Mortgage & Loan Guides

Debt Consolidation Remortgage: Save £1000+ Monthly 2025

Explore how a debt consolidation remortgage transformed financial stability for a Northern Irish homeowner. By consolidating £44,071 of high-interest debt into a manageable fixed-rate mortgage, they increased their monthly disposable income by over £1,000, simplified repayments, and funded home improvements. This case demonstrates the benefits of strategic remortgaging in enhancing budgeting flexibility and maintaining a healthy credit score, empowering homeowners to navigate financial commitments with confidence.

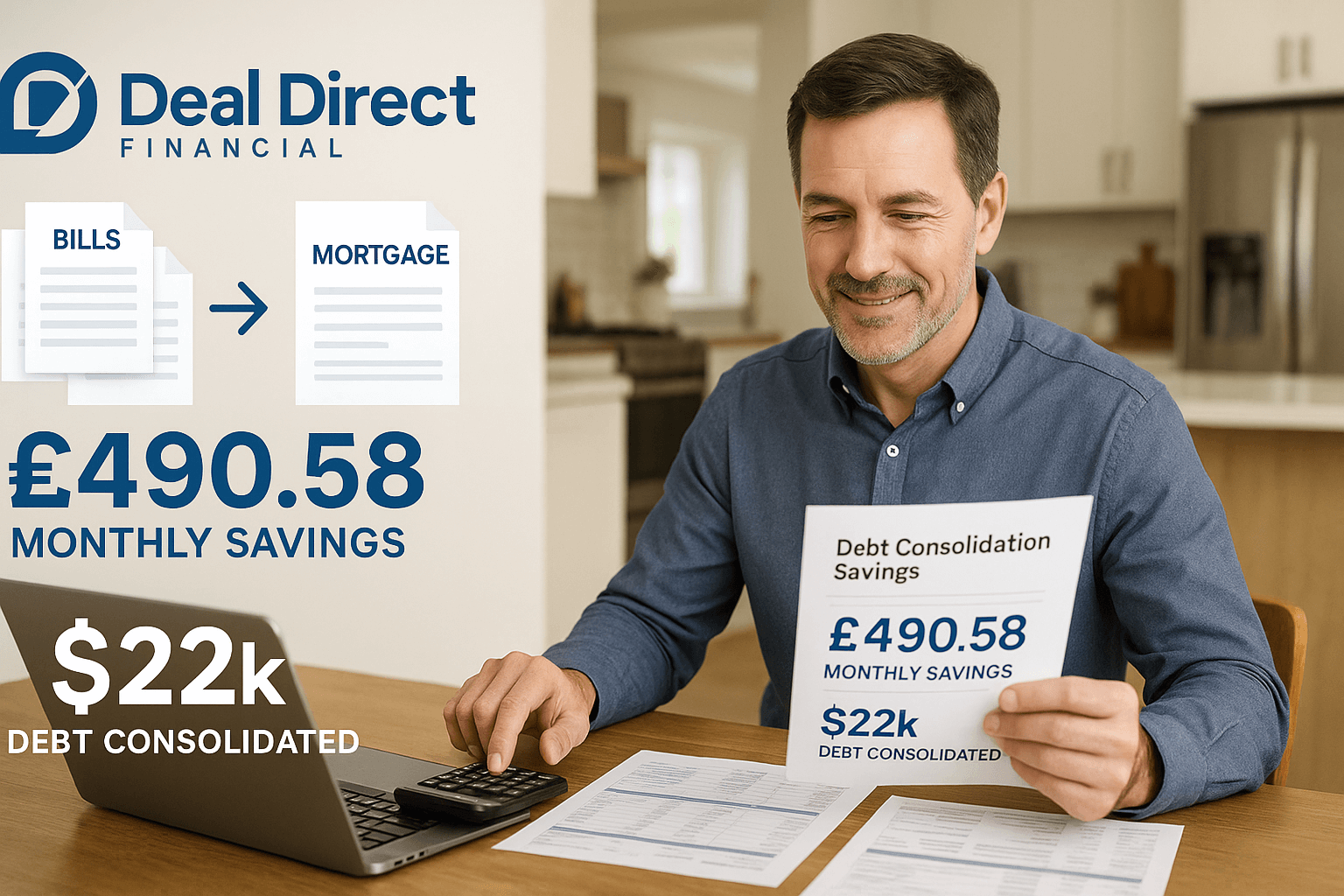

Debt Consolidation Remortgage Case Study 2025 | Deal Direct

Discover how a debt consolidation remortgage can transform your finances. This article explores the journey of a UK homeowner who, burdened by high-interest debts from home improvements, regained control by merging £22,377.40 of unsecured debt into a single, manageable mortgage payment. With expert guidance, they increased their disposable income by £490.58 per month, simplifying their finances and enhancing financial stability. Learn how tailored remortgaging can help you reduce monthly outgoings and secure your financial future.

Remortgage to Consolidate Debt: Save £573 Monthly in 2025

Discover how one UK homeowner transformed her financial situation by consolidating £21,724 of high-interest credit card debt through a remortgage. By streamlining her payments, she slashed monthly costs by approximately £573.23, paving the way for savings and financial peace. This article explores the benefits of debt consolidation remortgages, including lower interest rates and simplified finances, providing a clear path to a brighter financial future.

Debt Consolidation Mortgage Case Study – Save £672/Month

Discover how a debt consolidation mortgage transformed the financial landscape for a couple in the North West of England, enabling them to manage £33,000 in high-interest credit card debt more effectively. This strategic move not only simplified their repayments but also provided them with greater disposable income, enhancing their financial resilience and paving the way for a debt-free future. Learn about the key benefits, potential savings, and expert advice on consolidating debts responsibly.

Debt Consolidation Remortgage Case Study | £378 Saved

Discover how a debt consolidation remortgage transformed the financial landscape for a couple struggling with high-interest debts. By consolidating £40,321 into their mortgage, they reduced their monthly outgoings by £378.85, alleviating financial pressure and providing a clear path to becoming debt-free. This approach not only simplified their repayments but also improved their quality of life, demonstrating the potential benefits of remortgaging to consolidate debt.

Remortgage to Clear Debt: Save £9K+ Monthly Income Boost

Discover how a couple from the South of England transformed their financial situation by remortgaging to clear debt. Facing high-interest debts and an expiring mortgage, they opted for a strategic consolidation that not only saved them over £9,000 but also increased their disposable income by approximately £632 per month. This insightful journey towards financial freedom showcases the power of making informed decisions in debt management and mortgage restructuring.

Debt Consolidation Mortgage: Save £500+ Monthly Payments

Struggling with multiple high-interest debts and feeling financially overwhelmed? Discover how one couple transformed their situation through a tailored debt consolidation mortgage. By consolidating over £45,000 of debt into a single, manageable monthly payment, they reduced their outgoings by approximately £493, regained financial control, and funded essential home improvements. This insightful case study highlights the benefits of debt consolidation and offers guidance for those seeking financial relief.

Debt Consolidation Remortgage: Save £29k Like This Couple

Discover how a UK couple successfully consolidated £81,000 of high-interest debt through a strategic remortgage, transitioning to a capital repayment model. By simplifying their finances, they not only reduced their monthly payments by approximately £129.92 but also regained control over their financial future. This insightful article explores the benefits of remortgaging to clear debt, offering valuable advice for anyone looking to improve their financial situation and achieve long-term stability.

Remortgage Debt Consolidation Success Story 2025 | Save £536

Discover how one Midlands professional transformed her financial situation by opting for a remortgage to consolidate £19,500 in debt. Facing mounting pressure from rising mortgage rates and high-interest credit cards, she found immediate relief by restructuring her payments into a manageable monthly figure. This strategic move not only alleviated her financial stress but also increased her disposable income by £536.73. Learn how a debt consolidation remortgage can be a lifeline for those struggling with overwhelming debt.

Debt Consolidation Remortgage Success Story

Discover how a debt consolidation remortgage enabled a Midlands homeowner to regain financial control by merging multiple high-interest debts into a single, manageable mortgage payment. Faced with £64,709 in debts and minimal disposable income, this strategic move not only simplified their finances but also freed up £848.64 monthly, allowing for savings and early mortgage overpayments. Learn how consolidating debts can provide peace of mind and pave the way towards a more secure financial future.

Remortgage to Clear Help to Buy & Remove Ex-Partner 2025

Discover how remortgaging can empower you to achieve financial independence by clearing Help to Buy loans and removing ex-partners from joint mortgages. This article outlines a strategic remortgage plan that not only consolidates debt but also simplifies financial obligations. By gaining sole ownership of her home and managing monthly repayments effectively, our case study highlights the importance of tailored mortgage solutions for personal finance stability. Explore the benefits of remortgaging to take control of your financial future.

Deal Direct Debt Consolidation Mortgage Success Story 2025

Struggling with overwhelming debt? Discover how a debt consolidation mortgage transformed a UK couple's financial situation by merging 16 high-interest obligations into a single manageable payment. With their monthly disposable income increasing by approximately £1,463.20, they regained control over their finances, alleviating stress and paving the way for future savings. Learn how you too can take the pressure off your finances and explore the benefits of debt consolidation.