West One New Build Mortgage: 92.5% LTV Extra Plan August 2025

Read more

Halifax HomePlus Survey August 2025: Digital Level 2 Reports

Read more

Equitable 2nd Charge Bridging Loans: No Lender Consent Required

Read more

Kensington Buy-to-Let Mortgage 2025: New 4.89% Fixed Rate

Read more

Leeds Building Society August 2025: New Income Plus & Rate Cuts

Read more

Virgin Money & Clydesdale Bank Cut Rates August 2025: SVR to 6.99%

Read more

Skipton Building Society Contractor Mortgages: Flexible Criteria

Read more

Leek Building Society Mortgage August 2025: 5-Year Fixed at 4.45%

Read more

Virgin Money Mortgage Rates August 2025: New Exclusives & Cuts

Read more

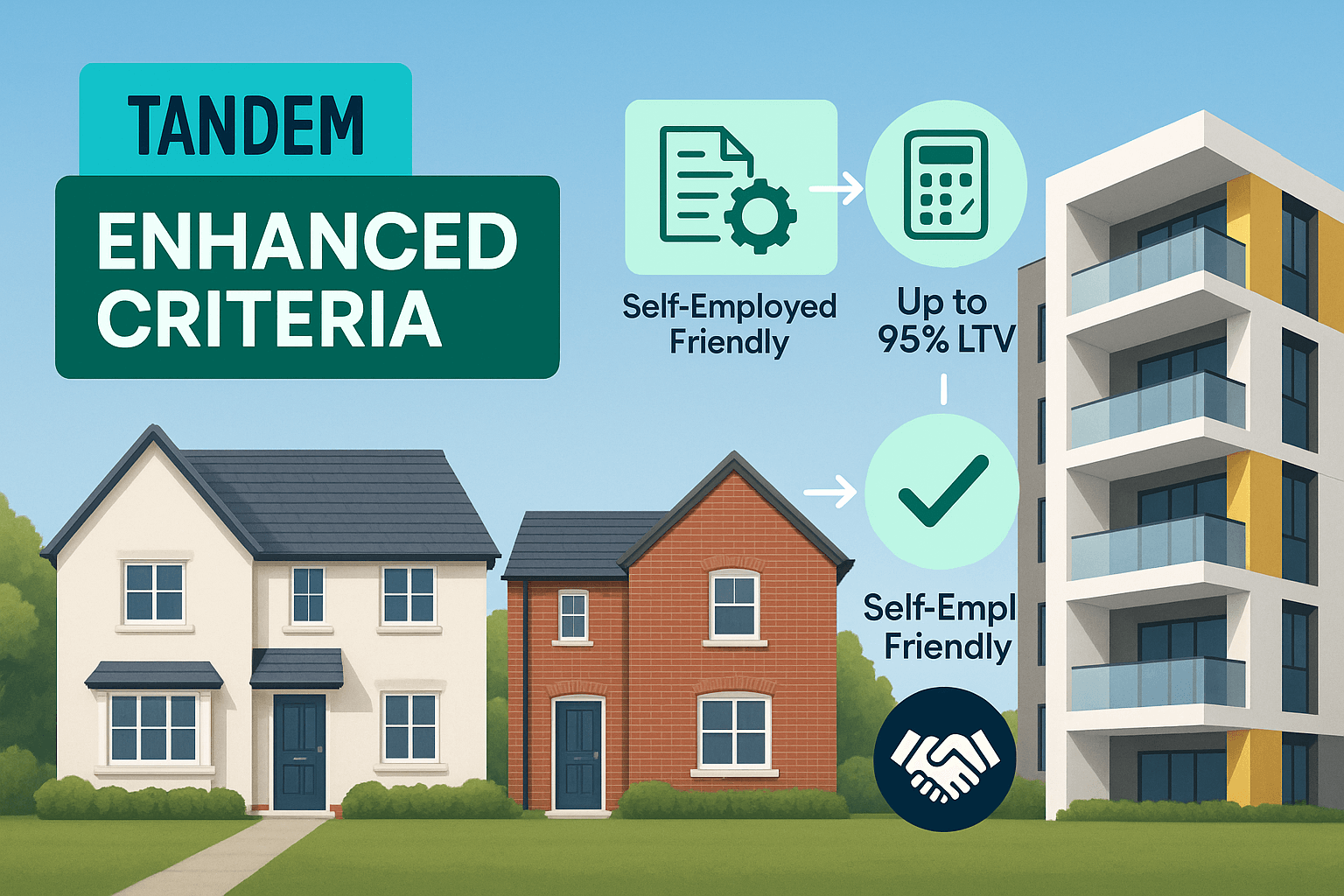

Tandem Bank Mortgage Criteria 2025: Enhanced Lending Updates

Read more

United Trust Bank Mortgage Rates August 2025: New Rate Cuts

Read more

HSBC Mortgage Rates August 2025: Latest Changes & Savings

Read more

experience a 5 star customer service