Mortgage & Loan Guides

Birmingham Midshires Remortgage Saves £356 Monthly 2025

Discover how a swift remortgage can alleviate financial stress and enhance your cash flow. In this article, we explore a case study of a West Midlands property investor who transitioned from a high standard variable rate to a competitive two-year fixed rate, saving over £350 monthly. This solution not only provided immediate relief but also ensured the rental income comfortably covered mortgage payments. Learn how a simple rate switch with your existing lender can lead to significant savings and flexibility in an ever-changing market. Take charge of your finances today!

Accord Mortgages Remortgage: Interest-Only BTL Solution 2025

Discover how two sisters leveraged the equity from their inherited, mortgage-free property to invest in a buy-to-let venture through a tailored remortgage solution. Facing challenges such as contractor status and the need for flexible financing, they secured a £275,800 interest-only mortgage with Accord Mortgages. This strategic move not only provided low monthly payments but also capital for future investments, showcasing an effective approach to property financing. Whether you're considering how to remortgage an inherited property or looking to expand your investment portfolio, expert guidance can help you navigate the options available.

HSBC Buy to Let Top Slicing Policy Update 2025 | New Rules

HSBC UK has enhanced its Buy to Let (BTL) mortgage offerings by introducing 'Top Slicing', effective from 6th October. This innovative policy allows applicants to use personal disposable income alongside rental income to meet affordability criteria, making it easier for professional landlords and investors in lower yield areas to secure funding. With a minimum income requirement of £50,000 and a stressed Interest Cover Ratio of 110%, this update aims to unlock greater mortgage opportunities for those who may have previously struggled to qualify. Discover how this change can benefit your property investments.

Remortgage to Clear Debt: Real Case Study Saves £69 Monthly

Facing increasing debt can be overwhelming, but a debt consolidation remortgage can provide the relief needed to regain financial control. This case study highlights how a middle-aged homeowner in the UK transformed his financial situation by consolidating £9,810 of high-interest debt into his mortgage, resulting in a monthly disposable income increase of £69.22. Discover how this strategic move not only alleviated financial pressure but also enabled essential home improvements, illustrating the potential benefits of remortgaging for debt management.

BM Solutions Energy Efficient Mortgages: New Band B Criteria 2025

BM Solutions has updated its Energy Efficient Home mortgage criteria, effective from 3 October 2025, now requiring properties to achieve a minimum Energy Efficiency rating of Band B (81 or higher). This change aims to promote sustainability in the UK housing market by incentivising landlords to improve energy performance. While properties rated Band C may still access standard mortgage products, those with higher ratings can benefit from competitive rates and tailored support. Understanding these updates is essential for homeowners and landlords looking to optimise their mortgage options.

Barclays Adverse Credit Remortgage Success Story 2025

Discover how a professional couple from the South of England overcame their adverse credit history to secure their dream home through remortgaging. After struggling with top lenders, they found a suitable mortgage with Barclays Bank that offered a 20-year term, competitive interest rate, and flexibility. This case highlights the importance of working with knowledgeable mortgage specialists who can navigate the complexities of securing a mortgage, even in challenging financial situations. If you're facing similar hurdles, explore your options today!

NatWest Interest-Only Remortgage 4.15% – Fund Home Upgrades

Unlock the potential of your property with a strategic remortgage to fund home improvements! This article explores how a professional couple in their 50s successfully secured a competitive interest-only mortgage, enabling them to raise £30,000 for renovations without increasing their monthly payments. Discover the challenges they faced, the tailored solutions they found, and the benefits of opting for an interest-only option. Whether you're looking to upgrade your kitchen or bathroom, learn how remortgaging can help you achieve your renovation goals while maintaining financial stability.

Halifax Debt Consolidation Remortgage 4.01% Fixed 2025

Explore how a debt consolidation remortgage transformed the finances of a southern England couple, allowing them to simplify their monthly payments and reduce their financial stress. By merging their existing secured loan with a new mortgage from Halifax, they locked in a competitive fixed rate and streamlined their repayments into one manageable sum. With a focus on affordable terms and a reduced mortgage term, this strategy not only provided stability but also paved the way for long-term savings. Discover how you too can take control of your finances through effective debt consolidation.

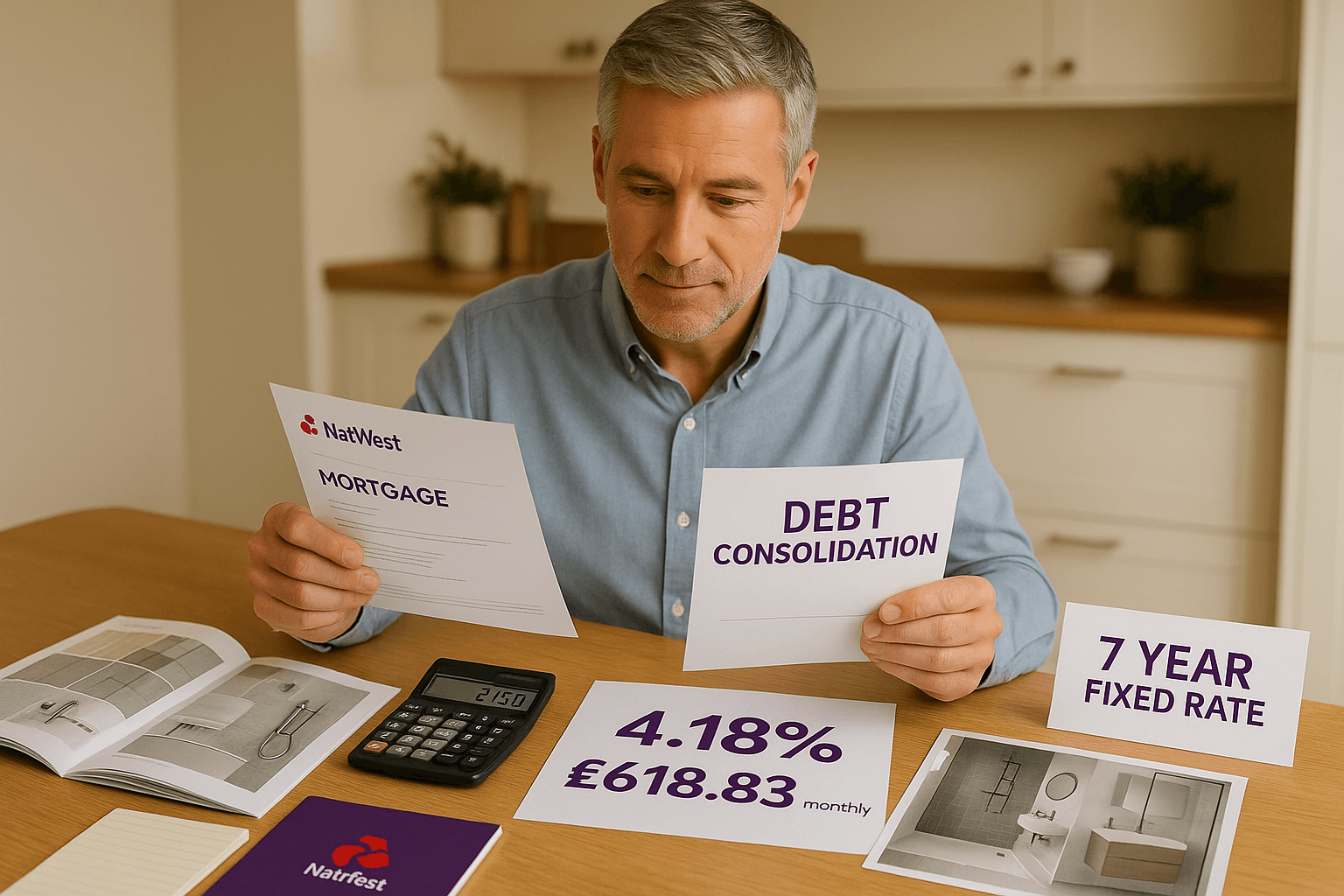

NatWest Remortgage 4.18% Rate Debt Consolidation 2025

In today’s financial landscape, remortgaging can be a strategic move to regain control of your finances. This article shares the inspiring story of a 50-year-old professional who effectively consolidated £9,810 in debt and secured £6,569 for essential home improvements through a competitive remortgage with NatWest. By locking in a fixed rate and keeping monthly payments under £625, the client not only simplified their financial commitments but also avoided the uncertainty of rising interest rates. Discover how remortgaging can enhance your cash flow and provide peace of mind.

Barclays 2-Year Fixed Rate Remortgage Success Story 2025

In the face of rising interest rates, a couple in their early 30s successfully secured financial stability by opting for a 2-year fixed-rate remortgage with Barclays Bank. This strategic decision allowed them to maintain manageable monthly payments while avoiding additional fees, all without altering the original mortgage term. Their case highlights the importance of tailored remortgaging solutions in today's volatile market, enabling homeowners to navigate economic shifts with confidence. Discover how smart remortgaging can lead to peace of mind and financial security.

Pepper Remortgage Debt Consolidation & Home Improvements 2025

Discover how remortgaging can be a game-changer for your finances. In this article, we explore a case study of a middle-aged professional in the South of England who successfully remortgaged to clear debt and fund home improvements, despite facing credit challenges. By partnering with a specialist lender, he secured a 5-year fixed rate mortgage that not only reduced his monthly payments but also provided capital for renovations. Learn how tailored remortgage solutions can help you regain control of your finances and improve your property.

West One Commercial Mortgages Launch 2025 | Rates from 6.54%

West One has expanded its offerings to include commercial mortgages, now available to the entire intermediary market. This launch introduces competitive products with LTVs up to 75% and rates starting from 6.54% for semi-commercial properties. Designed for diverse needs, the flexible criteria accommodate self-employed borrowers, foreign nationals, and those with minor credit issues, making it an ideal choice for investors and businesses. Explore tailored solutions that support your commercial property goals with West One's expert team.