Related articles...

Remortgage to Consolidate Debt: Save £573 Monthly in 2025

Discover how one UK homeowner transformed her financial situation by consolidating £21,724 of high-interest credit card debt through a remortgage. By streamlining her payments, she slashed monthly costs by approximately £573.23, paving the way for savings and financial peace. This article explores the benefits of debt consolidation remortgages, including lower interest rates and simplified finances, providing a clear path to a brighter financial future.

Debt Consolidation Mortgage Case Study – Save £672/Month

Discover how a debt consolidation mortgage transformed the financial landscape for a couple in the North West of England, enabling them to manage £33,000 in high-interest credit card debt more effectively. This strategic move not only simplified their repayments but also provided them with greater disposable income, enhancing their financial resilience and paving the way for a debt-free future. Learn about the key benefits, potential savings, and expert advice on consolidating debts responsibly.

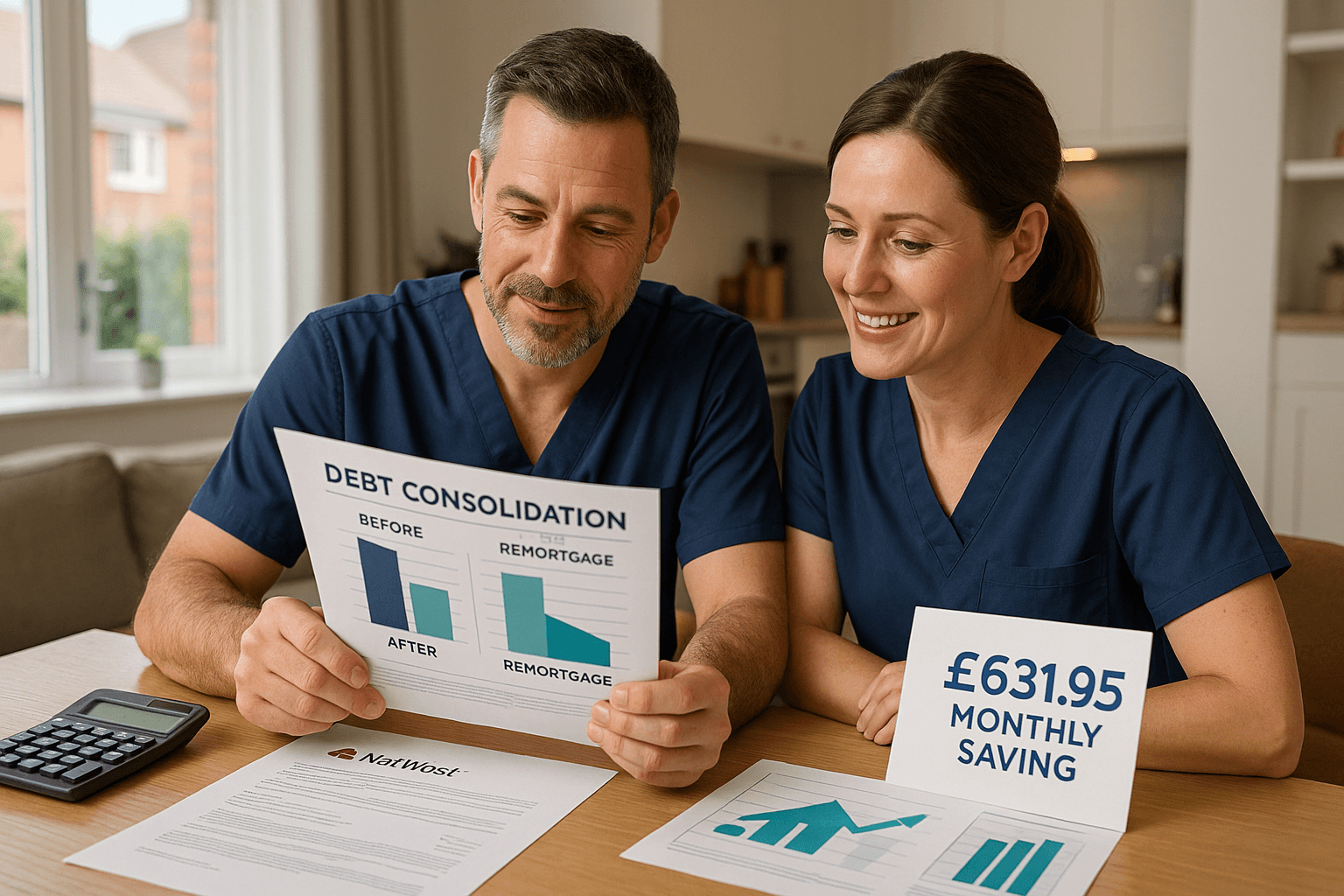

Debt Consolidation Remortgage Case Study | £378 Saved

Discover how a debt consolidation remortgage transformed the financial landscape for a couple struggling with high-interest debts. By consolidating £40,321 into their mortgage, they reduced their monthly outgoings by £378.85, alleviating financial pressure and providing a clear path to becoming debt-free. This approach not only simplified their repayments but also improved their quality of life, demonstrating the potential benefits of remortgaging to consolidate debt.

Written by

Gareth Davies | Mortgage Advisor

About the Author: