Finding the right lender for your debt consolidation

Choosing the right debt consolidation mortgage lender is crucial for securing the best rates and terms for your specific circumstances. Different lenders have varying criteria, specialties, and rate structures that can significantly impact your monthly savings and overall borrowing costs.

Deal Direct Financial provides access to the UK’s leading debt consolidation mortgage lenders, including high street banks, building societies, and specialist lenders, ensuring you get the most competitive deal available.

We’ve made it quick and simple to…

- Compare the whole market

- Save your quote – return any time

- Get a quote without affecting credit score

- Receive a formal lender offer within 24hrs

- Easily complete whole process online

Your home is at risk if you do not keep up repayments on a mortgage or other loan secured on it.

A leading UK Mortgage broker since 2005 – Trusted by over 10,000 people every year

Instant online quote for a remortgage to pay off debt

With DirectQuote, our industry leading online process, you can compare the latest deals available to you and see how much better of you could be with a remortgage to pay off debt.

Unsure which lender is right for you?

If you’re unsure which lender is right for your debt consolidation mortgage – call today to speak with one of our mortgage lender experts or talk with us via our live mortgage advisor help chat.

Types of debt consolidation mortgage lenders

High Street Banks

Major banks like Barclays, HSBC, Lloyds, and NatWest offer competitive rates for borrowers with good credit profiles and standard employment situations.

Strengths:

- Competitive rates for prime borrowers

- Established customer service networks

- Comprehensive product ranges

- Strong brand recognition and stability

Considerations:

- Stricter lending criteria

- Less flexibility for complex cases

- Limited options for impaired credit

- Standardised approach to applications

Building Societies

Nationwide, Coventry, and Yorkshire Building Society often provide more personalised service and flexible lending criteria.

Strengths:

- Member-focused approach

- Flexible lending criteria

- Competitive rates

- Local presence and relationships

Considerations:

- Smaller product ranges

- May have membership requirements

- Limited specialist products

- Regional restrictions in some cases

Specialist Lenders

Lenders like Kensington, Precise, and Foundation Home Loans focus on complex cases and non-standard situations.

Strengths:

- Flexible lending criteria

- Complex income assessment

- Impaired credit specialists

- Innovative product solutions

Considerations:

- Higher rates than mainstream lenders

- More extensive documentation requirements

- Longer processing times

- Specialist broker relationships required

Key factors lenders consider for debt consolidation

Credit Profile Assessment

- Excellent Credit (750+): Access to best rates from all lender types

- Good Credit (650-749): Competitive rates from most mainstream lenders

- Fair Credit (550-649): Limited mainstream options, specialist lenders available

- Poor Credit (<550): Specialist lenders only, higher rates but still potential savings

Income Verification

- Employed: Standard 4-5x income multiples

- Self-Employed: 2-3 years accounts, variable income assessment

- Contractors: Day rate calculations, contract continuity

- Pension Income: Age-related lending criteria

Property and Equity

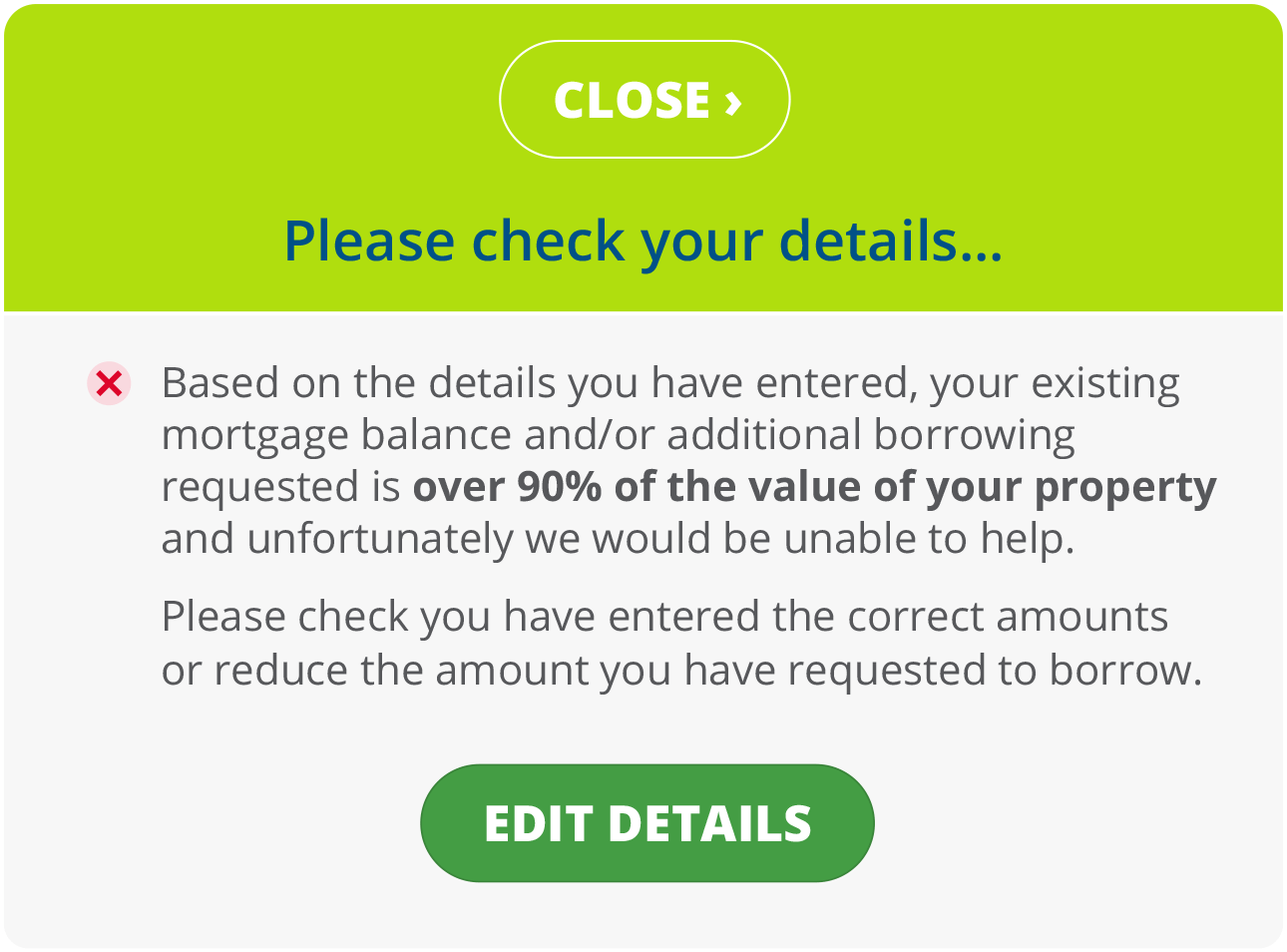

- Loan-to-Value Ratios: 60-85% depending on lender and credit profile

- Property Types: Standard, non-standard construction, ex-local authority

- Valuation Methods: Desktop, drive-by, or full survey depending on amount

Debt-to-Income Ratios

- Total Debt Levels: Including proposed mortgage and remaining debts

- Debt Consolidation Amount: Proportion of total borrowing for debt clearance

- Affordability Stress Testing: Ability to maintain payments if rates increase

Comparing lender rates and criteria

Prime Lenders (Excellent Credit Required)

| Typical Rates: | Maximum LTV | Income Multiples | Specialist Features |

| 3.5% - 5.5% depending on LTV and term | 85% for debt consolidation | 4.5x joint income, 5x single income | Offset mortgages, flexible overpayment options |

Near-Prime Lenders (Good Credit Accepted)

| Typical Rates: | Maximum LTV | Income Multiples | Specialist Features |

| 4.5% - 6.5% depending on circumstances | 80% for debt consolidation | 4x joint income, 4.5x single income | Higher income multipliers, flexible criteria |

Specialist Lenders (All Credit Profiles)

| Typical Rates: | Maximum LTV | Income Multiples | Specialist Features |

| 5.5% - 12% depending on risk assessment | 75% for debt consolidation typically | Income Multiples: Case-by-case assessment | Manual underwriting, complex income assessment |

How Deal Direct Financial accesses all lender types

- Whole-of-Market Access

We maintain relationships with over 200 lenders across all categories, ensuring access to the full range of available products and rates.

-

Specialist Lender Relationships

Many specialist lenders work exclusively through selected brokers, giving you access to products unavailable through direct applications.

- Rate Comparison Technology

Our systems compare rates across all lender types in real-time, ensuring you see the most competitive options available.

- Application Optimisation

We match your profile to lenders most likely to approve your application, improving success rates and reducing credit footprint.

Lender comparison: Debt consolidation specialists

Mainstream Lenders

– best for:

- Excellent credit borrowers

- Standard employment situations

- Straightforward property types

- Lower LTV requirements

Specialist Lenders

– best for:

- Impaired credit histories

- Self-employed borrowers

- Complex income structures

- Non-standard properties

- Higher LTV requirements

Building Societies

– best for:

- Local property markets

- Relationship-based lending

- Flexible criteria interpretation

- Member benefits and loyalty

Frequently Asked Questions about Remortgages

The best rates depend on your credit profile, income, and property equity. Prime borrowers typically get best rates from high street banks, while those with impaired credit may find better value with specialist lenders despite higher rates.

Yes, specialist lenders offer debt consolidation mortgages for borrowers with CCJs, defaults, arrears, and even previous bankruptcies. Rates will be higher, but significant savings are often still achievable compared to existing high-cost debt.

No, LTV ratios vary significantly. Mainstream lenders typically offer up to 85% LTV, while specialist lenders may restrict to 75% or lower for debt consolidation cases, especially with impaired credit.

Lenders use detailed affordability models considering your income, existing commitments, living expenses, and the proposed new mortgage payment. They stress-test affordability at higher interest rates to ensure sustainability.

Mainstream lenders use automated scoring systems with strict criteria, while specialist lenders often use manual underwriting, considering individual circumstances and complex situations that automated systems might decline.

It’s better to work with a broker who can identify the most suitable lenders for your profile. Multiple applications can impact your credit score and some lenders may decline applications if they see recent credit searches.

Not necessarily. Building societies often offer competitive rates and more flexible criteria, but banks may have better rates for certain profiles. Comparison across all lender types is essential.

Mainstream lenders typically take 3-4 weeks, building societies 4-6 weeks, and specialist lenders 6-8 weeks. Processing times depend on case complexity and documentation requirements.

Key takeaways

- Lender Diversity: Different lender types serve different borrower profiles and circumstances

- Rate Variations: Significant rate differences exist between lender types and individual lenders

- Criteria Flexibility: Specialist lenders offer solutions when mainstream lenders decline

- Whole Market Access: Broker access provides comprehensive lender comparison

- Application Strategy: Matching borrower profiles to suitable lenders improves success rates

- Ongoing Relationships: Established lender relationships facilitate smoother applications

Lender selection strategy

For Excellent Credit Borrowers:

- Start with mainstream lenders for best rates

- Compare high street banks and building societies

- Consider offset mortgage options for additional flexibility

- Evaluate fee structures alongside interest rates

For Good Credit Borrowers:

- Compare mainstream and near-prime lenders

- Consider building societies for flexible criteria

- Evaluate specialist lenders if mainstream options limited

- Balance rates with acceptance probability

For Impaired Credit Borrowers:

- Focus on specialist lenders with flexible criteria

- Compare adverse credit specialists for best rates

- Consider building societies with local presence

- Prioritise acceptance over rate optimisation

For Complex Situations:

- Start with specialist lenders experienced in your situation

- Consider manual underwriting options

- Evaluate building societies for flexible interpretation

- Prepare comprehensive documentation for complex cases

Why Choose Deal Direct Financial for Lender Selection?

- Comprehensive Lender Panel: Access to 200+ lenders across all categories

- Specialist Relationships: Exclusive access to products unavailable elsewhere

- Rate Comparison: Real-time comparison across all available options

- Application Strategy: Optimal lender matching for your specific profile

- Ongoing Support: Dedicated relationship management throughout the process

- Market Intelligence: Insight into lender appetite and criteria changes

Your next steps

1

Profile Assessment

Complete our detailed assessment to understand which lender categories suit your circumstances.

2

Lender Comparison

Review our comprehensive comparison of available lenders and products for your profile.

3

Rate Analysis

Compare rates, fees, and terms across all suitable lenders to identify the best overall value.

4

Application Strategy

Develop an optimal application strategy to maximise approval chances and minimise credit impact.

5

Ongoing Support

Benefit from our lender relationships and expertise throughout the application process.

Contact our lender specialists

Ready to find the perfect debt consolidation mortgage lender for your needs? Our specialist advisors have in-depth knowledge of all lender types and can guide you to the most suitable options.

- Free Lender Comparison: Understand which lenders suit your profile

- Rate Analysis: Compare all available rates and terms

- Application Strategy: Optimise your approach for best results

- Ongoing Support: Expert guidance throughout the process

Related services

Beyond debt consolidation mortgages, Deal Direct Financial offers access to:

- Secured Loans – Alternative to remortgaging for smaller consolidation amounts

- Bridging Finance – Short-term solutions for urgent debt clearance

- Commercial Mortgages – Business debt consolidation options

- Buy-to-Let Mortgages – Investment property refinancing

- Development Finance – Property development and refurbishment funding

Contact us today to explore all available options and find your perfect lending solution.

Your home may be repossessed if you do not keep up repayments on your mortgage or any other debt secured on it. The guidance and/or advice contained in this website is subject to UK regulatory regime and is therefore targeted at consumers based in the UK.

Get personalised advice from our expert advisors