Mortgage & Loan Guides

Monmouthshire Building Society Rate Switch Mortgages 2025

Monmouthshire Building Society has launched a new range of residential mortgage rate switch products starting from 1st October 2025. These offerings cater to existing borrowers, allowing them to secure competitive fixed and discount rates with options at 60% and 75% loan-to-value (LTV). Key features include fee-free choices and a variety of terms, ensuring homeowners can find a suitable deal to reduce monthly repayments and avoid reverting to higher standard variable rates. This initiative aims to provide flexibility and support for loyal customers seeking to optimise their mortgage arrangements.

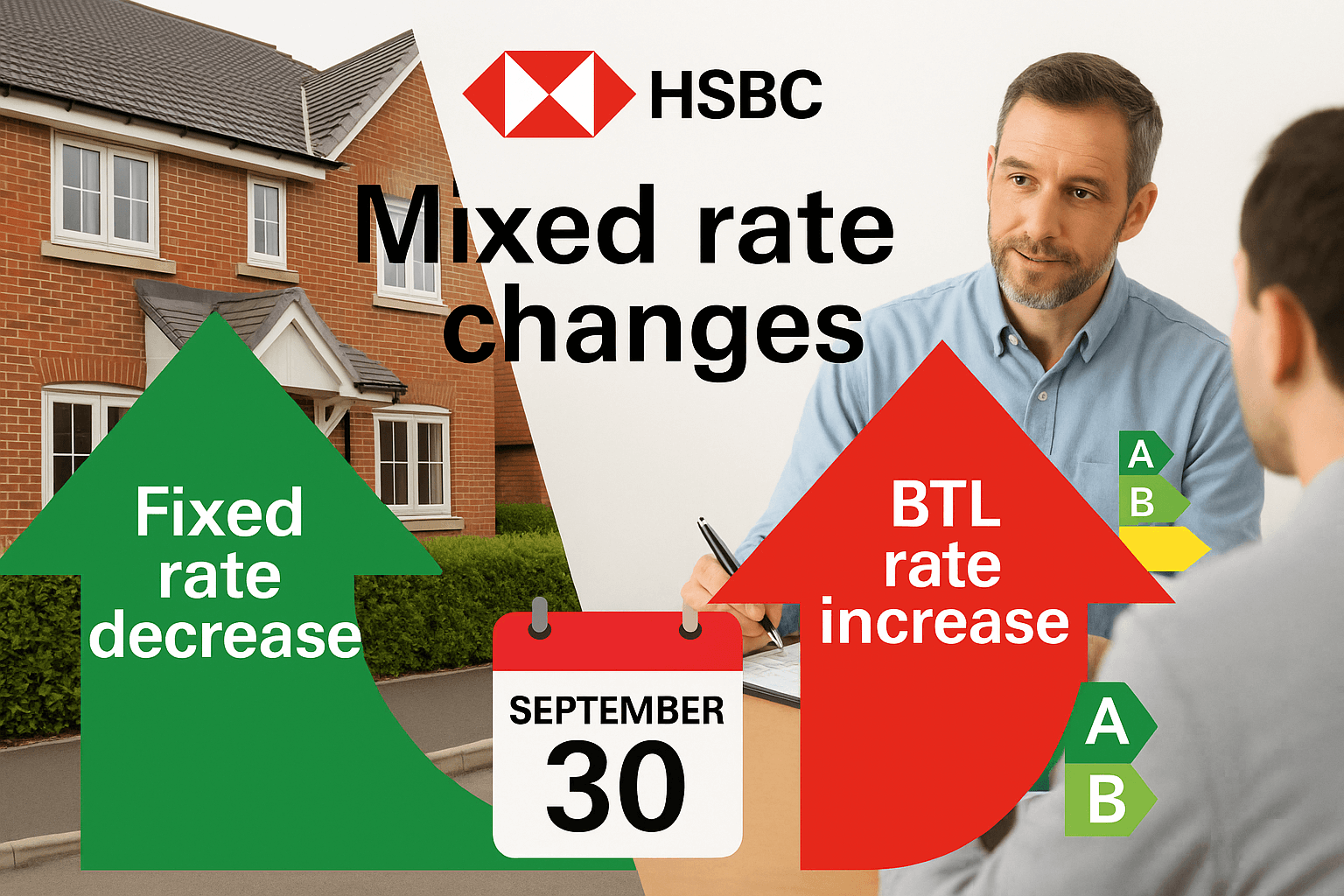

HSBC Mortgage Rates September 2025: New Cuts & BTL Changes

HSBC UK is set to update its residential and buy-to-let mortgage rates from 30th September, with a mix of increases and decreases depending on borrower type. First-time buyers and home movers will benefit from lower rates on select fixed products, while existing customers may face higher costs when switching or borrowing more. This guide outlines the key changes, eligibility criteria, and what borrowers should consider to secure the best deals. Timing is crucial for those looking to remortgage or purchase, so prompt action is advised.

Debt Consolidation Remortgage: Clear £15,990 Credit Card Debt

Discover how a UK homeowner successfully cleared £15,990 in high-interest credit card debt through a debt consolidation remortgage. By rolling her debts into a lower-interest mortgage, she simplified her finances, reduced monthly repayments, and increased her disposable income by nearly £493. This strategic move not only alleviated financial stress but also paved the way for future savings and home improvements. Learn how you too can take control of your financial future with expert mortgage advice.

NatWest Remortgage Debt Consolidation Saves £556 Monthly 2025

Discover how a couple in their 40s transformed their financial landscape by remortgaging to consolidate £42,867 of high-interest debt. By partnering with NatWest, they streamlined their repayments, boosted their monthly cash flow by £556.45, and funded home improvements—all while enjoying the flexibility of overpayment options. This insightful case study illustrates the benefits of debt consolidation and how it can pave the way for financial freedom. Learn to simplify your finances today!

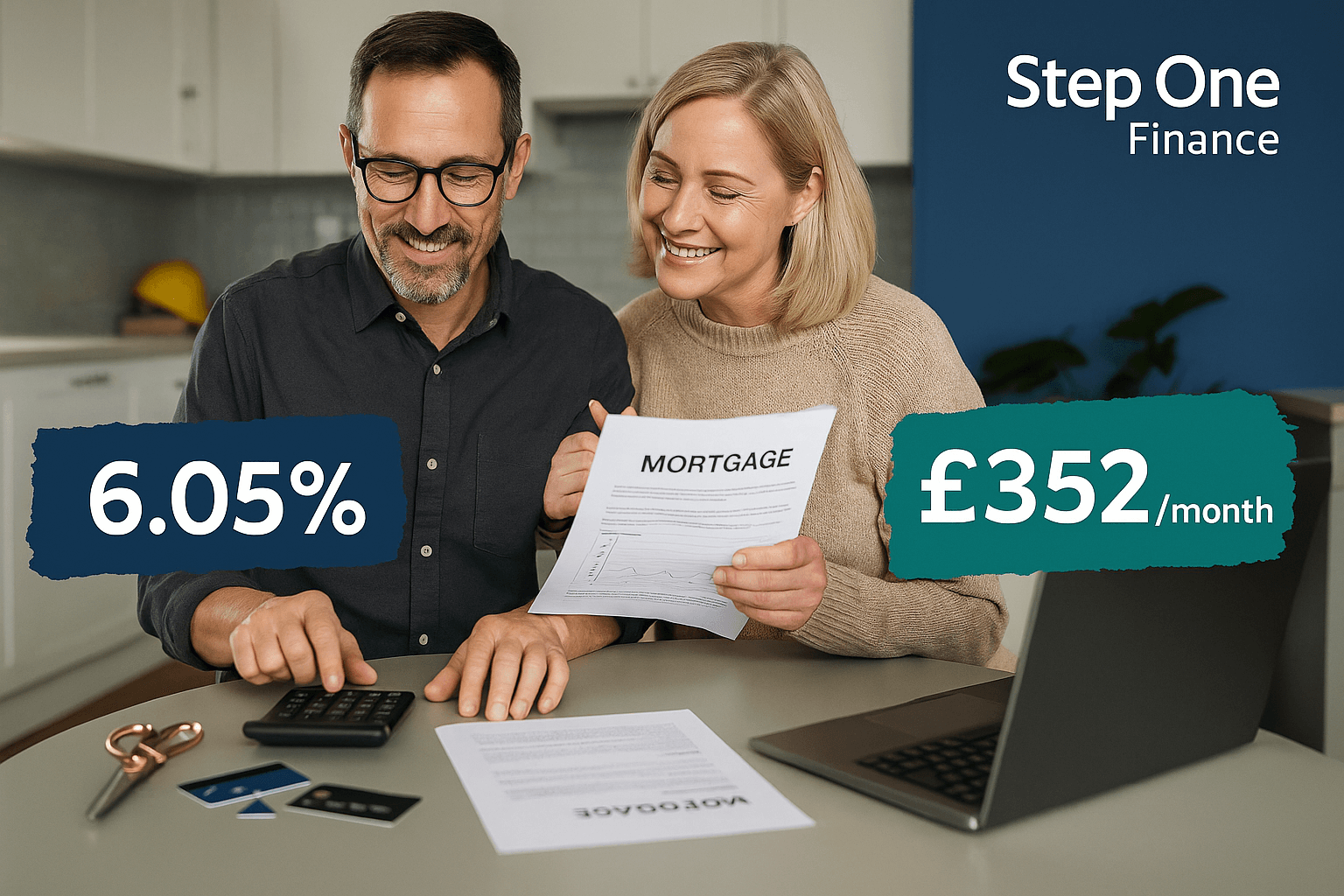

Step One Finance Debt Consolidation Mortgage 2025 Guide

Discover how a debt consolidation mortgage transformed the financial landscape for a South England contractor couple. After being declined by Nationwide for further borrowing, they sought expert guidance to consolidate £4,882 of credit card debt while funding a £35,000 kitchen renovation and car purchase. With a tailored mortgage solution from Step One Finance Limited, they secured a manageable £352 monthly payment, simplifying their finances and allowing for future flexibility. This case highlights the benefits of expert mortgage advice for self-employed individuals facing financial hurdles.

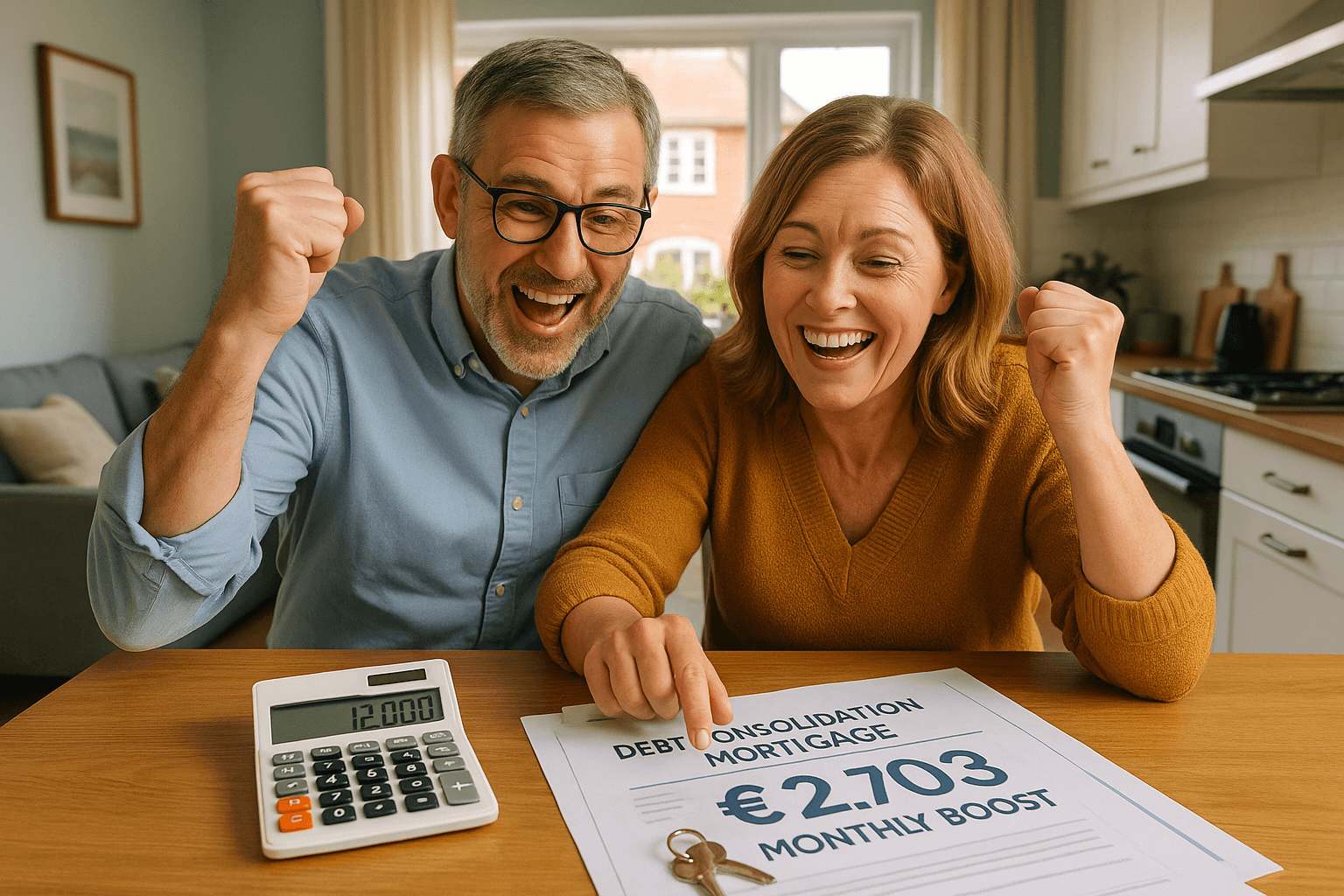

Debt Consolidation Remortgage Saves Family £12,000 2025

Discover how a debt consolidation remortgage transformed one family's financial situation, saving them over £12,000 in interest and boosting their monthly disposable income by approximately £2,703.03. This article delves into their journey of consolidating £87,644 of high-interest debts into a single manageable mortgage payment, alleviating financial stress and paving the way for a brighter future. Learn about the benefits of remortgaging and how it can help you regain control of your finances.

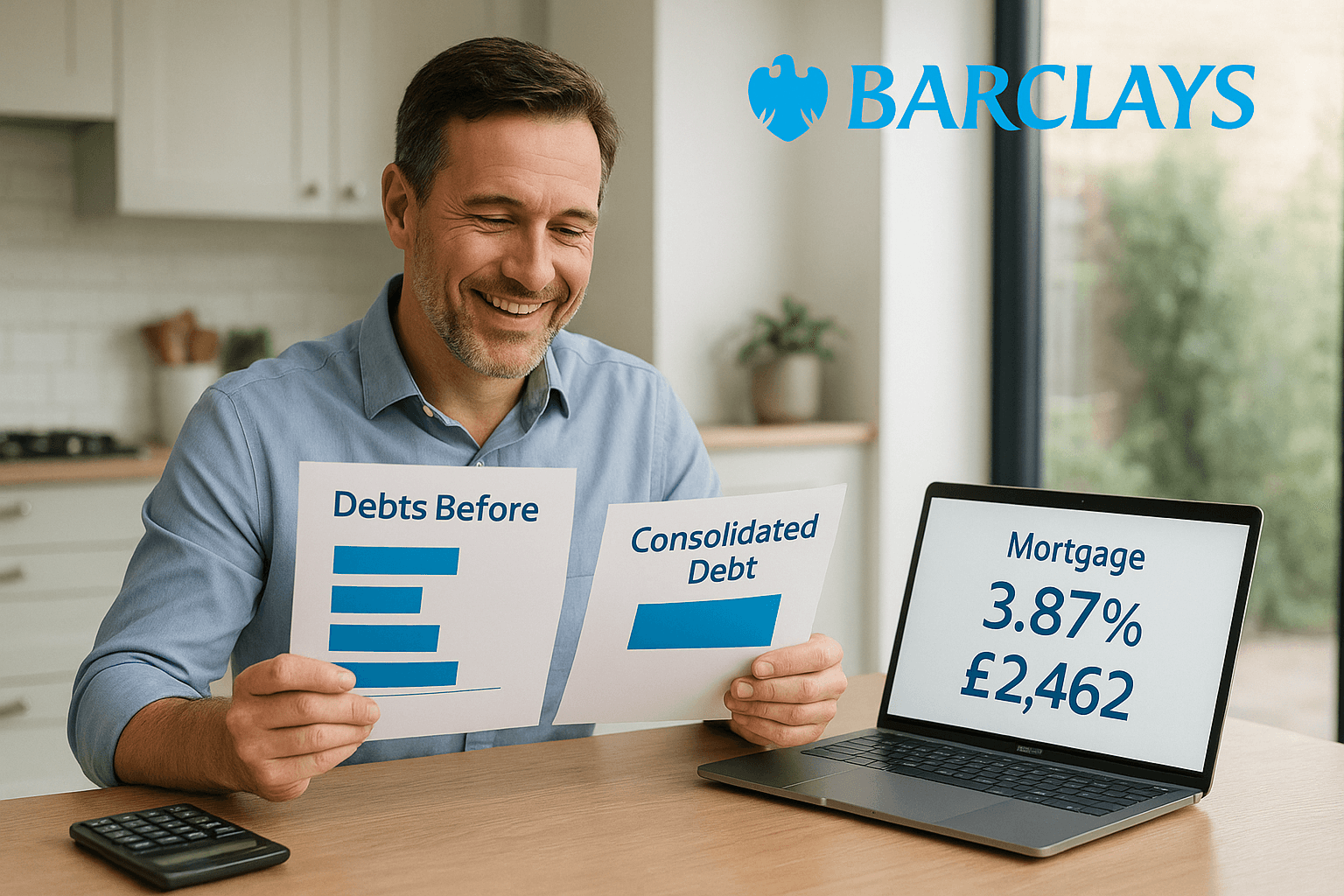

Barclays Debt Consolidation Remortgage Case Study 2025

Discover how a debt consolidation remortgage helped a Hampshire homeowner regain control of his finances by consolidating over £103,000 in unsecured debts into a manageable mortgage payment. With a competitive fixed rate, he achieved significant monthly savings and improved cash flow, all while keeping his payments under £2,500. This case study highlights the importance of exploring flexible remortgage options to relieve financial stress and enhance affordability. Whether you're considering consolidation or simply seeking to improve your financial situation, our expert advisers are here to guide you through the process.

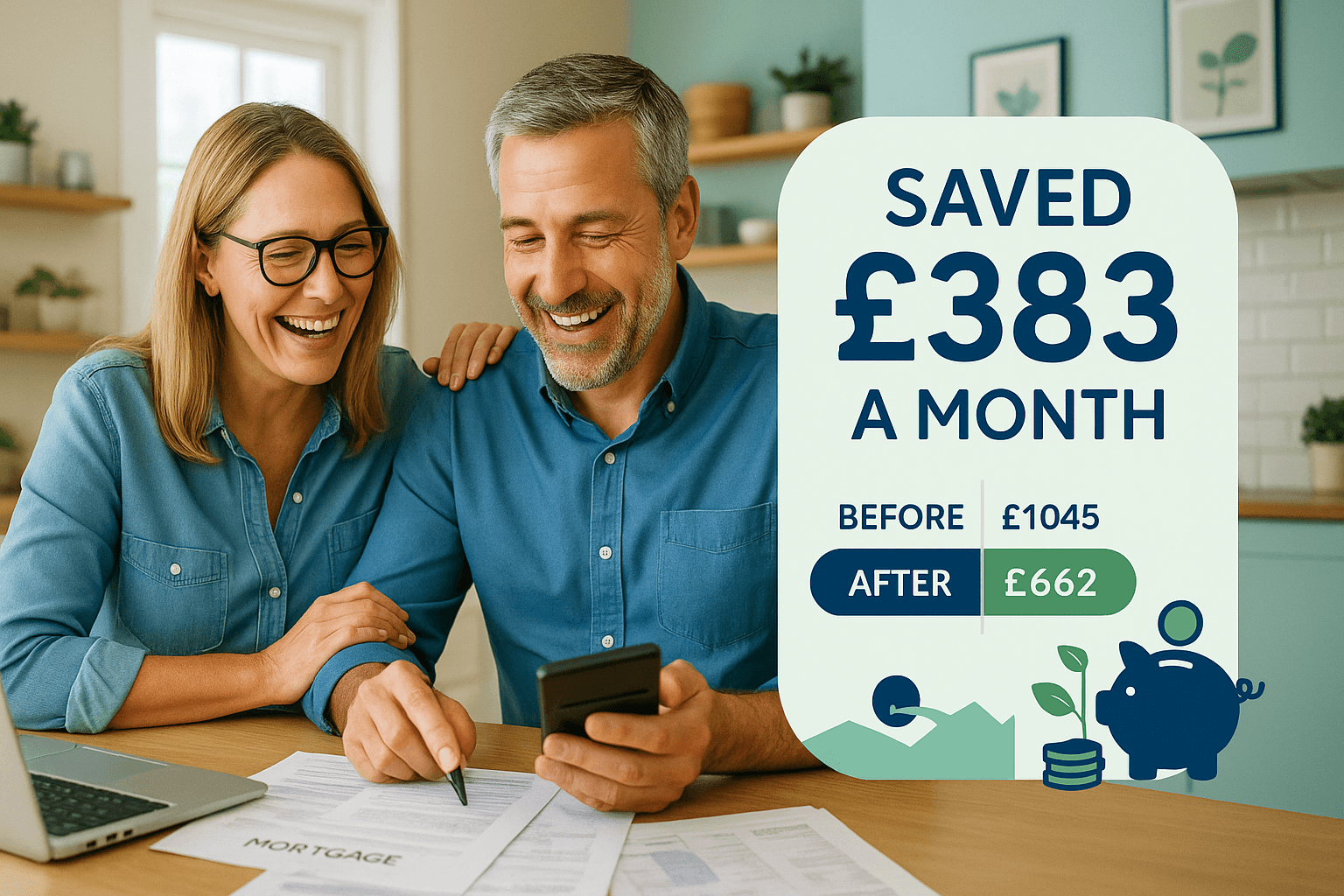

How Debt Consolidation Remortgage Saved £383 Monthly | Real Case Study 2025

Discover how a debt consolidation remortgage transformed the financial situation of a Midlands couple, reducing their monthly payments by £383. Struggling with high outgoings from a mortgage and a secured loan, they found relief through remortgaging, which simplified their debts into one manageable payment. This strategic move not only improved their cash flow but also set the stage for future savings and stability. Learn how this approach can help others facing similar financial challenges.

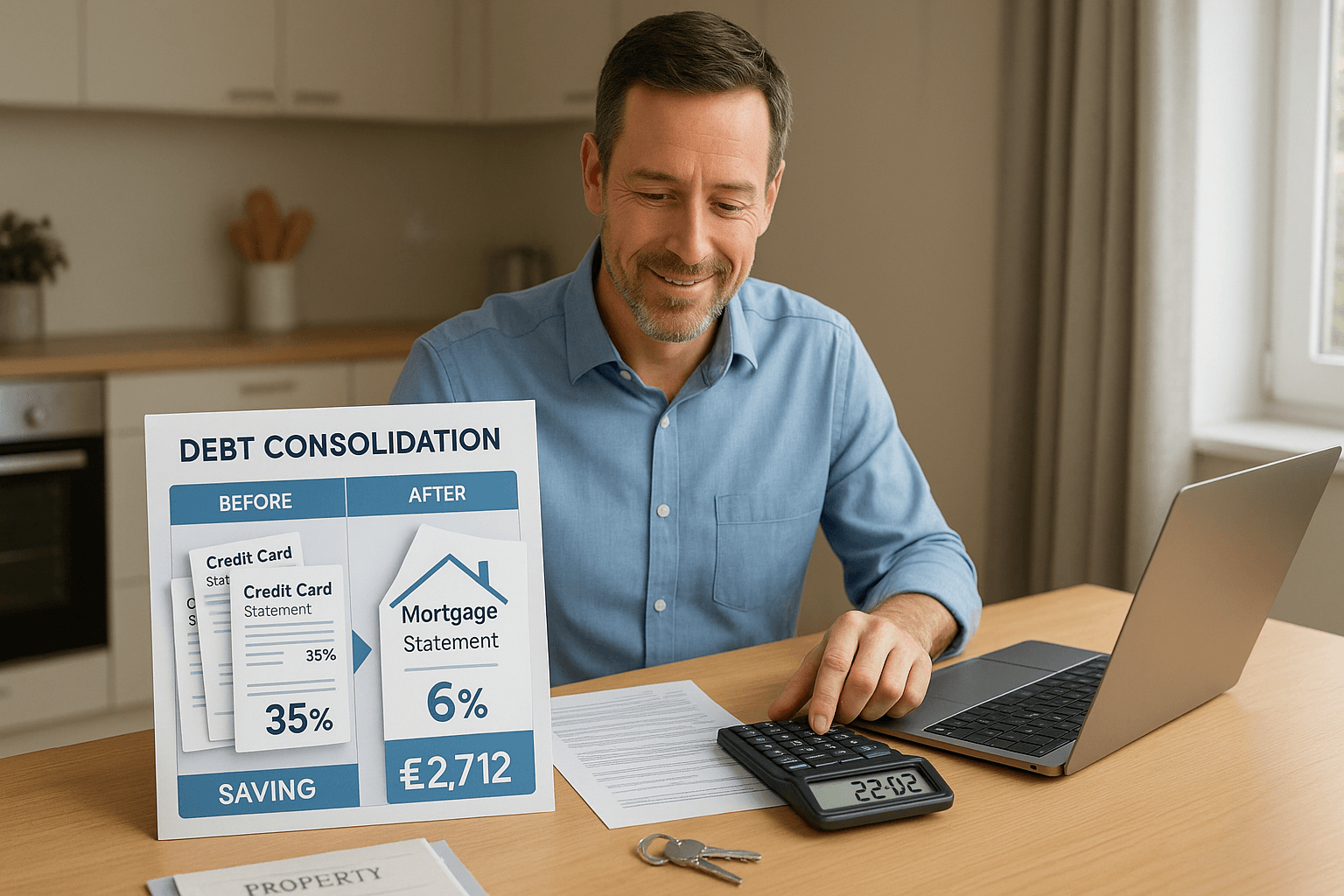

Debt Consolidation Remortgage Case Study & Savings 2025

Discover how a debt consolidation remortgage transformed one UK homeowner's finances by simplifying multiple debts into a single, manageable mortgage payment. By securing an additional £20,000 to buy out an ex-partner and consolidating £3,530 of high-interest credit card debt, they saved approximately £2,712.30 over the mortgage term. This strategic approach not only enhanced financial security but also enabled sole ownership of the property, proving that debt consolidation can be a smart solution even for those in stable financial situations.

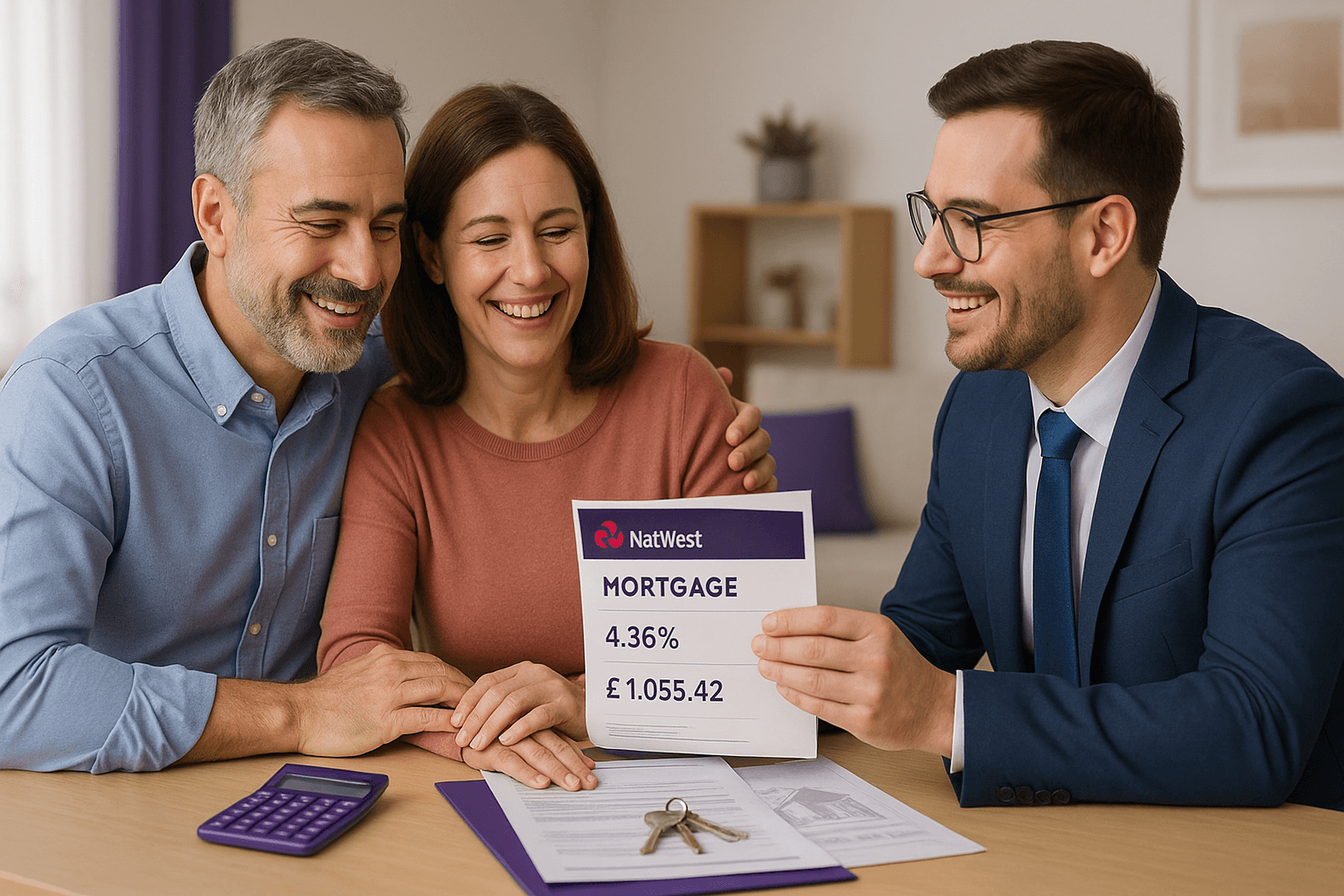

NatWest Debt Consolidation Mortgage Success Story 2025

Discover how a couple streamlined their finances with a debt consolidation mortgage from NatWest, enabling them to combine a secured loan and essential home improvements into a single, manageable monthly payment. With a fixed rate of 4.36% until December 2030, they achieved financial stability and reduced their monthly obligations. This solution not only simplified their financial management but also provided flexibility for future needs. Explore how consolidating debt can lead to significant savings and peace of mind.

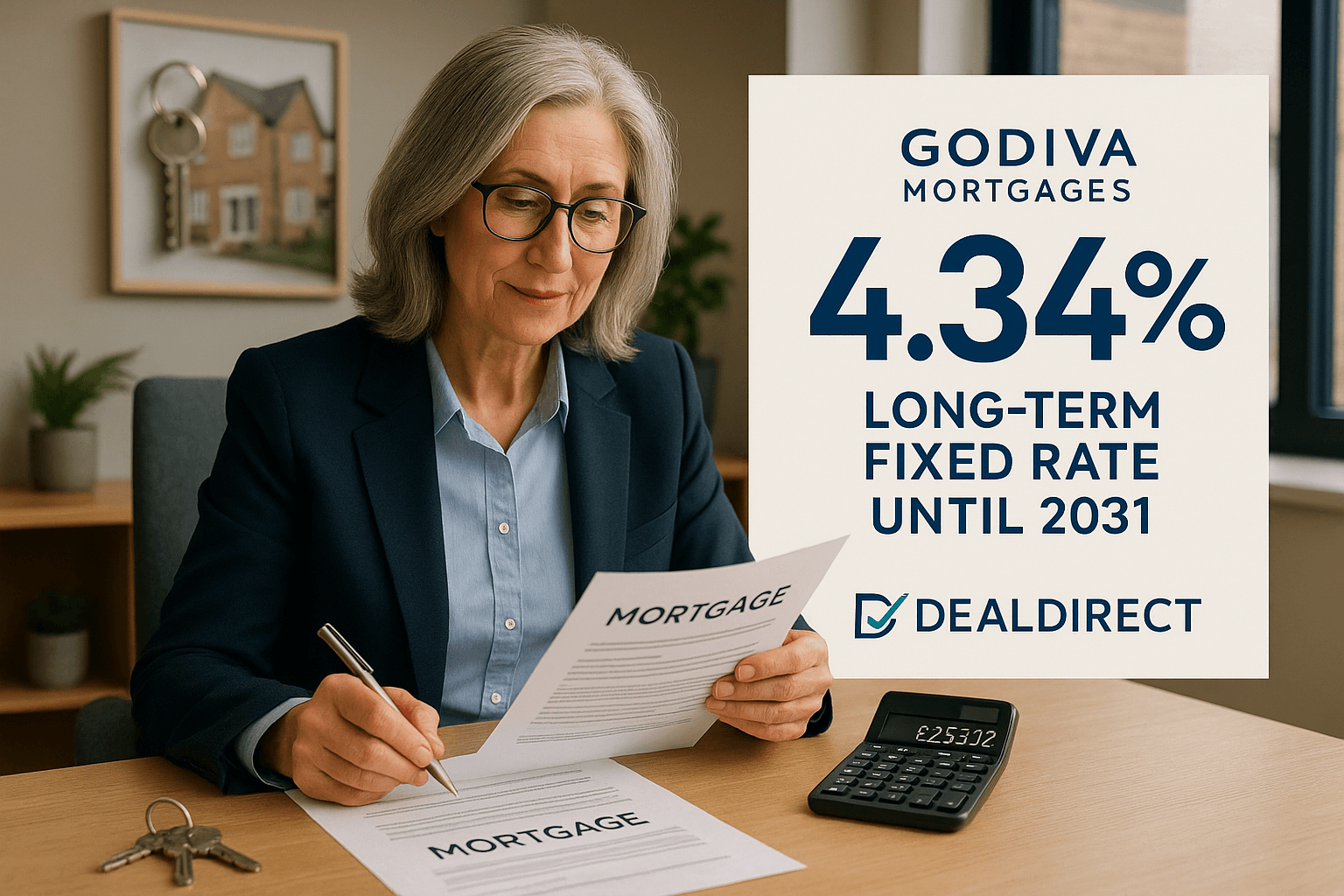

Godiva Mortgages Remortgage: 4.34% Fixed Interest-Only 2025

Explore how one landlord in her mid-60s achieved long-term financial flexibility by remortgaging with Godiva Mortgages. Faced with the end of her fixed-rate mortgage, she sought to clear debt while maintaining steady rental income. By opting for a fixed-rate interest-only plan, she secured lower monthly payments and avoided additional fees. This strategic move not only streamlined her finances but also provided options for future investments. Discover the benefits of staying with your lender and how a smart remortgage can enhance your property strategy.

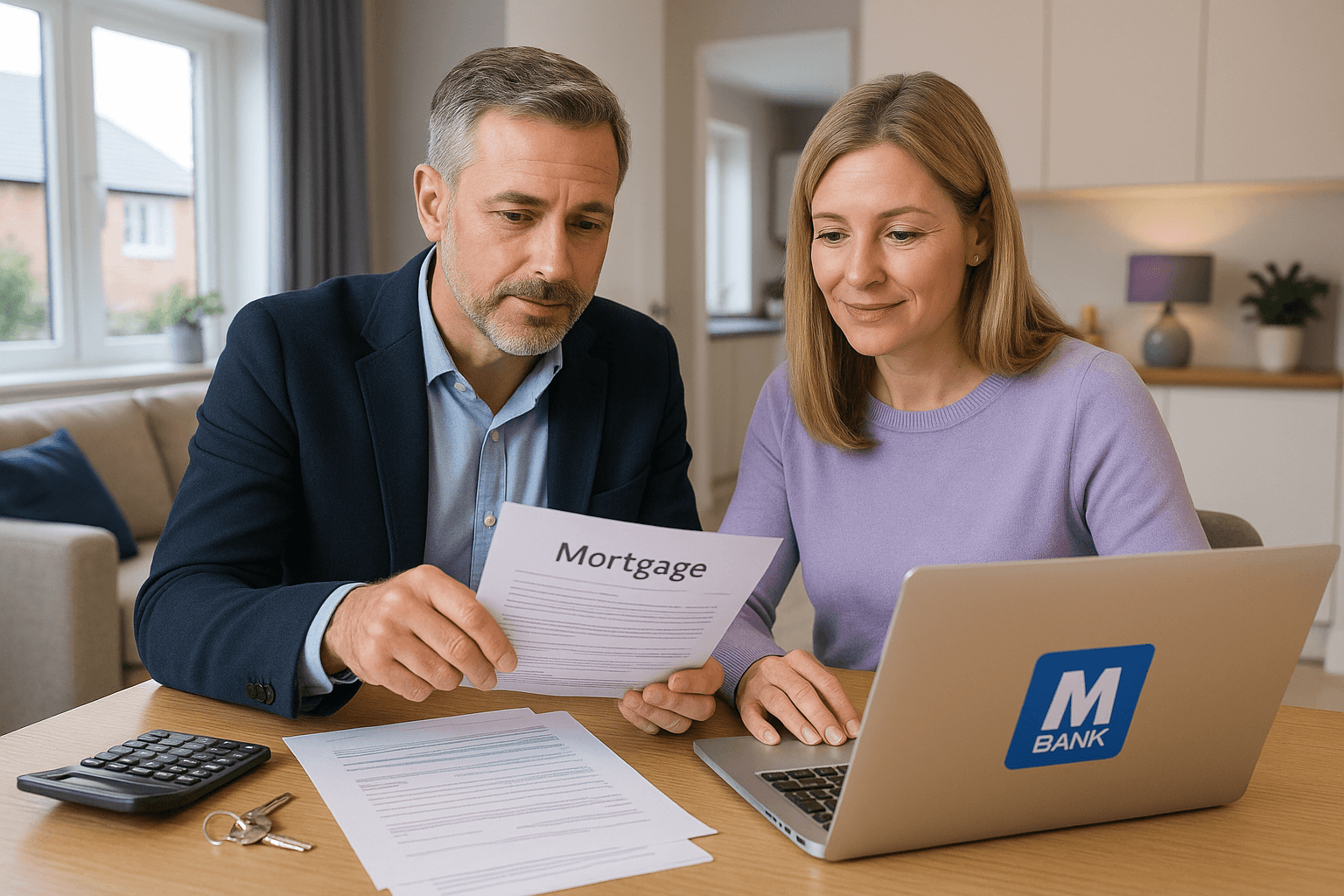

Metro Bank Remortgage 2025: 5.59% Fixed Rate, Zero Fees

Discover how a Hampshire couple successfully navigated rising mortgage costs by opting to remortgage with their existing lender, Metro Bank. By securing a 2-year fixed rate of 5.59%, they avoided the pitfalls of a standard variable rate and significant monthly payment increases. This strategic move not only provided peace of mind but also preserved their existing mortgage term without any additional fees. Learn how remortgaging early can safeguard your finances and enhance flexibility in a fluctuating market.