Mortgage & Loan Guides

Halifax Self-Employed Mortgages: 1-Year Accounts Accepted

Halifax has introduced significant changes to its mortgage criteria for self-employed individuals for the 2024/25 tax year, allowing applicants to use just one year's income evidence. This update aims to enhance mortgage accessibility and flexibility, particularly for newly self-employed borrowers. Key features include the acceptance of 1-year accounts, no averaging of income, and tailored assessments based on net profits. These changes position Halifax as a leading choice for self-employed individuals seeking competitive mortgage options and support in navigating their unique financial situations.

Co-operative Bank Mortgage Rates Rise

The Co-operative Bank is set to increase rates on its Mainstream and Buy to Let fixed-rate mortgage products effective 24 September 2025. Key changes include up to a 0.14% rise in residential mortgage rates and continued flexibility in lending criteria, catering particularly to first-time buyers and those with unique employment situations. Prospective borrowers should act swiftly, as current rates will be withdrawn by 5pm on 23 September 2025. For tailored advice, get in touch with our team today.

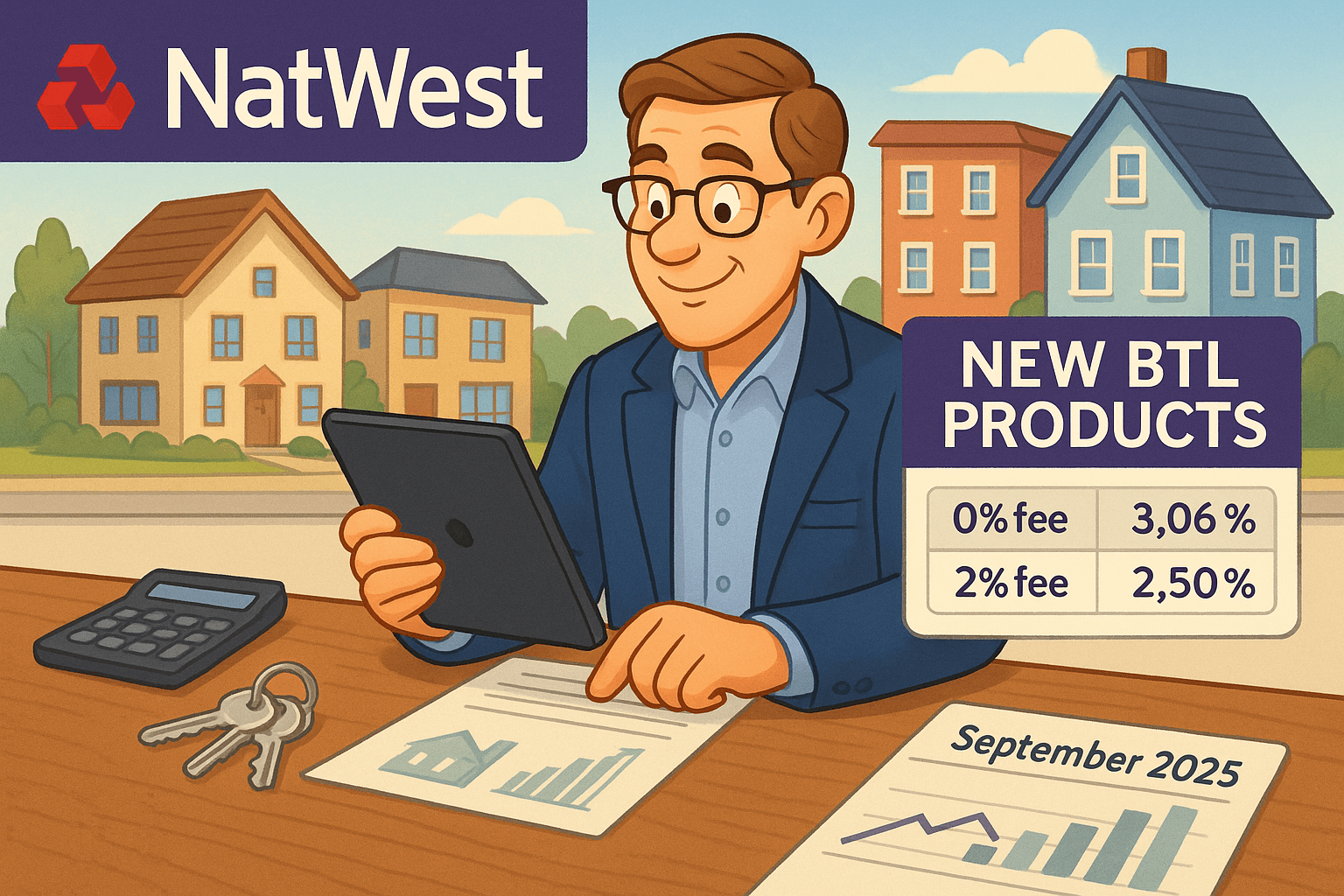

NatWest Buy to Let Mortgages & Rate Changes Sept 2025

NatWest has unveiled a new range of Buy to Let mortgage products, effective from 23rd September 2025, offering enhanced flexibility for landlords and property investors. With various rate and fee structures, these products cater to diverse investment strategies. Additionally, rate adjustments across New Business and Existing Customer products aim to provide competitive options for home movers and remortgagers. This initiative supports both seasoned landlords and first-time investors, ensuring access to tailored financing solutions. Discover how NatWest's new offerings can benefit your property investment journey.

Pepper Flex Mortgages: Complex Credit & Probation OK

Pepper Flex, launched by Pepper Money, offers tailored lending solutions for complex borrowers in the UK. This innovative product is designed to assist those who are often overlooked by mainstream lenders, including individuals with recent credit issues, variable incomes, or those in probationary employment. With flexible criteria allowing for up to 85% loan-to-value and acceptance of recent credit blips, Pepper Flex opens doors for homeownership and debt consolidation. Discover how this service can transform a mortgage application from a decline to approval, offering hope to those in unique financial situations.

Deal Direct Debt Consolidation Remortgage Saves £2,250

Discover how one UK professional successfully remortgaged to consolidate £85,562 in high-interest debt, reducing her monthly outgoings by over £2,250. This informative article unveils the challenges she faced with multiple credit loans and the strategic financial advice that transformed her situation. Learn about the benefits and considerations of debt consolidation through remortgaging, and find out how you too can regain control of your finances.

CTL Trust New Mortgage Rates from 4.39%

CTL Trust has unveiled new mortgage pricing and flexible lending options aimed at diverse UK borrowers, including homeowners and first-time buyers. With fixed-rate mortgages starting from just 4.39%, the lender enhances its appeal in the competitive market. Key updates include improved affordability assessments and no product fees on selected deals, making it easier for applicants with complex income situations to secure funding. These changes position CTL Trust as a leading choice for those seeking tailored mortgage solutions.

Together BTL Mortgage Rates Cut: From 8.54%

Together, a leading UK lender, has announced reductions in Buy to Let (BTL) mortgage rates, effective from 19th September 2025. With new variable rates starting at 8.54%, these changes offer more competitive options for landlords and investors. Together's flexible lending criteria cater to a diverse range of applicants, including first-time landlords, those with imperfect credit, and foreign nationals. This update supports investors looking for tailored solutions in a dynamic property market, making Together a strong choice for property finance.

Principality Building Society Mortgage Rate

Principality Building Society has announced significant changes to its mortgage product rates, effective from 22nd September 2025. These updates include both reductions and increases across various mortgage types, including residential and Help to Buy (Wales) options. First-time buyers and homeowners remortgaging may benefit from new competitive rates, particularly at higher loan-to-value tiers. Prospective borrowers are advised to act quickly before existing products are withdrawn on 21st September 2025. For tailored advice, contact our expert mortgage advisers today.

Nationwide Cuts Fixed Mortgage Rates by 0.18%

Nationwide Building Society has announced reductions of up to 0.18% on selected fixed-rate mortgages, effective from 19 September. This update benefits first-time buyers, home movers, and those remortgaging, making some of their rates among the most competitive in the UK market. With a strong reputation and a diverse range of products, Nationwide continues to be a preferred choice for borrowers. Explore your options and take advantage of these lower rates to potentially reduce your borrowing costs.

Precise Mortgages 6x Income & 95% LTV Home Improvement

Precise Mortgages has unveiled new remortgage options that allow homeowners to borrow up to 95% of their property's value and utilise up to six times their income. These changes cater specifically to those looking to fund home improvements, even with recent credit issues. With no profession restrictions and flexible criteria, Precise Mortgages stands out as a solution for borrowers needing higher LTV and income calculations. Explore how these updates can help you adapt your home for future needs.

Vida Homeloans Cashback Mortgages 2025 – Up to £1,250 Back

Vida Homeloans has introduced a new Cashback mortgage range, offering valuable incentives for both Residential and Buy to Let borrowers. Key features include £1,250 Cashback for high LTV residential products and £500 Cashback on various Buy to Let options. This initiative aims to reduce upfront costs and enhance access to competitive mortgage solutions, catering to first-time buyers and experienced investors alike. With a focus on flexibility and support, Vida stands out as a notable choice among UK lenders.

Barclays Debt Consolidation Remortgage Case Study

In this insightful article, we explore how a self-employed professional from the South of England successfully remortgaged to consolidate £38,500 in unsecured debt while raising funds for essential home improvements. By securing a 2-year fixed-rate mortgage with Barclays, he streamlined his repayments into one manageable monthly cost under £710, allowing him to regain financial control. This case highlights the benefits of tailored debt consolidation remortgages and offers valuable insights for anyone considering similar financial strategies.