Remortgage to pay off debt:

How remortgaging can clear your debts

Remortgaging to pay off debt involves replacing your existing mortgage with a new, larger mortgage, using the additional funds to clear your outstanding debts. This strategy can transform multiple high-interest payments into one manageable monthly mortgage payment at a significantly lower rate.

Deal Direct Financial specialises in remortgage solutions for debt consolidation, offering access to the whole mortgage market alongside secured loan alternatives when remortgaging isn’t the optimal solution.

We’ve made it quick and simple to…

- Compare the whole market

- Save your quote – return any time

- Get a quote without affecting credit score

- Receive a formal lender offer within 24hrs

- Easily complete whole process online

Your home is at risk if you do not keep up repayments on a mortgage or other loan secured on it.

A leading UK Mortgage broker since 2005 – Trusted by over 10,000 people every year

Instant online quote for a remortgage to pay off debt

With DirectQuote, our industry leading online process, you can compare the latest deals available to you and see how much better of you could be with a remortgage to pay off debt.

Unsure which remortgage option is right for you?

If you’re unsure which remortgage option is right for you when looking to pay off debt – call today to speak with one of our mortgage experts or talk with us via our live mortgage advisor help chat.

Why choose remortgaging over other debt solutions?

- Lower Interest Rates

Mortgage rates are typically 3-7% compared to credit card rates of 15-25% and personal loan rates of 8-15%. This difference can result in substantial monthly savings.

- Extended Repayment Terms

Mortgages offer repayment periods of up to 35 years, significantly reducing monthly payment amounts compared to shorter-term unsecured borrowing.

- Single Monthly Payment

Replace multiple payment dates, amounts, and creditors with one predictable monthly mortgage payment, simplifying your financial management.

- Potential for Better Rates

When remortgaging, you may also secure a better rate on your existing mortgage borrowing, providing additional monthly savings.

How much can you release through remortgaging?

The amount you can release depends on several factors:

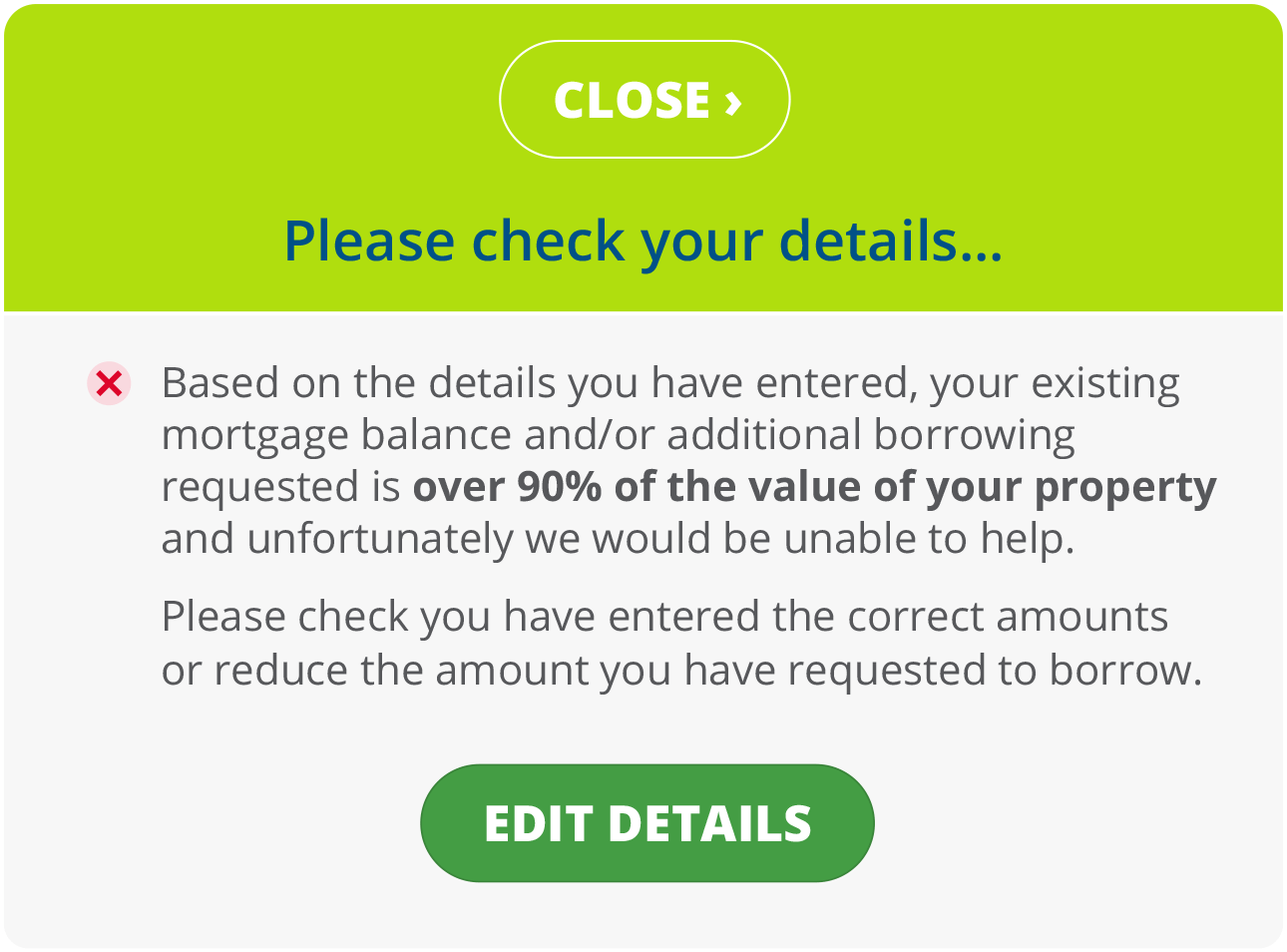

- Property Equity: Most lenders allow borrowing up to 85% of your property value

- Income Multiple: Typically 4-5 times your annual income, depending on the lender

- Affordability Assessment: Your disposable income after essential expenses

- Credit Profile: Your credit history affects available loan-to-value ratios

Example Calculation:

- Property Value: £300,000

- Existing Mortgage: £150,000

- Available Equity (85% LTV): £255,000 – £150,000 = £105,000

- Potential Debt Consolidation Fund: £105,000

What debts can you clear with a Remortgage?

High-Priority Debts to Consider:

- Credit Cards: Often carrying rates of 18-25% APR

- Personal Loans: Typically 8-15% APR depending on credit profile

- Store Cards: Often 25-30% APR on outstanding balances

- Payday Loans: Extremely high APR rates, sometimes exceeding 1,000%

- Overdrafts: Arranged and unarranged overdraft charges

- Car Finance: Higher-rate HP and PCP agreements

Priority order for debt clearance:

- Highest interest rate debts first

- Debts with penalty charges or fees

- Unsecured borrowing over secured alternatives

- Debts affecting your credit score most significantly

The remortgage process for debt consolidation

1

Phase 1: Initial Consultation (Week 1)

- Complete affordability assessment

- Review current debts and mortgage arrangement

- Identify optimal remortgage strategy

- Obtain agreement in principle

2

Phase 2: Property Valuation (Week 2)

- Professional property valuation arranged

- Confirm available equity for debt consolidation

- Finalise borrowing amount and product selection

3

Phase 3: Formal Application (Week 3-4)

- Submit full mortgage application

- Provide supporting documentation

- Underwriter assessment and approval

4

Phase 4: Legal Process (Week 5-7)

- Solicitor instructed to handle legal aspects

- Local authority searches completed

- Mortgage offer issued and accepted

5

Phase 5: Completion (Week 8)

- Legal completion of remortgage

- Existing mortgage redeemed

- Debt consolidation funds released to clear debts

- New mortgage arrangement begins

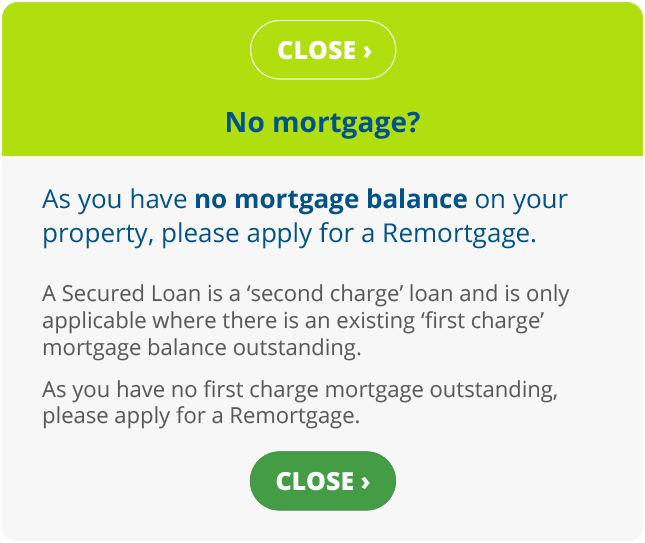

Remortgage vs Secured Loan for Debt Consolidation

When remortgaging is optimal:

- Your current mortgage rate is higher than available deals

- You’re outside any early repayment charge period

- You want the lowest possible consolidation rate

- You prefer managing just one monthly payment

When a Secured Loan might be better:

- Your existing mortgage has a competitive rate

- You’re within an early repayment charge period

- You need a smaller debt consolidation amount

- You want to preserve your current mortgage terms

Our Advantage: Deal Direct Financial offers both options, ensuring you get the most suitable solution for your circumstances.

Calculate your potential savings

Example debt consolidation scenarios:

| Scenario 1 - Young Professional | Scenario 2 - Growing Family: | Scenario 3 - Mid-Career: | |

| Current debts | £25,000 (average 18% APR) | £40,000 (average 22% APR) | £60,000 (average 16% APR) |

| Current monthly payments | £650 | £1,100 | £1,350 |

| Remortgage rate | 4.5% | 4.8% | 4.2% |

| New monthly payment | £180 | £290 | £415 |

| Monthly saving | £470 | £810 | £935 |

Assuming strong credit and a sizeable deposit. Your rate may differ based on your circumstances.

Frequently Asked Questions about Remortgages

Savings depend on your current debt levels and interest rates. For example, consolidating £30,000 of debt at an average 20% APR into a mortgage at 4% could save over £400 monthly. Our calculators provide personalised savings estimates.

Yes, we work with specialist lenders who accept applications from clients with impaired credit histories. While rates may be higher than prime products, significant savings are often still achievable compared to existing high-cost debt.

Recent property valuations are essential for accurate equity calculations. Even if values have decreased, you may still have sufficient equity for debt consolidation. Our advisors will assess your specific situation.

While extending terms increases total interest paid, the monthly savings often outweigh this concern. You can always make overpayments to reduce the term once your finances are more manageable.

Absolutely. We work with lenders who specialise in self-employed mortgages and understand variable income patterns. You’ll typically need 2-3 years of accounts or SA302 forms.

Initially, there may be a small impact from credit searches. However, clearing existing debts and maintaining mortgage payments typically improves your credit score significantly over 6-12 months.

The main considerations are: using your home as security, potential early repayment charges on your existing mortgage, and setup costs. Our advisors ensure benefits outweigh any disadvantages before proceeding.

A typical remortgage takes 6-8 weeks from application to completion. We can often arrange bridging solutions if you need to clear debts more urgently.

Key takeaways

- Significant Savings: Transform high-interest debt payments into low-rate mortgage payments

- Simplified Management: Replace multiple creditors with one monthly mortgage payment

- Flexible Terms: Extend repayment periods to minimise monthly financial pressure

- Whole Market Access: Compare rates from hundreds of lenders through Deal Direct Financial

- Alternative Options: Access to secured loans when remortgaging isn’t optimal

- Expert Guidance: Specialist advisors ensure you choose the most cost-effective solution

Why Deal Direct Financial for Your Remortgage?

- Market-Leading Rates: Access to exclusive deals not available on the high street

- Flexible Lending: Solutions for various credit profiles and circumstances

- Transparent Fees: All costs explained upfront with no hidden charges

- Fast Processing: Streamlined application process with quick decisions

- Ongoing Support: Dedicated advisor support throughout and beyond completion

- Regulatory Protection: FCA authorised and regulated for your peace of mind

Next steps…

- Use Our Calculator: Estimate your potential monthly savings

- Book Consultation: Speak with a specialist advisor

- Get Agreement in Principle: Understand your borrowing capacity

- Compare Options: Review remortgage vs secured loan benefits

- Complete Application: Begin your journey to financial freedom

Contact Deal Direct Financial today and take the first step toward simplifying your finances with a debt consolidation remortgage.

Start your debt consolidation journey today

Don’t let multiple debt payments control your finances. Discover how much you could save by remortgaging to pay off debt with Deal Direct Financial.

Complete our secure form in under 10 minutes

Get personalised advice from our expert advisors

Quick decision – Receive an initial assessment within 24 hours Whole Market Search: Access rates from over 200+ lenders

Your home may be repossessed if you do not keep up repayments on your mortgage. The Financial Conduct Authority does not regulate some forms of buy to let mortgages.