Meet Lee - Senior Mortgage Adviser

Lee brings nearly three decades of financial services experience to his role as a senior mortgage adviser.

He began his career in 1996, working within the risk departments of major investment banks, where he developed a strong understanding of financial markets and risk management.

In 2004, after passing his CeMAP qualification, Lee transitioned into mortgage advice and spent nearly a decade advising clients at First Union Mortgages. He expanded his financial knowledge further by earning his CeFA qualification in 2008.

Since 2014, Lee has been part of the DDFS team, where his deep industry insight and analytical background allow him to guide clients through even the most complex mortgage scenarios with confidence.

Known for his calm, professional approach, Lee ensures every client receives clear, tailored advice based on their unique circumstances.

Read Lee's articles...

Debt Consolidation Remortgage for Single Parents

Facing high monthly commitments after separating, a UK woman successfully turned to debt consolidation remortgaging. By leveraging her property equity, she transformed £46,336 of unsecured debt into a single manageable mortgage payment, significantly reducing her monthly outgoings. This strategic move not only improved her cash flow by £1,263.60 but also allowed her to regain financial control and live independently. Explore how a debt consolidation remortgage could be the solution for you.

Debt Consolidation Mortgage: Lower Payments & Save £263/Month

Discover how a debt consolidation mortgage can help UK homeowners regain financial stability by lowering monthly payments. In this article, we explore one client's journey from multiple high-interest debts to a single, manageable loan. Learn about effective debt management strategies, the implications of securing debt against your property, and key considerations before choosing this path. With proper guidance, improving your cash flow and simplifying your finances is achievable, allowing you to focus on long-term goals and savings.

Debt Consolidation Remortgage: A Smart Solution

Discover how a debt consolidation remortgage can simplify your finances while funding vital home improvements. This article explores a client's journey to consolidate over £25,000 of high-interest debt into a single mortgage payment, offering insights into the financial benefits and potential pitfalls. Learn about improving control over your budget, securing additional funds for family events, and the importance of assessing individual circumstances before making financial decisions. If you're struggling with multiple debts, find out how a tailored remortgage could provide you with a fresh start.

Debt Consolidation Remortgage: Clear £30k Loans Case Study

In this insightful article, discover how a retired couple successfully used a debt consolidation remortgage to clear £30,000 of loans and improve their financial stability. Facing high monthly repayments and the burden of multiple unsecured debts, they opted for a structured remortgage solution, enabling them to simplify their finances while funding essential home improvements. Learn about the benefits and considerations of remortgaging as a strategy for managing debt effectively in retirement.

Debt Consolidation Mortgage: Save £540+ Monthly

Struggling with high-interest debts and rising living costs, one UK homeowner found relief through a debt consolidation mortgage. This approach allowed him to combine over £23,000 in unsecured debt into a single mortgage payment, reducing his monthly repayments significantly and increasing disposable income by approximately £540.64. This article explores his journey towards better financial control, highlighting the benefits and considerations of using a remortgage to manage debt effectively. Learn how you can take charge of your finances too!

Debt Consolidation Mortgage Case Study – Save £1,474 Monthly

Discover how a debt consolidation mortgage transformed one Midlands client’s financial situation, alleviating the stress of over £44,000 in high-interest debts. By merging her obligations into a single, manageable repayment, she gained control over her finances, achieving substantial monthly savings and enhanced cash flow. This article explores the challenges she faced, the effective solution implemented, and the positive outcomes that emerged from her journey to financial freedom.

HSBC Buy to Let Top Slicing Policy Update 2025 | New Rules

HSBC UK has enhanced its Buy to Let (BTL) mortgage offerings by introducing 'Top Slicing', effective from 6th October. This innovative policy allows applicants to use personal disposable income alongside rental income to meet affordability criteria, making it easier for professional landlords and investors in lower yield areas to secure funding. With a minimum income requirement of £50,000 and a stressed Interest Cover Ratio of 110%, this update aims to unlock greater mortgage opportunities for those who may have previously struggled to qualify. Discover how this change can benefit your property investments.

BM Solutions Energy Efficient Mortgages: New Band B Criteria 2025

BM Solutions has updated its Energy Efficient Home mortgage criteria, effective from 3 October 2025, now requiring properties to achieve a minimum Energy Efficiency rating of Band B (81 or higher). This change aims to promote sustainability in the UK housing market by incentivising landlords to improve energy performance. While properties rated Band C may still access standard mortgage products, those with higher ratings can benefit from competitive rates and tailored support. Understanding these updates is essential for homeowners and landlords looking to optimise their mortgage options.

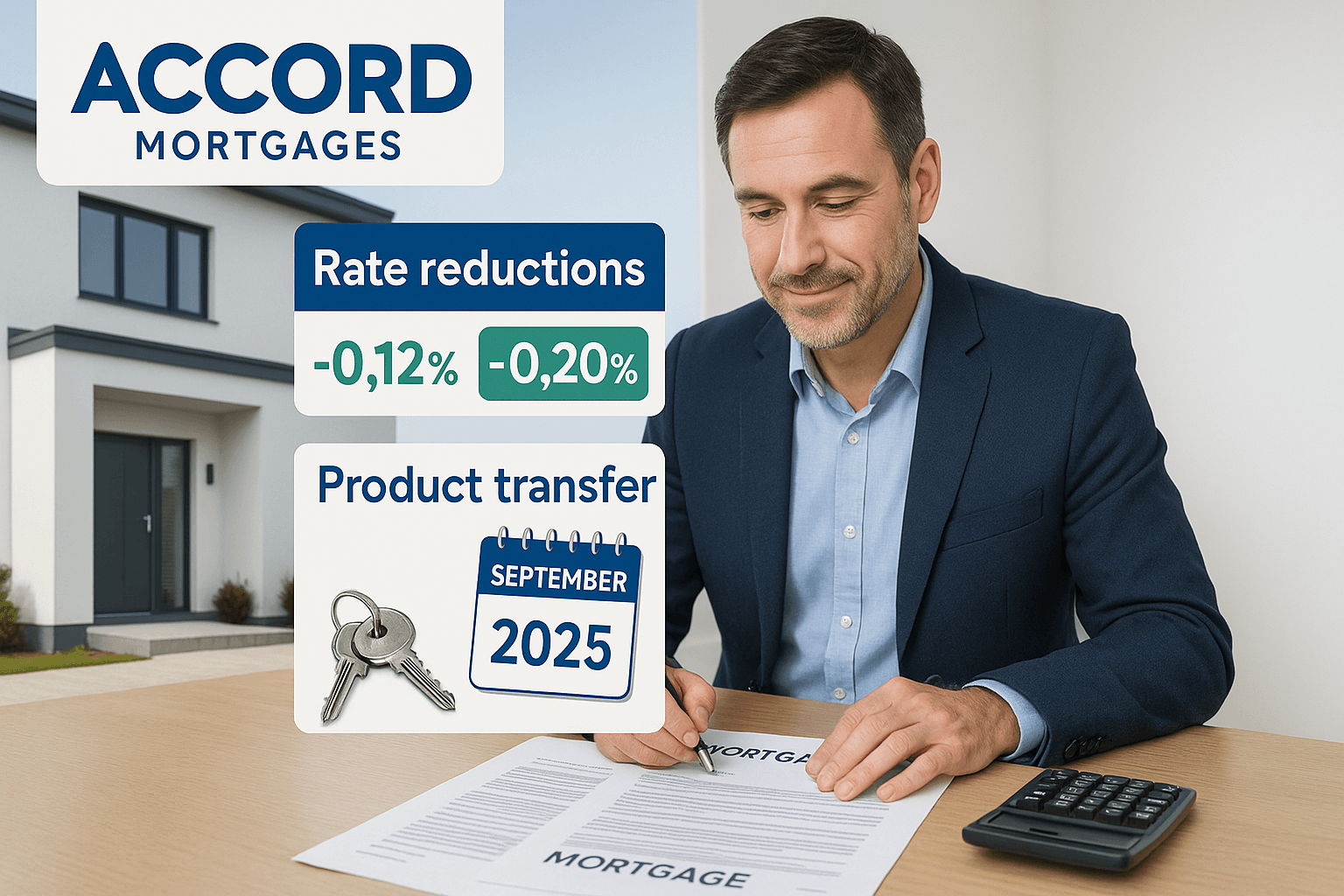

Accord Mortgages BTL Product Transfer: Lower Rates 2025

Accord Mortgages has introduced significant changes to its Buy to Let (BTL) product transfer range, effective from 26 September 2025. Landlords can benefit from lower rates on 3-year and 5-year products, while end dates have been extended to 31 January, providing increased flexibility. This update offers an excellent opportunity for existing customers to secure better deals, particularly for medium and long-term plans. However, those considering 2-year terms may face a slight rate increase. For full details, visit Accord's website or contact their team for tailored advice.

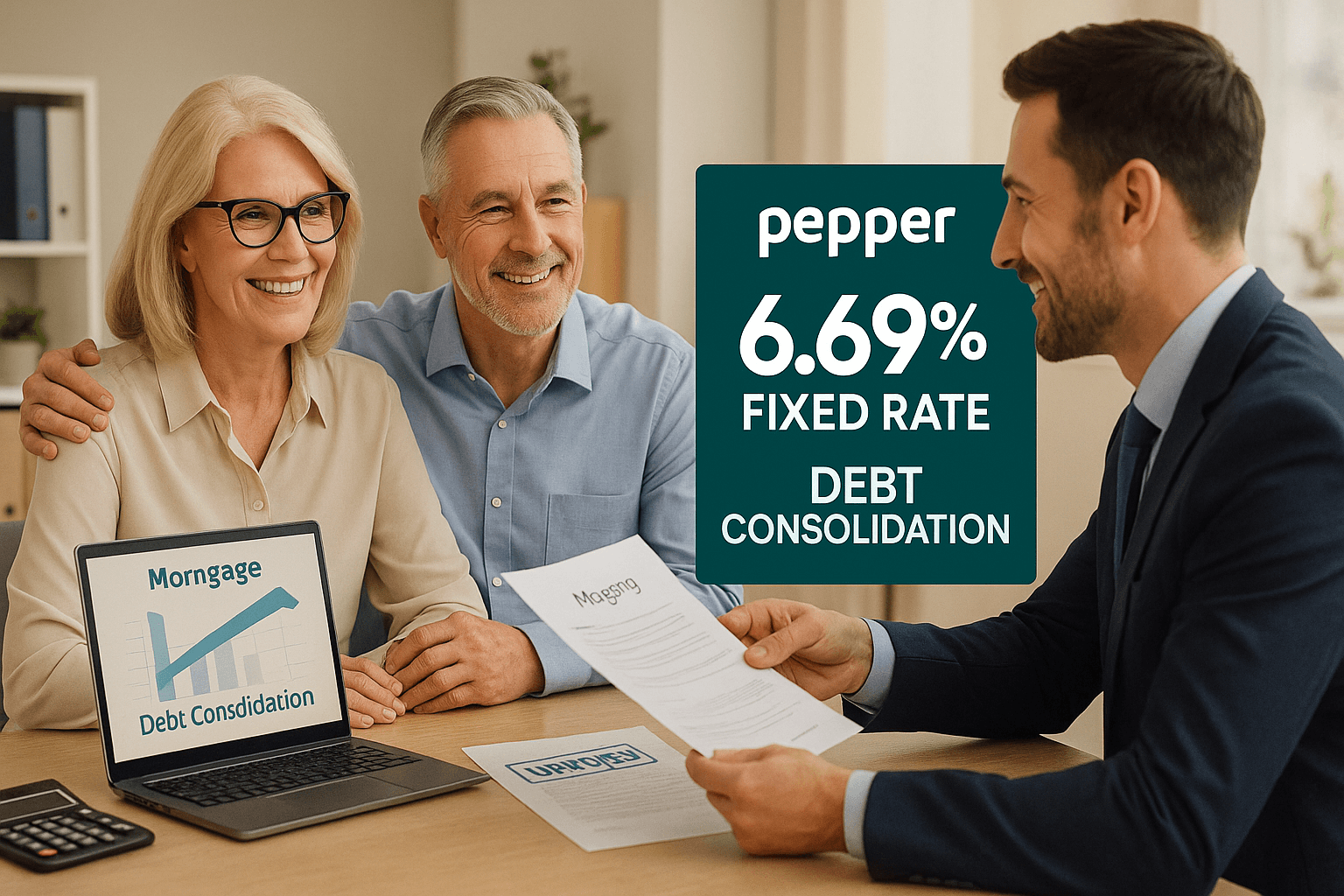

Pepper Debt Consolidation Remortgage Case Study 2025

Discover how a tailored debt consolidation remortgage transformed the financial stability of a professional couple in their 50s. Struggling with a high variable interest-only mortgage and over £31,000 in debt, they sought expert guidance to regain control. By consolidating their debts into a manageable £130,500 repayment mortgage with a fixed rate, they streamlined their finances and secured long-term home ownership. Learn how this strategic approach not only eased their monthly budgeting but also provided peace of mind for the future. Explore the benefits of debt consolidation and remortgaging today!

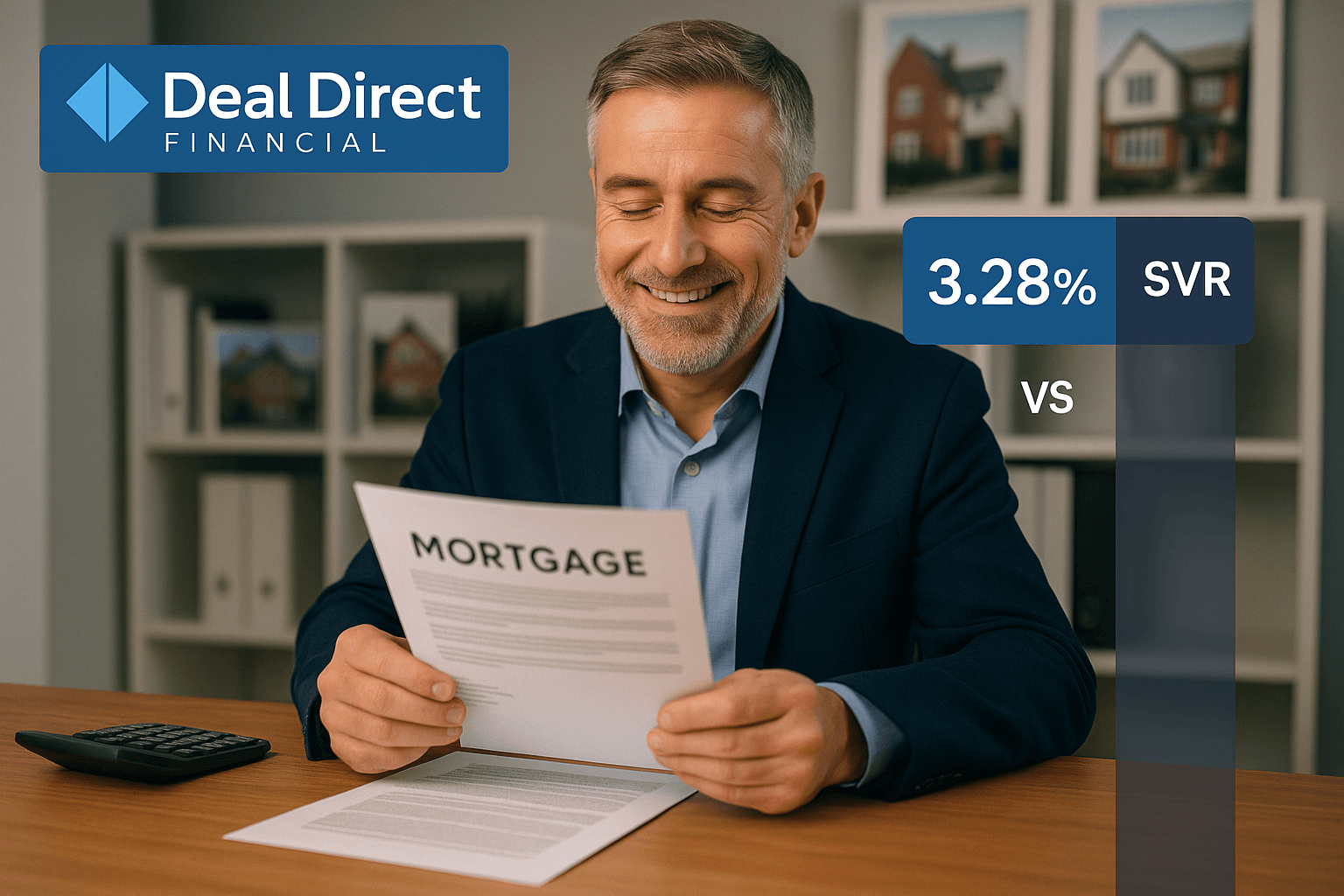

Best Buy to Let Remortgage Rates UK 2025 – Deal Direct

In this insightful case study, we explore how a landlord successfully navigated the complexities of remortgaging his buy-to-let property just days before his fixed-rate mortgage expired. Facing the risk of reverting to a costly Standard Variable Rate (SVR), he opted for a swift rate switch with his existing lender, securing a competitive 3.28% fixed rate for 20 years. This strategic move not only preserved his rental income but also provided flexibility for future market reassessment. Discover how timely decision-making can safeguard your investment and maintain cash flow in the buy-to-let market.

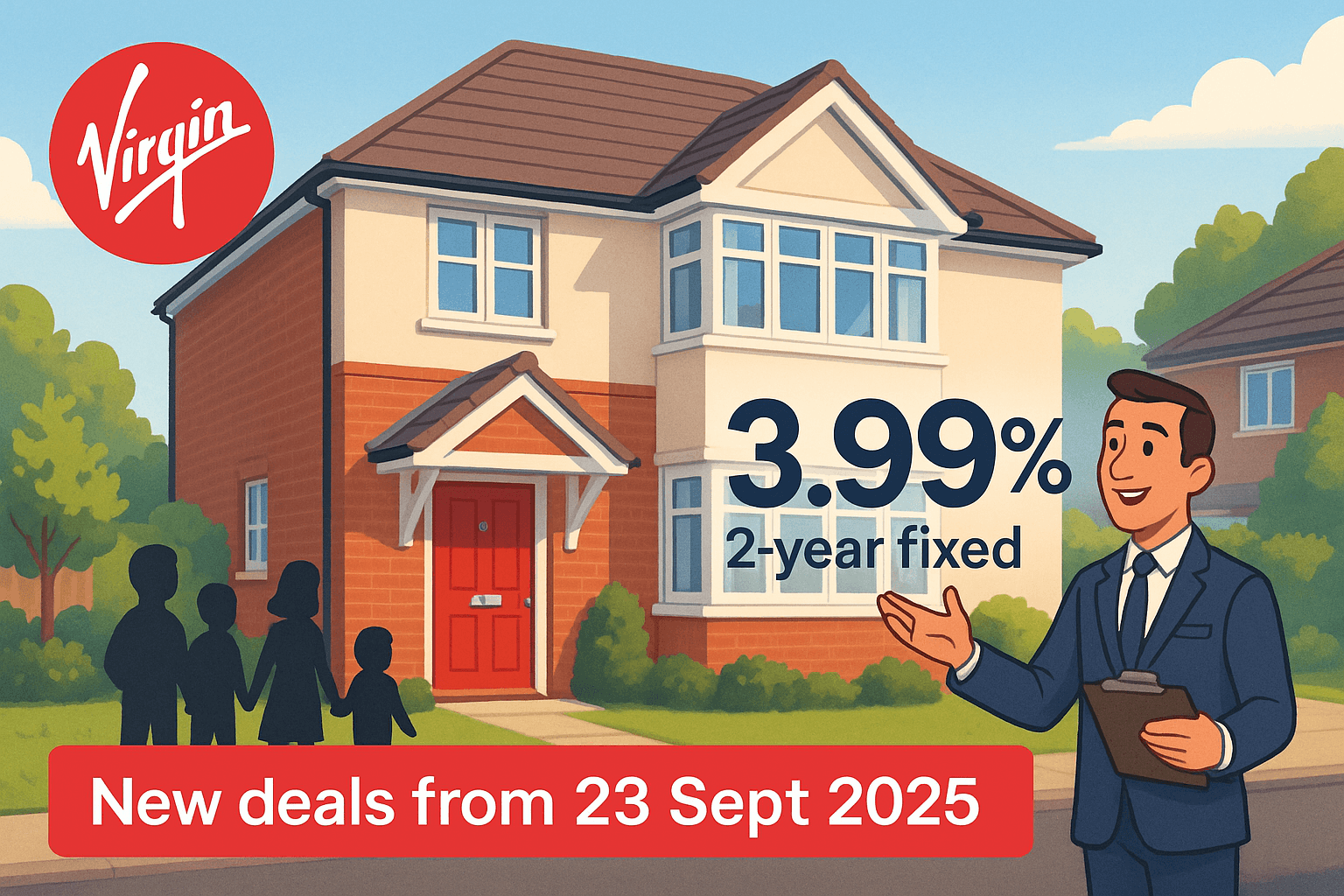

Virgin Money Cuts Mortgage Rates Sept 2025 | New BTL Deals

Virgin Money announces significant reductions in fixed mortgage rates, effective from 23 September 2025, catering to UK homebuyers, remortgagers, and buy-to-let landlords. With competitive rates starting from 2.83% and new fee-saver options, borrowers can benefit from lower monthly payments and flexible choices. This update marks an opportunity for first-time buyers and seasoned landlords alike to secure favourable terms in a dynamic market. Explore how these changes can enhance your mortgage strategy today.

TSB Mortgage Rate Increases

TSB Bank has announced significant rate increases for selected Product Transfer and Additional Borrowing mortgages, effective 24 September 2025. Homeowners considering a product switch or seeking additional funds should act swiftly to secure current rates before the deadline. These changes mainly affect existing customers with medium to high loan-to-value ratios. With flexible porting options and generous bonus income criteria, TSB remains an attractive option for borrowers. For tailored advice, contact our mortgage experts today.

Halifax Self-Employed Mortgages: 1-Year Accounts Accepted

Halifax has introduced significant changes to its mortgage criteria for self-employed individuals for the 2024/25 tax year, allowing applicants to use just one year's income evidence. This update aims to enhance mortgage accessibility and flexibility, particularly for newly self-employed borrowers. Key features include the acceptance of 1-year accounts, no averaging of income, and tailored assessments based on net profits. These changes position Halifax as a leading choice for self-employed individuals seeking competitive mortgage options and support in navigating their unique financial situations.

Co-operative Bank Mortgage Rates Rise

The Co-operative Bank is set to increase rates on its Mainstream and Buy to Let fixed-rate mortgage products effective 24 September 2025. Key changes include up to a 0.14% rise in residential mortgage rates and continued flexibility in lending criteria, catering particularly to first-time buyers and those with unique employment situations. Prospective borrowers should act swiftly, as current rates will be withdrawn by 5pm on 23 September 2025. For tailored advice, get in touch with our team today.