borrow a larger sum of money than you would be able to with an unsecured loan.

Consolidate expensive loans & credit cards

Pay off your debts including credit cards, store cards, personal loans and overdrafts with one simple and easy to manage monthly repayment.

Home improvement

A home improvement secured loan can be a cheaper way of funding improvement than taking out an unsecured loan or maxing out your credit cards.

What paperwork will I need?

Applying for a secured loan you will typically need the following paperwork:

- Proof of income (your last three months’ payslips, or two to three years’ accounts if self-employed).

- Three months’ worth of bank statements

- Proof of any bonuses or commission you have received

- Your latest P60 tax form

- SA302 tax return forms, (mainly for the self-employed)

Why not see the best possible secured loan rates available to you…

through DirectQuote

Search for the best secured loan rates with DirectQuote, and you’ll have access to a system that’s on its own as a search tool. Click ‘Find my best deal’ to complete some details, and within minutes you’ll see a range of loan rate and repayment options that are tailored to your needs. The results are seen in real-time, and are the latest figures from a whole-of-market UK loan search.

A search that can deliver the best results for you

Deal Direct has helped thousands of customers source the very best loan rates, not only through the accurate and UK-wide search it provides, but because the DirectQuote system can take your application through to completion with utmost efficiency. You’ll have complete confidence at every stage and all the support you need from our experienced team of secured loan specialists.

Compare the best available loan rates from UK lenders

We’re more than just a loan broker.

With Deal Direct, you don’t just get a leading UK secured loan broker, you get a dedicated team of professionals to support your application from start to finish. We build trust and we act for each and every customer to ensure the product, the rate and the deal as a whole is the best it can possibly be. We’re immensely proud of our 5 star customer rating, and of each and every individual review.

Some straightforward secured loan rate advice…

1

Search the whole of UK market

Getting the best secured loan rate relies on the ability to search far and wide to get the best options, with up-to-the-minute loan rates and repayments.

3

Trust a process designed for you

From application right through to completion, our application process removes stress, delays and complications, so everything is straightforward.

2

Impartial advice means confidence

Deal Direct’s loan experts are on hand to help you make all the right decisions for your future financial security with complete impartiality.

4

Don’t wait to apply

It costs nothing to apply, not even a credit search. If you think you want to consider a secured loan, it’s a good idea to start now so you have time to plan wisely.

Experience 5 Star Customer Service with Deal Direct

Efficient & professional service

From the first contact, we had enquiring about types of mortgages to the final contact receiving confirmation that the funds had been released, the advisors were knowledgeable and professional. Responses to all our queries were always quick & comprehensive. Great service.