Client Overview: High Earners in Financial Strain

A married couple in their early 40s, both employed in professional roles, were living in the UK and earning good incomes. Despite this, they found themselves under substantial financial pressure, struggling with high-interest credit card and secured loan repayments. With little disposable income left at the end of the month, they were anxious about potential interest rate or cost-of-living increases and sought financial stability and more freedom to enjoy their earnings. They saw the need for strategies like a debt consolidation remortgage by 2025 to enhance their financial security.

The Challenge: Overwhelming Monthly Commitments

With a combined debt of £77,691 across multiple high-interest credit cards and a secured loan, the couple’s monthly repayments totalled £1,716. These repayments were primarily going towards interest, not significantly reducing the loan balances. The couple didn’t have savings or any lifestyle expenses they could cut, and the financial pressure was building swiftly. Their goal was clear: reduce monthly repayments and regain financial control.

Debt Breakdown Highlights:

- Credit cards with interest rates as high as 30%

- A secured loan of over £28,000 at 9% interest

- Repayment timeline stretching over a decade

- Total repayment costs nearing £150,723 if left unmanaged

The Solution: Debt Consolidation Remortgage

To address their situation, we recommended a debt consolidation remortgage—rolling all existing debts into a new mortgage. This financial restructuring would transform multiple high-interest payments into a single, lower-interest monthly mortgage payment over the mortgage term. This decision was aligned with their plans for a debt consolidation remortgage strategy in 2025.

The couple consolidated debts totalling £77,691, including:

- High-balance credit cards

- A 9% interest secured loan

We discussed at length the implications of consolidating unsecured debts into a mortgage, such as increased total interest paid over the loan term and the risk associated with securing previously unsecured debt. Still, the couple agreed the benefits—especially improved monthly cash flow—outweighed the long-term cost increases.

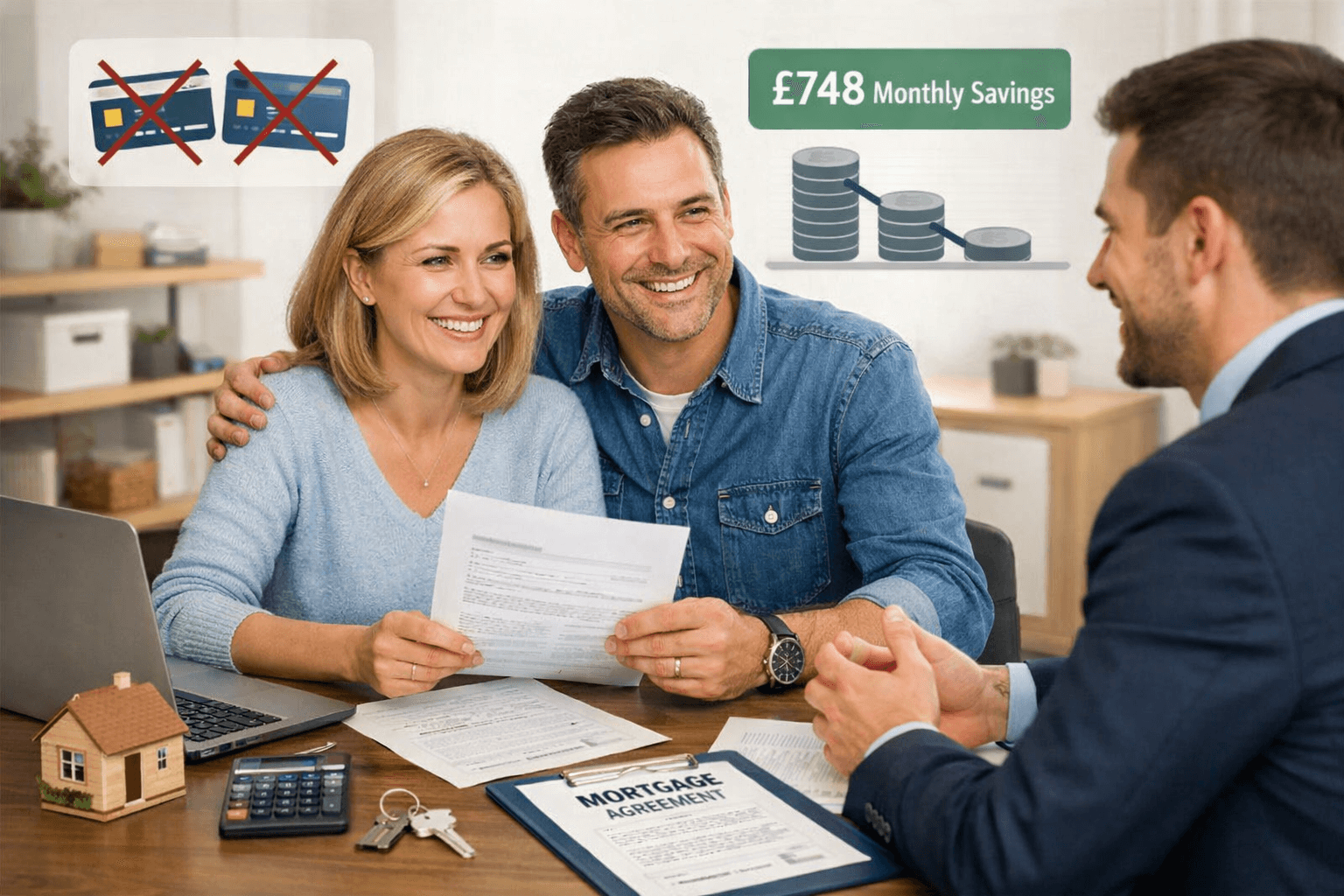

The Outcome: Significant Monthly Savings and Financial Freedom

After remortgaging, the clients experienced an immediate and tangible financial transformation:

- Monthly savings of approximately £1,383.40

- Reduced number of monthly creditors, easing management of finances

- Improved cash flow, enabling better preparedness for emergencies and future savings

- Improved credit score potential due to fewer active credit accounts and lower utilisation

“This remortgage has changed our lives. For the first time in years, we’re not living month-to-month. We finally have breathing room and can even start saving.” – Anonymous client

While the couple will repay an estimated £150,720.54 over the term—roughly £1.94 for every £1 borrowed—they are now enjoying immediate relief from financial strain and are less vulnerable to interest rate or living cost increases. Their decision around debt consolidation remortgaging has undeniably opened pathways to more financial control in 2025 and beyond.

Frequently Asked Questions

How much can I save monthly by consolidating credit card debts into a mortgage?

This depends on your current debts, interest rates, and new mortgage terms. In this example, the clients saved £1,383.40 monthly by transferring their debts into their mortgage.

Can I remortgage to fund home improvements?

Yes. In this case, the clients included final home improvement costs in the remortgage amount, which helped prevent future borrowing.

Does remortgaging affect my credit score?

Yes, in a positive way. By repaying or consolidating outstanding debts and reducing the number of creditors, your credit score can improve. Managing fewer accounts also reduces the risk of missed payments.

What documents are required for a remortgage application?

Generally, you’ll need proof of income (payslips or tax returns), ID, bank statements, and information about your current mortgage and debts. A financial advisor can help tailor the checklist to your situation.

Can I repay a fixed-rate mortgage early without penalties?

This depends on the specific mortgage terms. Many fixed-rate mortgages apply early repayment charges. It’s essential to check your mortgage offer or speak with your lender before making extra payments.

Final Thoughts

Opting for a debt consolidation remortgage can provide significant financial relief if you’re currently buried in high-interest debts. While it may increase total interest paid, it can dramatically improve your monthly budget and long-term stability—just as we’ve seen with this couple planning ahead for a debt consolidation remortgage 2025.

If you’re struggling with multiple credit repayments and want to explore how a remortgage could help you consolidate debt and increase disposable income, contact our advisors today for a free consultation.

Ready to apply or see your best options?

Find your best deals online in minutes or request a no-obligation callback from one of our expert advisors to talk through your options or just get honest advice.