Mortgage & Loan Guides

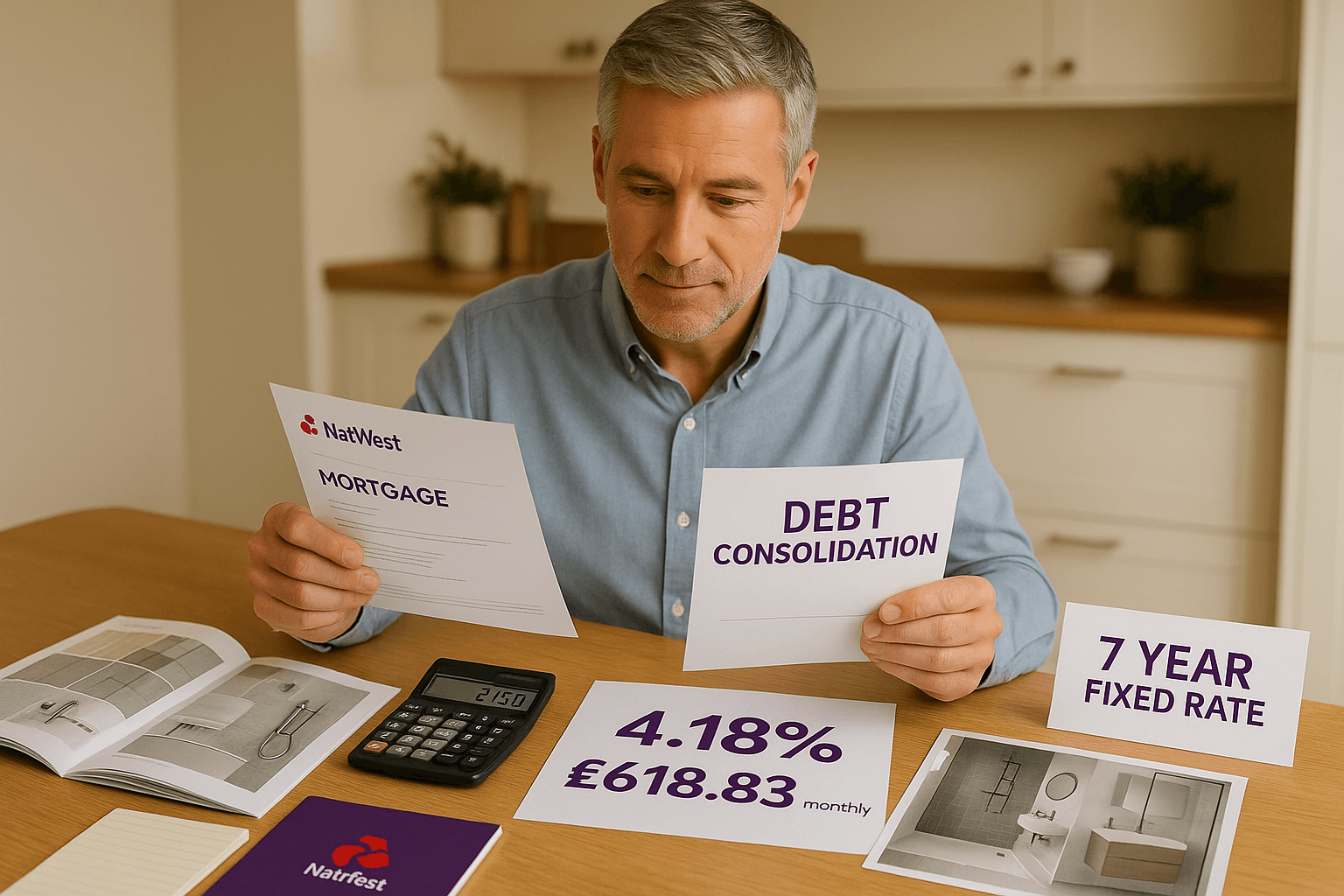

NatWest Remortgage 4.18% Rate Debt Consolidation 2025

In today’s financial landscape, remortgaging can be a strategic move to regain control of your finances. This article shares the inspiring story of a 50-year-old professional who effectively consolidated £9,810 in debt and secured £6,569 for essential home improvements through a competitive remortgage with NatWest. By locking in a fixed rate and keeping monthly payments under £625, the client not only simplified their financial commitments but also avoided the uncertainty of rising interest rates. Discover how remortgaging can enhance your cash flow and provide peace of mind.

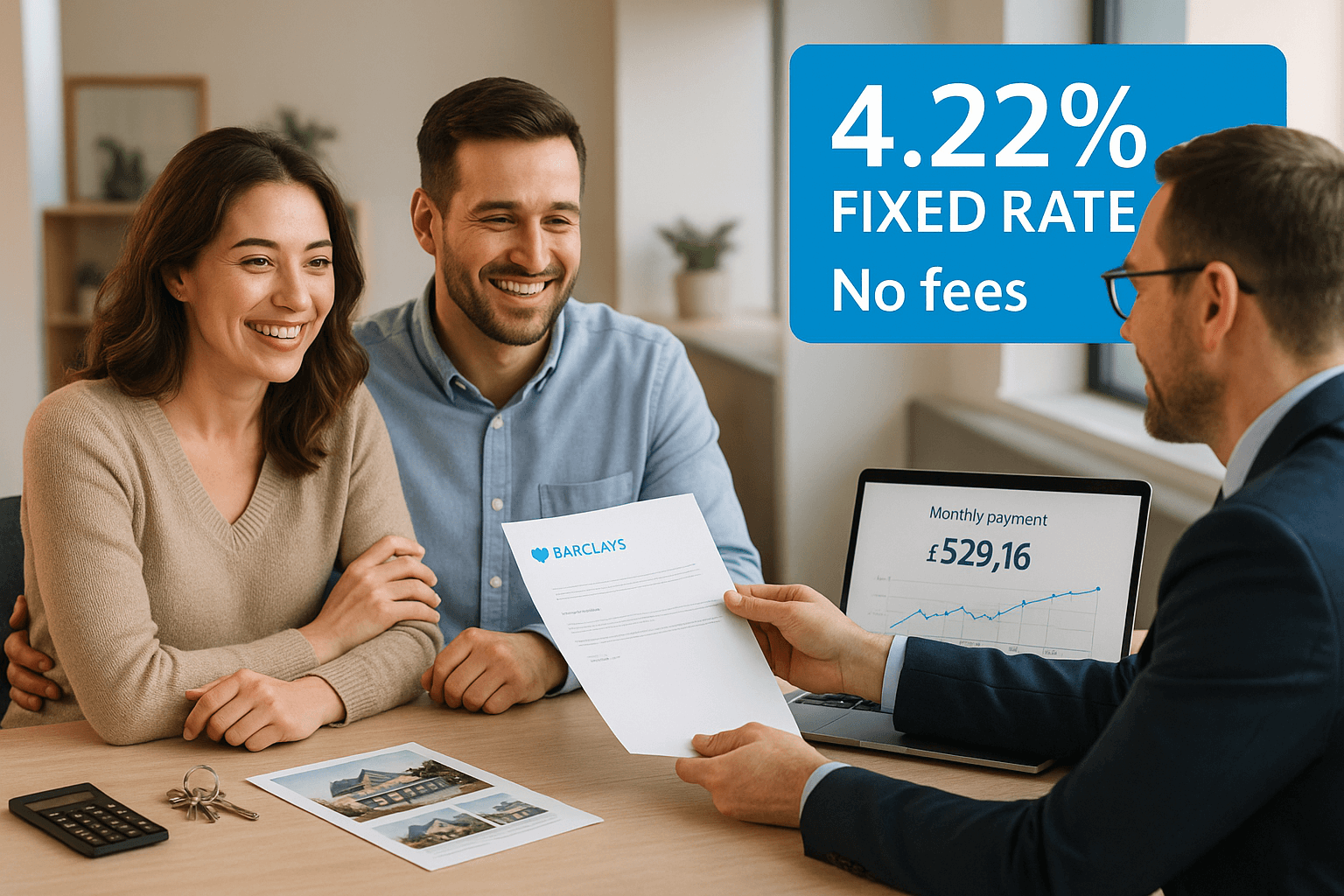

Barclays 2-Year Fixed Rate Remortgage Success Story 2025

In the face of rising interest rates, a couple in their early 30s successfully secured financial stability by opting for a 2-year fixed-rate remortgage with Barclays Bank. This strategic decision allowed them to maintain manageable monthly payments while avoiding additional fees, all without altering the original mortgage term. Their case highlights the importance of tailored remortgaging solutions in today's volatile market, enabling homeowners to navigate economic shifts with confidence. Discover how smart remortgaging can lead to peace of mind and financial security.

Pepper Remortgage Debt Consolidation & Home Improvements 2025

Discover how remortgaging can be a game-changer for your finances. In this article, we explore a case study of a middle-aged professional in the South of England who successfully remortgaged to clear debt and fund home improvements, despite facing credit challenges. By partnering with a specialist lender, he secured a 5-year fixed rate mortgage that not only reduced his monthly payments but also provided capital for renovations. Learn how tailored remortgage solutions can help you regain control of your finances and improve your property.

West One Commercial Mortgages Launch 2025 | Rates from 6.54%

West One has expanded its offerings to include commercial mortgages, now available to the entire intermediary market. This launch introduces competitive products with LTVs up to 75% and rates starting from 6.54% for semi-commercial properties. Designed for diverse needs, the flexible criteria accommodate self-employed borrowers, foreign nationals, and those with minor credit issues, making it an ideal choice for investors and businesses. Explore tailored solutions that support your commercial property goals with West One's expert team.

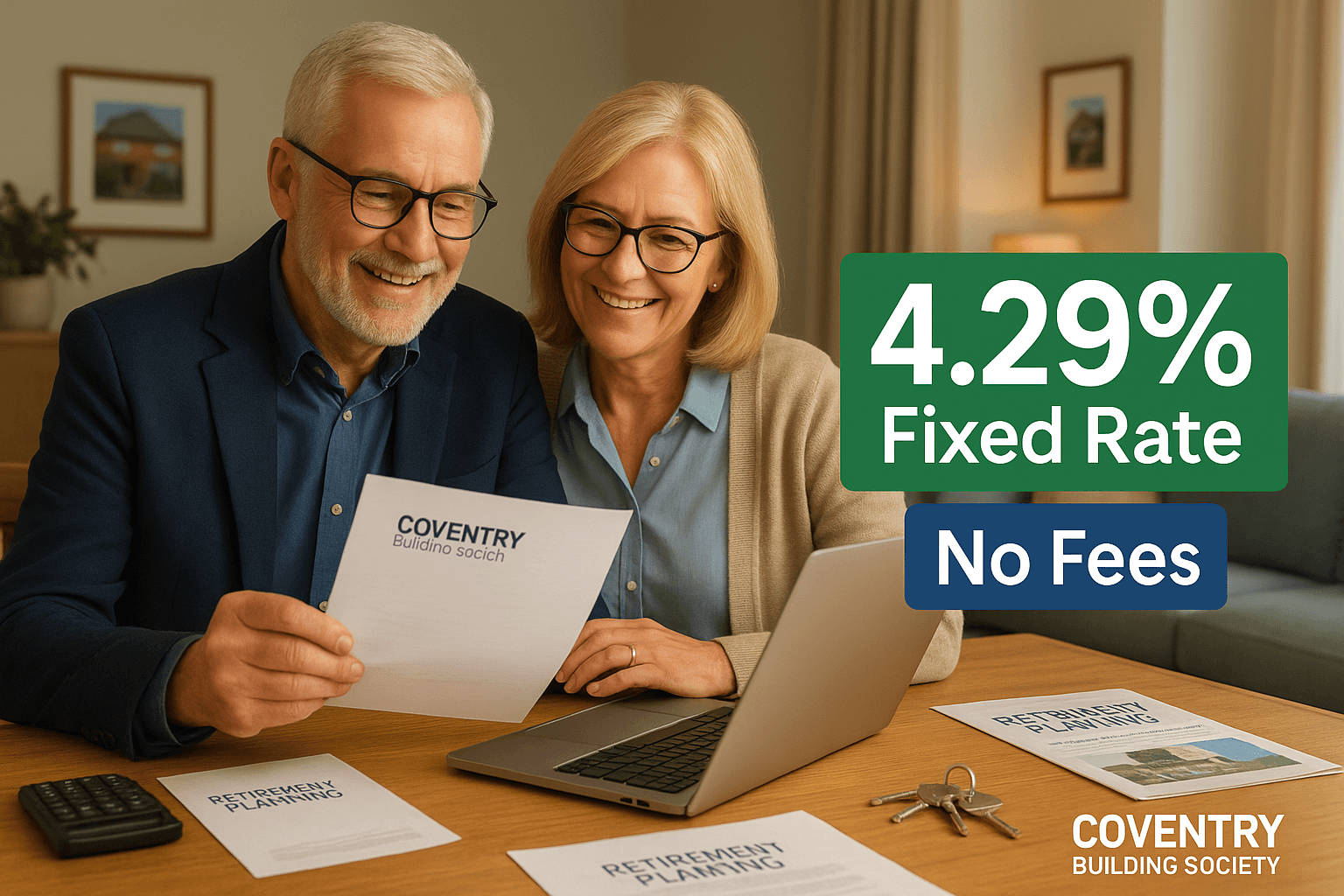

Coventry Building Society Remortgage 4.29% Rate 2025 Success

Discover how a couple in their 60s secured a hassle-free remortgage with Coventry Building Society, locking in a fixed rate of 4.29% until 2028, perfectly aligning with their retirement plans. With no additional fees or complicated paperwork, they maintained their seven-year term while ensuring flexibility for potential lump sum repayments. This successful remortgage strategy not only avoided unnecessary rate hikes but also provided peace of mind as they prepared for retirement. Explore how remortgaging can save you money and simplify your financial future.

NatWest Remortgage for Home Improvements 2025 | 4.03% Rate

Unlock the potential of your home with a smart remortgage strategy. This article explores how a couple in their 50s successfully remortgaged to secure a competitive fixed rate, allowing them to access £30,000 for essential home improvements without increasing their monthly payments significantly. Discover the benefits of remortgaging, from funding renovations to maintaining financial stability, and learn how to navigate the process effectively. Whether you're looking to upgrade your living space or consolidate costs, this guide provides valuable insights for mid-life homeowners in the UK.

Deal Direct Debt Consolidation Mortgage Case Study 2025

Explore the benefits of a debt consolidation mortgage for effective home improvement and credit management. This article highlights a case study of a Midlands homeowner who transformed her financial landscape by consolidating high-interest credit card debts into a secured loan. By strategically managing her finances, she not only completed her home renovations but also improved her cash flow and set the stage for long-term savings. Discover how consolidating debts can provide financial clarity and peace of mind.

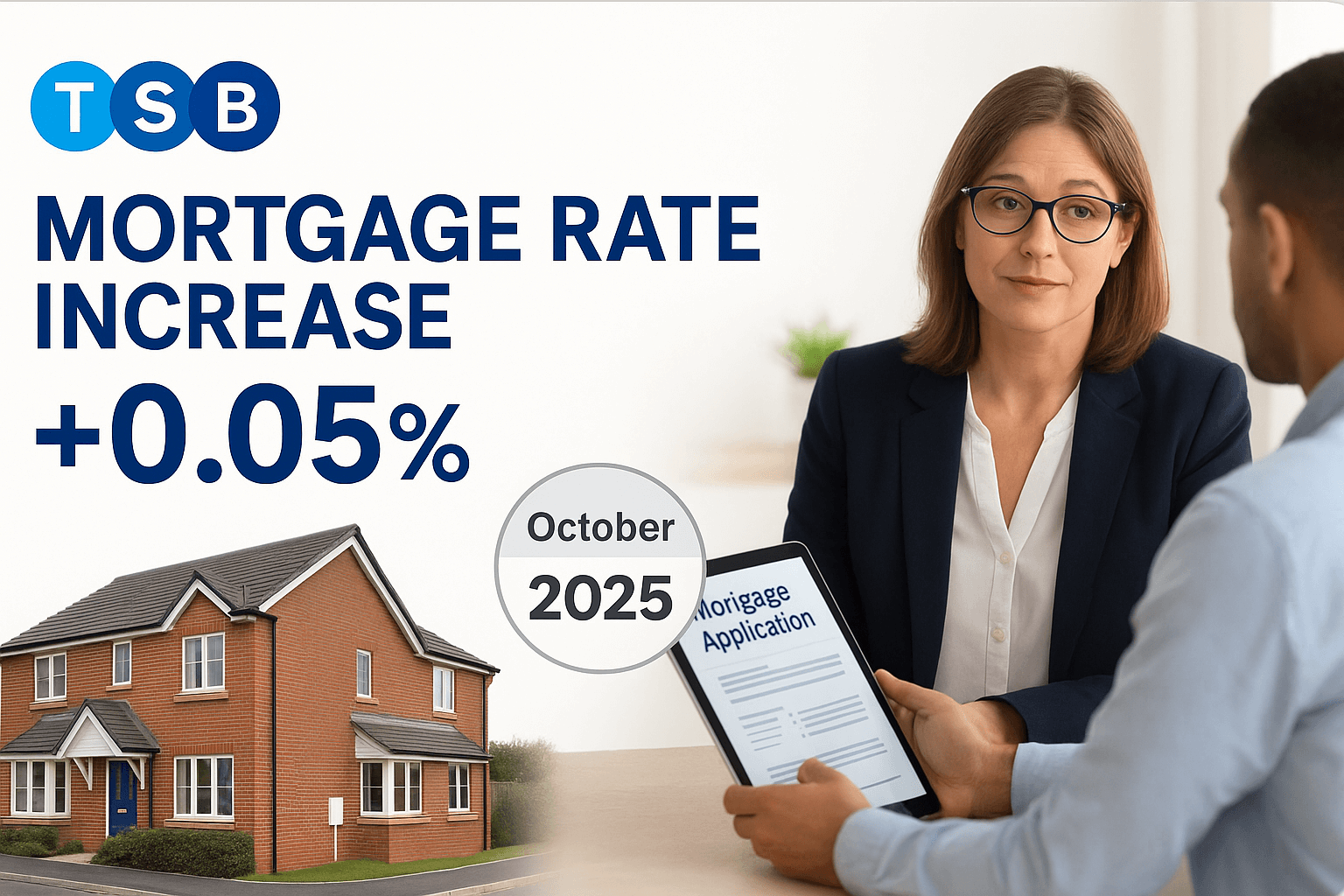

TSB Rate Increases October 2025 – Product Transfer Updates

TSB has announced rate increases on select Product Transfer and Additional Borrowing mortgages effective from 3 October 2025. Homeowners considering remortgaging or additional borrowing should be aware of the changes, which primarily affect existing customers. It's crucial to review options and submit applications before the deadline of 2 October 2025 to secure current rates. TSB remains a competitive choice for mortgage products, offering a straightforward transfer process and strong digital support. Don't miss the opportunity to explore your options with TSB's expert team.

Barclays Mortgage Affordability Boost: £14k More Borrowing 2025

Barclays has enhanced its mortgage affordability assessments, enabling UK borrowers to access larger loans. This update could allow average households to borrow approximately £14,435 more, providing first-time buyers, home movers, and remortgagers with improved options in a challenging market. With updated criteria now live on their affordability calculator, potential applicants are encouraged to explore their new borrowing power and seek tailored advice from Barclays’ mortgage experts.

Halifax Debt Consolidation Remortgage 4.03% Rate 2025

Discover how a couple in southern England transformed their financial landscape through a debt consolidation remortgage with Halifax Plc. Faced with a high-interest secured loan and an expiring mortgage, they sought a way to simplify their repayments and secure a manageable monthly budget. By merging their £126,209 mortgage and £55,482 secured loan into a single loan of £182,500 at a fixed interest rate of 4.03%, they achieved both clarity and peace of mind. This strategic move not only streamlined their finances but also aligned with their goal of reducing their loan term, providing them with long-term financial flexibility.

Kent Reliance Expat Remortgage: 4.64% Rate Success 2025

Navigating the complexities of remortgaging from abroad can be daunting for UK expats. This article explores the successful remortgage solution for a New Zealand-based property owner, who sought to maintain her rental income while securing a competitive rate. With a 2-year fixed interest-only mortgage from Kent Reliance, she achieved minimal disruption and preserved her property’s cashflow, all while avoiding the challenges of switching lenders. Discover how tailored remortgage options can help you manage your UK property effectively, even from overseas.

Aldermore Mortgage Rates Cut October 2025 + New BTL Products

Aldermore has announced exciting updates for mortgage seekers, including reduced rates on residential and buy-to-let mortgages, effective from 2 October 2025. Homeowners and landlords can benefit from competitive fixed rates and new limited edition products. A 30-day Decision-In-Principle guarantee offers security while gathering necessary documents. This initiative aims to enhance affordability for first-time buyers and existing Aldermore customers, making it an ideal time to explore tailored financial solutions. Connect with our qualified advisers to navigate these opportunities.