Debt Consolidation Mortgage:

What is a Debt Consolidation Mortgage?

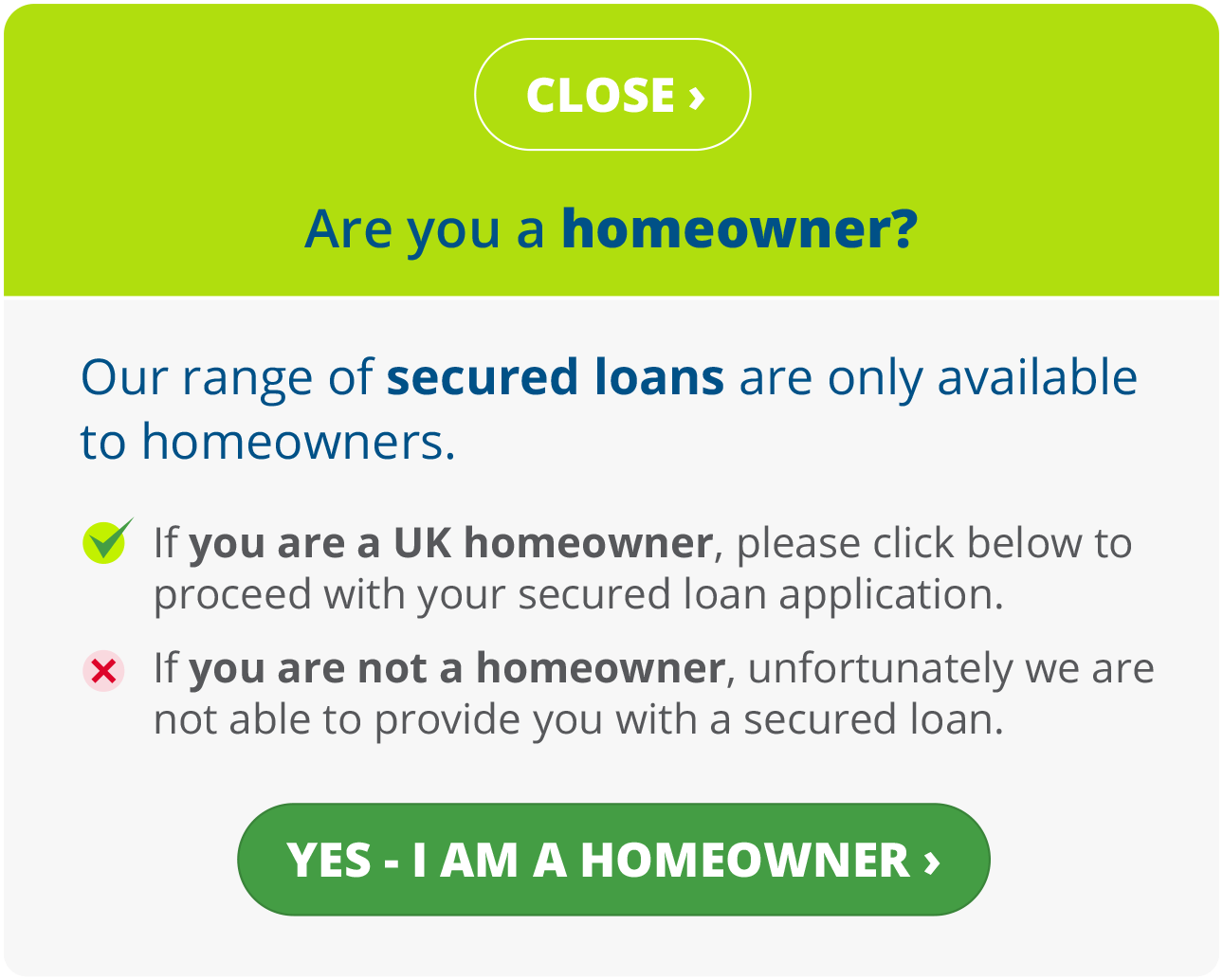

A debt consolidation mortgage allows you to combine multiple existing debts into a single, manageable monthly payment by either remortgaging your current property or taking out a secured loan against your home.

This financial solution can help UK homeowners regain control of their finances by potentially reducing monthly payments and simplifying debt management.

We’ve made it quick and simple to…

- Compare the whole market

- Save your quote – return any time

- Get a quote without affecting credit score

- Receive a formal lender offer within 24hrs

- Easily complete whole process online

At Deal Direct Financial, we offer both remortgage and secured loan options, making us your one-stop shop for debt consolidation solutions tailored to your specific circumstances.

Your home is at risk if you do not keep up repayments on a mortgage or other loan secured on it.

A leading UK Mortgage broker since 2005 – Trusted by over 10,000 people every year

See your best options online in minutes…

At Deal Direct Financial, we offer both remortgage and secured loan options, making us your one-stop shop for debt consolidation solutions tailored to your specific circumstances.

With DirectQuote, our industry leading online process, you can compare the latest deals available to you.

Unsure which debt consolidation option is right for you?

If you’re unsure which debt consolidation option is right for you – call today to speak with one of our mortgage experts or talk with us via our live mortgage advisor help chat.

How does debt consolidation work?

Remortgage for debt consolidation

When you remortgage for debt consolidation, you replace your existing mortgage with a new, larger mortgage. The additional funds are used to pay off your existing debts, leaving you with just one monthly mortgage payment.

Secured Loan for debt consolidation

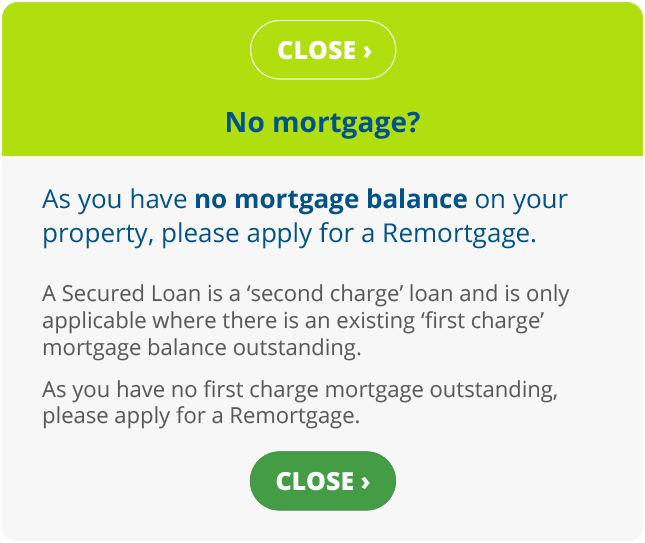

Alternatively, a secured loan uses your property as security while keeping your existing mortgage in place. This second charge loan provides funds to clear your debts, resulting in two secured payments instead of multiple unsecured ones.

Benefits of Debt Consolidation Mortgages

- Lower monthly payments: Mortgage rates are typically lower than credit cards, personal loans, and other unsecured debt, potentially reducing your total monthly outgoings.

- Simplified finances: Replace multiple payment dates and amounts with one predictable monthly payment.

- Improved credit score: Clearing existing debts can positively impact your credit rating over time.

- Potential tax benefits: Mortgage interest may be tax-deductible in certain circumstances.

- Flexible terms: Extend repayment periods to reduce monthly commitments or choose shorter terms to save on total interest.

Who can apply for a Debt Consolidation Mortgage?

You may be eligible if you:

- Own a property in the UK with sufficient equity

- Have a stable income to support mortgage payments

- Are aged 18-75 (varies by lender)

- Have debts you wish to consolidate totalling £5,000 or more

- Can demonstrate affordability for the new arrangement

Types of debt you can consolidate

Your borrowing power is based on:

- Credit card balances

- Personal loans

- Store cards and finance agreements

- Overdrafts

- Payday loans

- Car finance

- Business debts (in some cases)

- Other unsecured borrowing

Remortgage vs Secured Loan: Which is right for you?

Choose Remortgage When:

- You’re already considering remortgaging

- You want the lowest possible interest rate

- Your current mortgage rate is higher than available deals

- You prefer one single monthly payment

Choose Secured Loan When:

- You have a competitive existing mortgage rate

- You’re within an early repayment charge period

- You need a smaller amount relative to your property value

- You want to keep your current mortgage arrangement

The application process

1

Step 1: Initial Assessment

Complete our online application or speak with our expert advisors to assess your situation and determine the best debt consolidation option.

2

Step 2: Property Valuation

We’ll arrange a professional valuation of your property to confirm available equity.

3

Step 3: Affordability Assessment

Our underwriters will review your income, expenditure, and credit history to ensure the new arrangement is sustainable.

4

Step 4: Legal Process

Once approved, solicitors will handle the legal aspects of your remortgage or secured loan.

5

Step 5: Completion

Funds are released to pay off your existing debts, and your new arrangement begins.

Common questions about debt consolidation mortgages

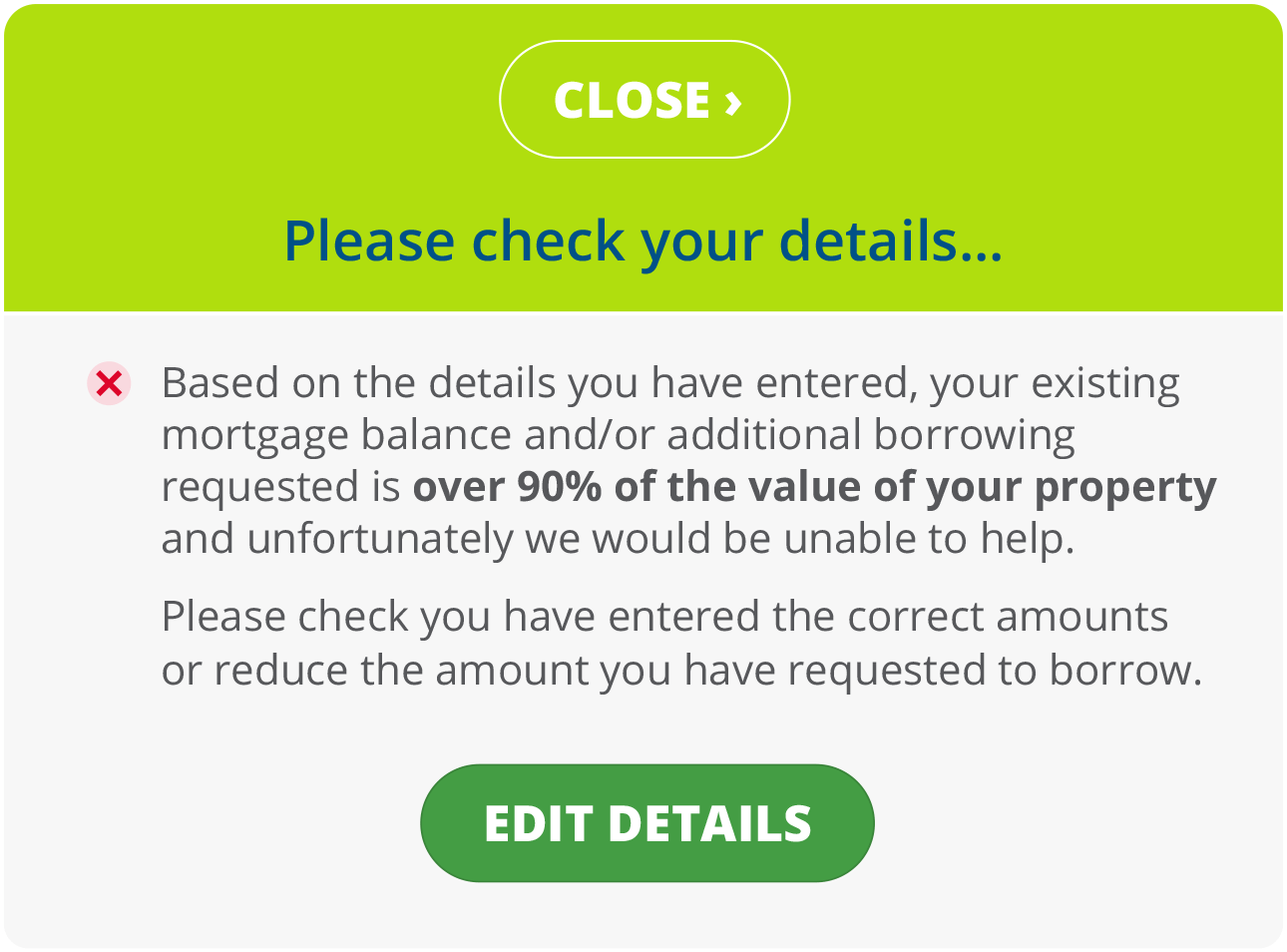

The amount you can borrow depends on your property value, existing mortgage balance, income, and affordability. Typically, you can access up to 85% of your property value minus your existing mortgage balance. Our advisors will calculate your maximum borrowing during your free consultation.

Initially, there may be a small temporary impact from credit searches. However, consolidating debts and making regular payments typically improves your credit score over time by reducing your credit utilisation ratio and payment complexity.

Your home is at risk if you cannot keep up repayments on your mortgage or secured loan. It’s essential to ensure the new payment is affordable and sustainable before proceeding. Our advisors will conduct thorough affordability assessments to minimise this risk.

A typical remortgage takes 4-8 weeks from application to completion, while secured loans can often complete within 2-4 weeks. Timeline depends on property valuation, legal processes, and lender requirements.

Yes, we work with specialist lenders who consider applications from clients with impaired credit. While rates may be higher, debt consolidation can still provide significant monthly savings and help rebuild your credit profile.

Potential fees include arrangement fees, valuation costs, legal fees, and early repayment charges on your existing mortgage. We’ll provide a clear breakdown of all costs before you proceed, and many can be added to your new borrowing.

Yes, we work with specialist lenders who consider applications from clients with impaired credit. While rates may be higher, debt consolidation can still provide significant monthly savings and help rebuild your credit profile.

Potential fees include arrangement fees, valuation costs, legal fees, and early repayment charges on your existing mortgage. We’ll provide a clear breakdown of all costs before you proceed, and many can be added to your new borrowing.

Debt consolidation works best for homeowners with multiple high-interest debts who want to simplify payments and potentially reduce monthly outgoings. Our advisors will review your specific situation to determine if it’s the most suitable option.

If you choose a variable rate product, your payments may increase with rate rises. We offer fixed-rate options to provide payment certainty, and our advisors will explain all rate options available to you.

Why choose Deal Direct Financial?

- Whole-of-Market Access: We search across hundreds of lenders to find your best rate

- Expert Advisors: Specialist knowledge in debt consolidation mortgages and secured loans

- Transparent Service: Clear explanation of all costs and options before you proceed

- Ongoing Support: Dedicated support from application through to completion and beyond

- Regulatory Protection: Fully authorised and regulated by the Financial Conduct Authority

Key takeaways

- Simplified Finances: Replace multiple debt payments with one manageable monthly payment

- Potential Savings: Lower interest rates can reduce your total monthly outgoings significantly

- Dual Options: Choose between remortgage or secured loan solutions based on your circumstances

- Expert Guidance: Deal Direct Financial provides comprehensive advice throughout the entire process

- Flexible Solutions: Tailored lending options for various credit profiles and circumstances

- One-Stop Service: Access to both remortgage and secured loan products under one roof

Ready to consolidate your debts?

Take control of your finances today with a debt consolidation mortgage or secured loan from Deal Direct Financial. Our expert advisors are ready to review your situation and recommend the most suitable solution.

Complete our secure online application in minutes

Speak with our advisors for personalised advice

Quick Decisions – Get an initial decision within 24 hours

Your home may be repossessed if you do not keep up repayments on your mortgage or any other debt secured on it. The guidance and/or advice contained in this website is subject to UK regulatory regime and is therefore targeted at consumers based in the UK.