Related articles...

Barclays Debt Consolidation Remortgage Case Study 2025

Discover how a debt consolidation remortgage transformed the financial landscape for a 60-year-old professional from the South of England. Struggling with high-interest credit card debt and seeking funds for home improvements, she turned to Barclays Bank, which offered the flexibility needed for her situation. By consolidating £15,990 of debt and raising £10,153 for renovations, she achieved manageable monthly payments and simplified her finances. This case highlights the benefits of tailored mortgage solutions for long-term financial control and peace of mind.

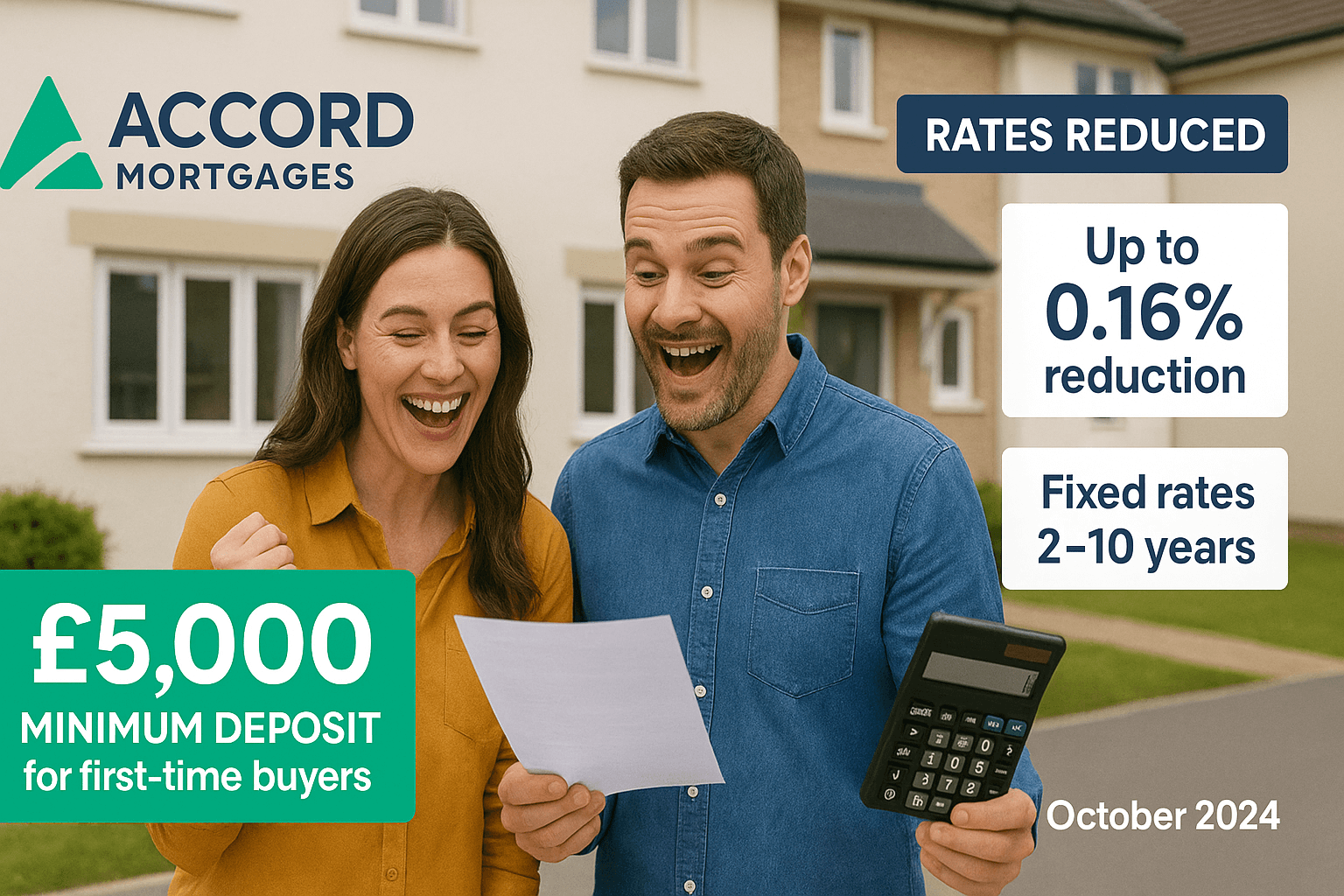

Accord Mortgages Rate Cuts October 2025 – Fixed Rates Reduced

Accord Mortgages has announced significant rate reductions across its Residential New Business product range, effective from 8am on 2 October. With reductions of up to 0.16% on fixed rates, prospective homeowners and those looking to remortgage can benefit from improved affordability and stability in a volatile market. These changes offer substantial opportunities for first-time buyers and home movers, making it an ideal time to explore new mortgage options. Contact Accord’s expert advisers for assistance with your application before the old rates expire on 1 October.

Debt Consolidation Remortgage Case Study: Save £8,647 2025

Discover how a proactive debt consolidation remortgage helped a UK couple streamline their finances and save over £8,600 in interest costs. By merging their high-interest secured loan into their primary mortgage, they simplified their payments and improved their financial visibility. This strategic move not only reduced their monthly outgoings but also set them on a faster path to being mortgage-free before retirement. Learn about the benefits, challenges, and the importance of financial planning in achieving your goals.

Written by

Gareth Davies | Mortgage Advisor

About the Author: