Managing multiple debts and high monthly outgoings can be daunting, especially when balancing life improvements and financial obligations. For one professional in Northern Ireland, sorting through several loan repayments and a variable-rate mortgage led to a smart financial decision—opting for a debt consolidation remortgage to simplify payments, reduce costs, and rebuild financial momentum. By considering a debt consolidation remortgage strategy for 2025, this homeowner is planning ahead for continued financial stability.

Customer Overview

This case involves a homeowner in his 40s working in a professional role in Northern Ireland. With a comfortable income and consistent on-time payments, the individual wasn’t struggling financially. However, multiple loans for home improvements, including a completed kitchen renovation and plans to finish the bathroom, combined with high monthly repayments, began limiting disposable income and long-term financial flexibility.

The Challenge: High Monthly Repayments and Loan Complexity

Although financially stable, this homeowner faced:

- Monthly commitments exceeding £1,300 across five different loans

- A secured loan with a high interest rate increasing his monthly burden

- A variable mortgage rate exposing him to possible payment hikes

- Desire to finish ongoing home improvements without taking on more unsecured borrowing

With a secured loan and several unsecured ones stacked against monthly bills and lifestyle expenses, the homeowner wanted to streamline outgoings, protect their credit score, and make practical use of home equity. Embracing a debt consolidation remortgage can also prepare this individual for possible financial trends in 2025.

Solution: A Strategic Debt Consolidation Remortgage

After a comprehensive financial review, a remortgage solution was proposed using the property’s built-up equity. Key steps included:

- Remortgaging the variable-rate loan into a fixed-rate mortgage

- Consolidating £44,071 in selected debts into the new mortgage to lower monthly outgoings

- Keeping smaller or soon-to-expire loans outside of the remortgage to avoid unnecessary interest

- Allocating some released equity to complete the bathroom renovation

This calculated approach ensures financial sustainability while retaining flexibility to handle unknowns using savings rather than further borrowing. Looking forward, this methodology aligns well with the principles of debt consolidation remortgage planning for 2025.

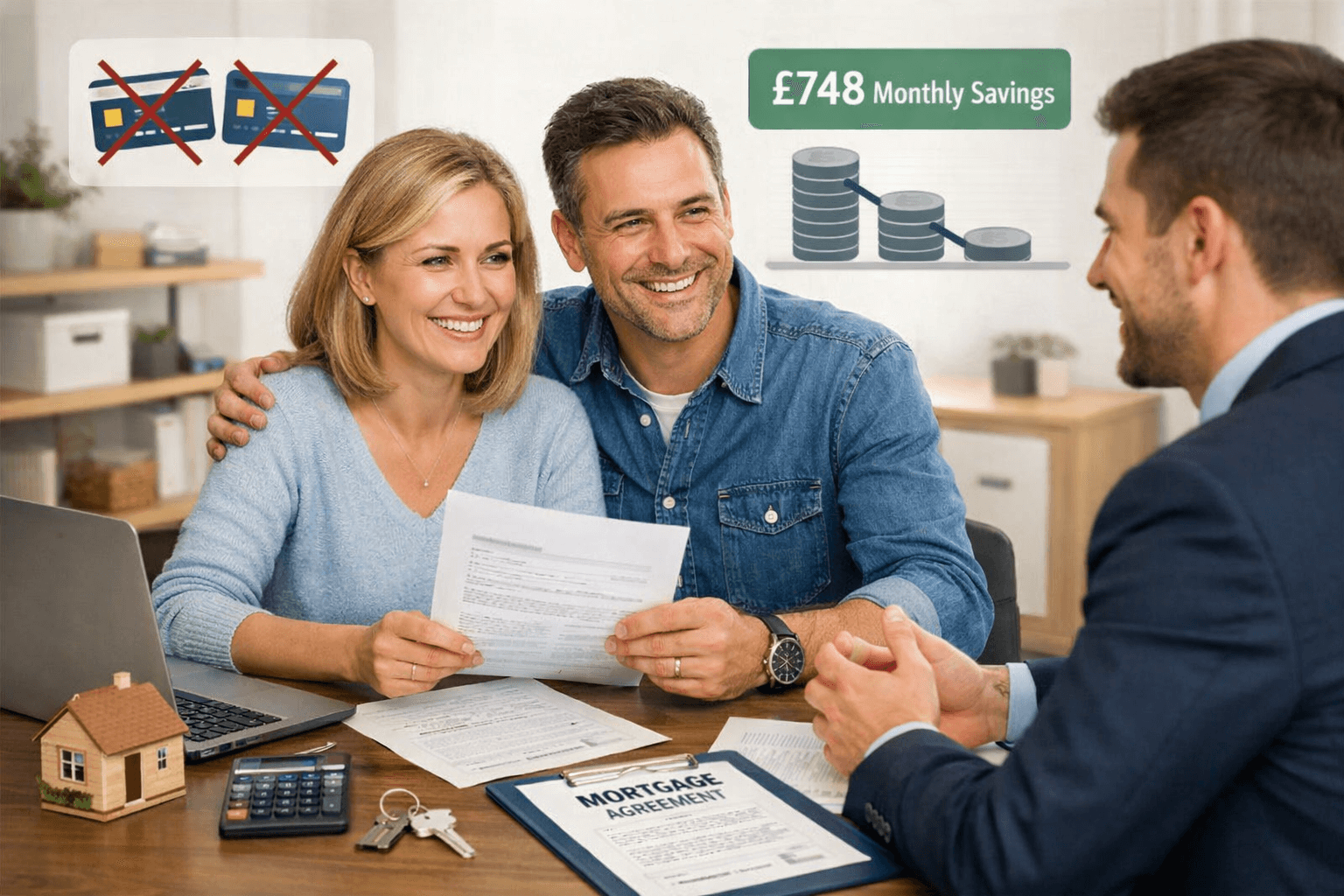

Results: Reduced Costs and Increased Financial Control

The new mortgage structure delivered significant benefits:

- Increased monthly disposable income by approximately £1,030.55

- Replaced higher interest loans with one manageable fixed-rate payment

- Allowed for regular savings contributions to continue

- Freed up funds to complete unfinished home improvements

- Prevented unnecessary refinancing or credit usage in the future

By consolidating strategically rather than blanket rolling all debt into the mortgage, the homeowner is now on a stronger financial footing and can approach future needs with confidence. The debt consolidation remortgage plan set for 2025 further enhances this financial preparedness.

“This wasn’t about being in trouble financially—it was about being sensible. I wanted fewer payments, more peace of mind, and the ability to get ahead while still saving. Now I can do that.”

Frequently Asked Questions

How much can I save monthly by consolidating credit card and loan debts into a remortgage?

In this case, the customer increased their disposable income by over £1,000 per month by combining selected debts into their mortgage. Your actual savings may vary depending on your current interest rates, terms, and balances.

Can you remortgage to fund home improvements?

Yes. With sufficient equity, you can release funds during a remortgage. This customer used part of the released equity to complete a bathroom renovation instead of incurring new loan costs.

Does remortgaging affect my credit score?

Properly structured remortgages can positively influence your credit score by reducing the number of open credit lines and improving debt-to-income ratios. However, it’s important to avoid accumulating new debt afterward.

What documents are required for a remortgage application?

Typically, you’ll need:

- Proof of income (payslips or accounts)

- Recent mortgage statements

- Identification and proof of address

- Details of existing debts (statements, balances, agreements)

Can I repay a fixed-rate mortgage early without penalties?

Some fixed-rate mortgages carry early repayment charges (ERCs). It’s essential to check your mortgage offer. In this case, overpayments were planned, and the homeowner aimed to reduce the term within allowances set by the lender.

Ready to Take Back Control of Your Finances?

If you’re juggling multiple debts, high interest payments, or looking to unlock value from your home for smarter budgeting, a debt consolidation mortgage could help. Speak with a mortgage advisor to explore your personalised options and use a remortgage calculator to begin planning today. Whether you’re planning now or considering a debt consolidation remortgage in 2025, it’s crucial to be informed and prepared.

Ready to apply or see your best options?

Find your best deals online in minutes or request a no-obligation callback from one of our expert advisors to talk through your options or just get honest advice.