Mortgage & Loan Guides

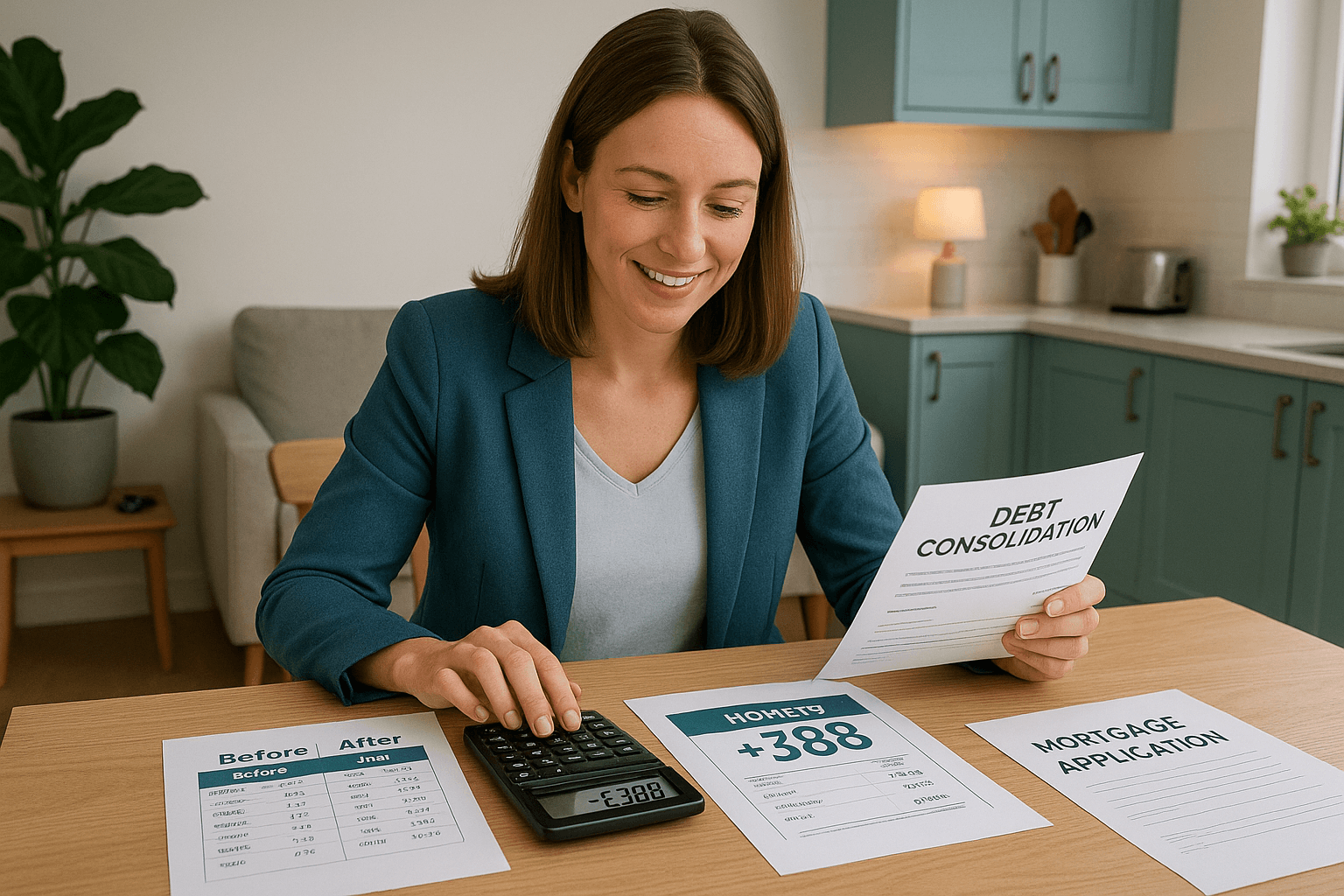

Remortgage to Clear Debt 2025: Save £388+ Monthly Cash Flow

Discover how Ashleigh, a Midlands homeowner, simplified her finances by remortgaging to consolidate £37,033 of debt into her mortgage. Faced with rising living costs and a looming mortgage rate increase, she gained approximately £388.91 in monthly disposable income, allowing her to focus on her financial stability and even plan for a new car purchase. This article explores the benefits and considerations of debt consolidation through remortgaging, providing insights for those seeking to manage their financial challenges effectively.

Remortgage to Clear Debt & Fund Home Improvements 2025

Explore how remortgaging can help homeowners clear debt and fund essential home improvements. This strategic approach allows for the release of equity while managing existing financial commitments, offering a pathway to improved budgeting and lifestyle flexibility. Discover how a tailored debt consolidation remortgage can replace high-interest loans, streamline payments, and provide financial confidence for future renovations.

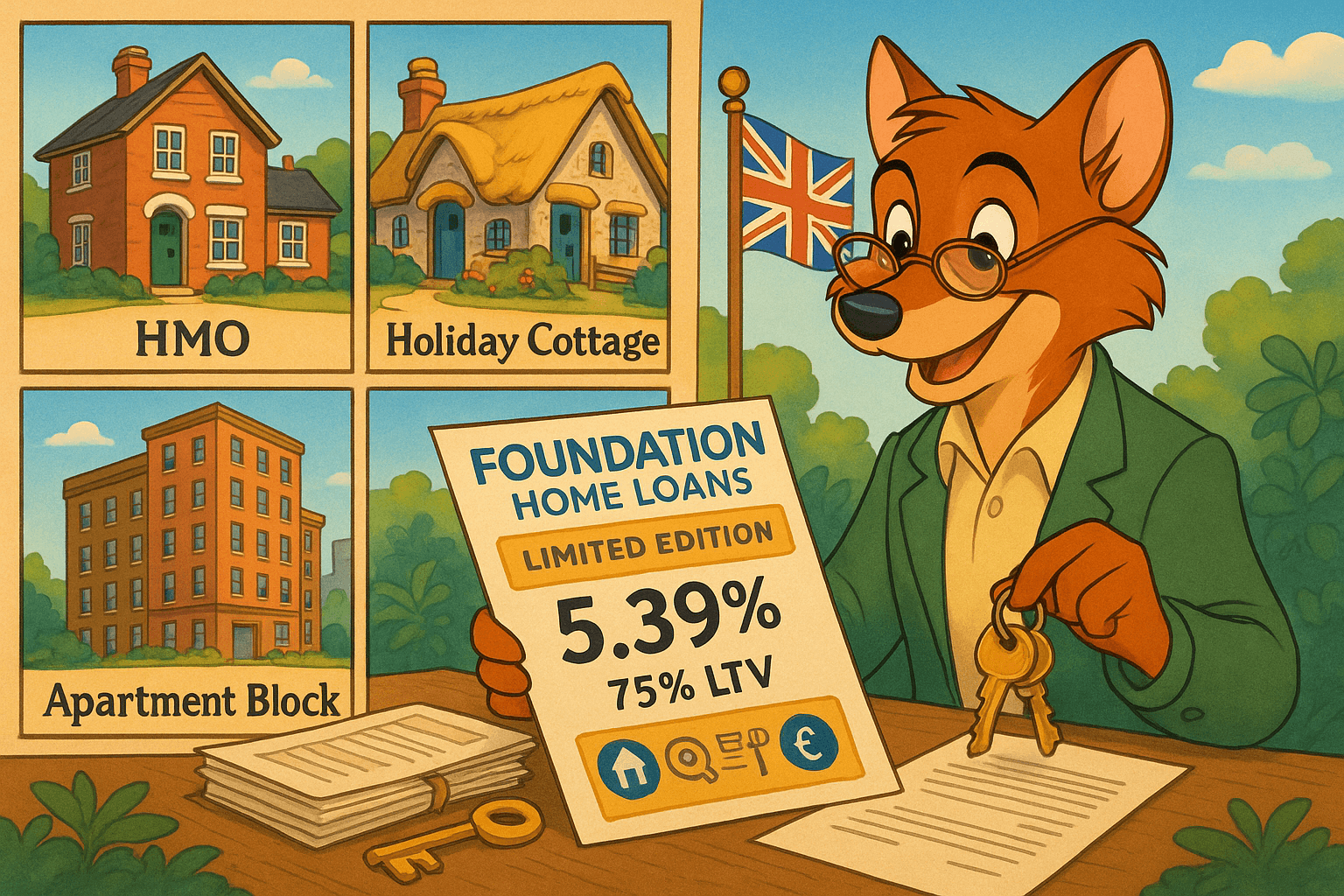

Foundation Home Loans Buy to Let & Expat Rates 2025

Foundation Home Loans has launched limited edition buy to let mortgages, offering competitive rates for portfolio landlords and expat borrowers. Effective from 23rd September 2025, new products include a 5.74% fixed rate for Multi-Unit Freehold Blocks and reduced rates for British expats. These offerings enhance access to UK property finance, providing greater affordability for holiday let investors and HMO owners. With flexible underwriting and tailored support, Foundation Home Loans aims to empower investors in today’s competitive market.

Remortgage to Clear Debt: Barclays 4.07% Fixed Deal 2025

Facing the end of a fixed-rate mortgage can be daunting, especially with the threat of soaring Standard Variable Rates. This article explores how a woman in her mid-50s successfully navigated her mortgage options, opting for a product transfer with Barclays that secured a 2-year fixed rate of 4.07% with no fees. By remortgaging to clear debt and avoid higher interest costs, she not only retained her existing 15-year term but also gained financial confidence and stability. Discover how a swift remortgage can help you avoid unnecessary expenses and maintain control over your finances.

Deal Direct Debt Consolidation Remortgage Case Study 2025

Discover how a debt consolidation remortgage transformed a young family's financial landscape. After accumulating over £49,000 in debts, they embraced this strategy to streamline repayments and enhance their monthly disposable income by £557.02. This case illustrates the potential of remortgaging to not only alleviate financial stress but also to facilitate savings for future family needs. Learn about the benefits and considerations of consolidating debts into your mortgage and regain control of your finances.

Buckinghamshire Building Society 95% LTV Mortgage 2025

Buckinghamshire Building Society has launched a 95% Loan-to-Value (LTV) Fixed Rate Mortgage, tailored specifically for first-time buyers. This innovative product allows borrowers to secure their first home with just a 5% deposit and offers a competitive fixed rate of 5.54% until November 2027. With no application or product fees, and flexible lending criteria, including acceptance of gifted deposits and consideration for historical credit issues, this mortgage aims to make homeownership more achievable for those facing financial hurdles. Discover how this offering can help you step onto the property ladder.

Leek Building Society 95% LTV Rate Rises to 4.85% | 2025

Leek Building Society has announced an increase in its 5-year fixed rate mortgage at 95% Loan-to-Value (LTV), now set at 4.85%. This change, effective from 24 September 2025, is significant for first-time buyers and home movers with smaller deposits. With a £495 arrangement fee, the mortgage remains competitive among UK lenders. Borrowers seeking financial stability will benefit from fixed payments over five years. As rates rise, potential buyers are encouraged to explore their options and secure the best deal promptly.

BM Solutions Buy to Let Rates Update September 2025 | New BTL

BM Solutions has announced a product refresh effective from 23 September 2025, introducing changes to buy to let and let to buy mortgage rates. This update includes both increases and decreases in rates across selected products, offering potential benefits for landlords and homeowners. Importantly, existing customers can take advantage of extended completion deadlines, providing greater flexibility. With a focus on maintaining a competitive mortgage portfolio, BM Solutions continues to support investors and property owners in navigating the evolving market landscape.

Halifax Mortgage Rates Update September 2025 – Up to 0.14% Cut

Halifax Intermediaries has announced significant updates to its mortgage product rates effective from 23 September 2025. Home movers and first-time buyers will benefit from reduced fixed rates, while some remortgage products see slight increases. This competitive shift makes Halifax a key player for new mortgage deals, although existing customers should act swiftly to secure current rates before changes take effect. For tailored mortgage advice, contact Halifax’s advisers today.

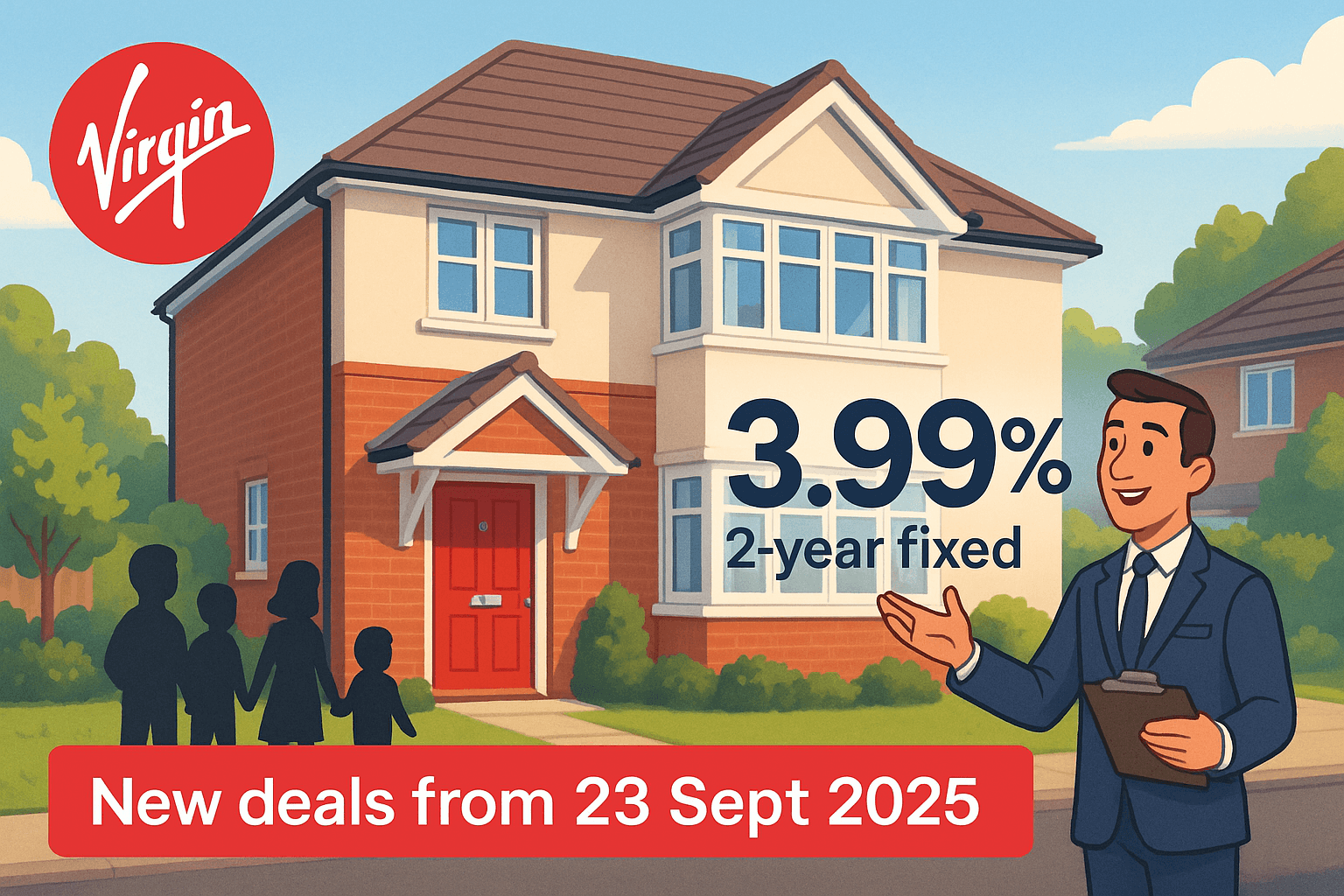

Virgin Money Cuts Mortgage Rates Sept 2025 | New BTL Deals

Virgin Money announces significant reductions in fixed mortgage rates, effective from 23 September 2025, catering to UK homebuyers, remortgagers, and buy-to-let landlords. With competitive rates starting from 2.83% and new fee-saver options, borrowers can benefit from lower monthly payments and flexible choices. This update marks an opportunity for first-time buyers and seasoned landlords alike to secure favourable terms in a dynamic market. Explore how these changes can enhance your mortgage strategy today.

Debt Consolidation Mortgage Success Story – Save £1526/Month

Discover how a debt consolidation mortgage transformed one UK client’s financial situation. Struggling with over £103,000 in high-interest debts, he streamlined his repayments into a single mortgage, significantly lowering his monthly outgoings by approximately £1,526.37. This strategic move not only alleviated financial stress but also safeguarded his credit profile, allowing him to focus on future savings. If you're overwhelmed by multiple debts, learn how a debt consolidation mortgage can help you regain control.

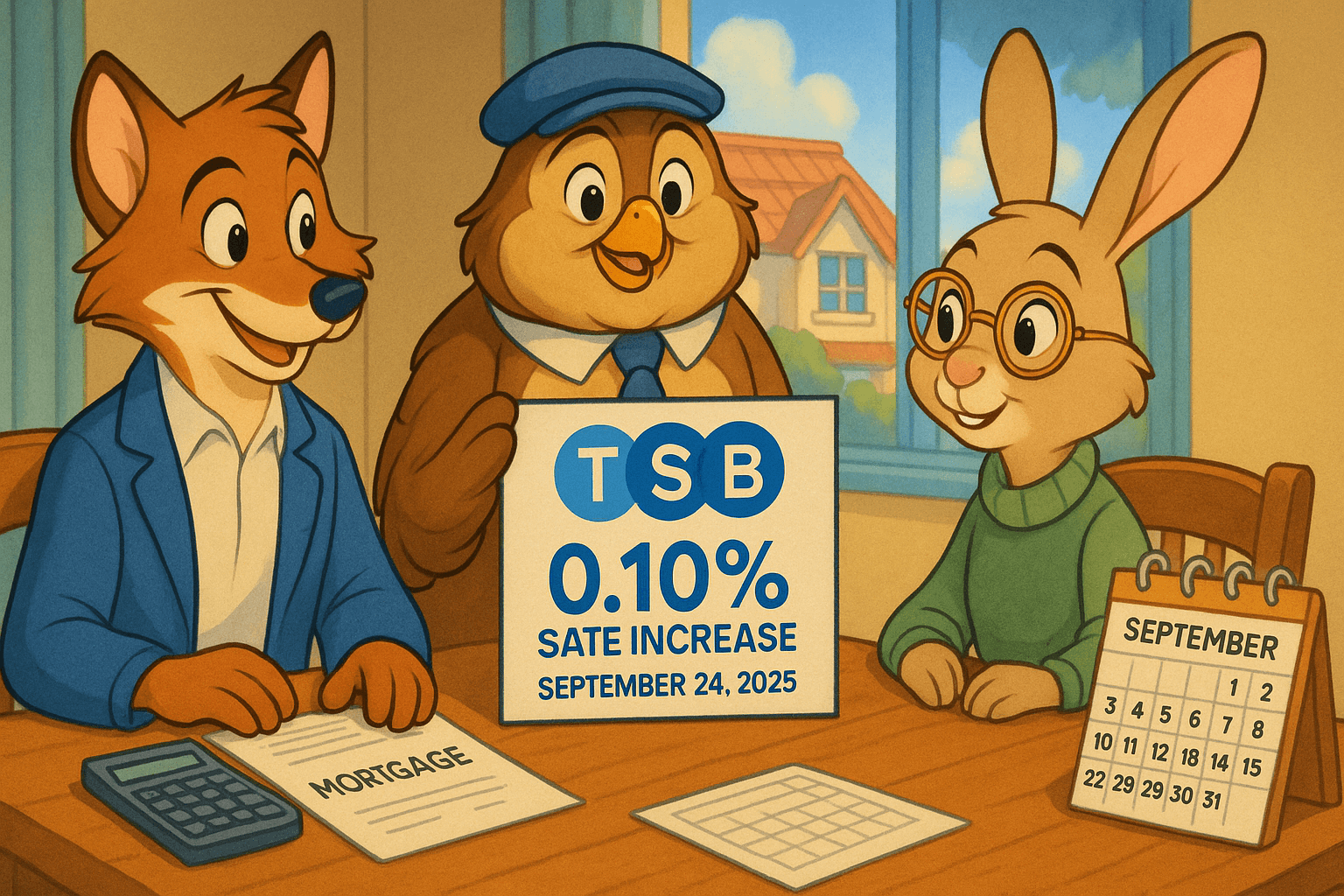

TSB Mortgage Rate Increases

TSB Bank has announced significant rate increases for selected Product Transfer and Additional Borrowing mortgages, effective 24 September 2025. Homeowners considering a product switch or seeking additional funds should act swiftly to secure current rates before the deadline. These changes mainly affect existing customers with medium to high loan-to-value ratios. With flexible porting options and generous bonus income criteria, TSB remains an attractive option for borrowers. For tailored advice, contact our mortgage experts today.