Mortgage & Loan Guides

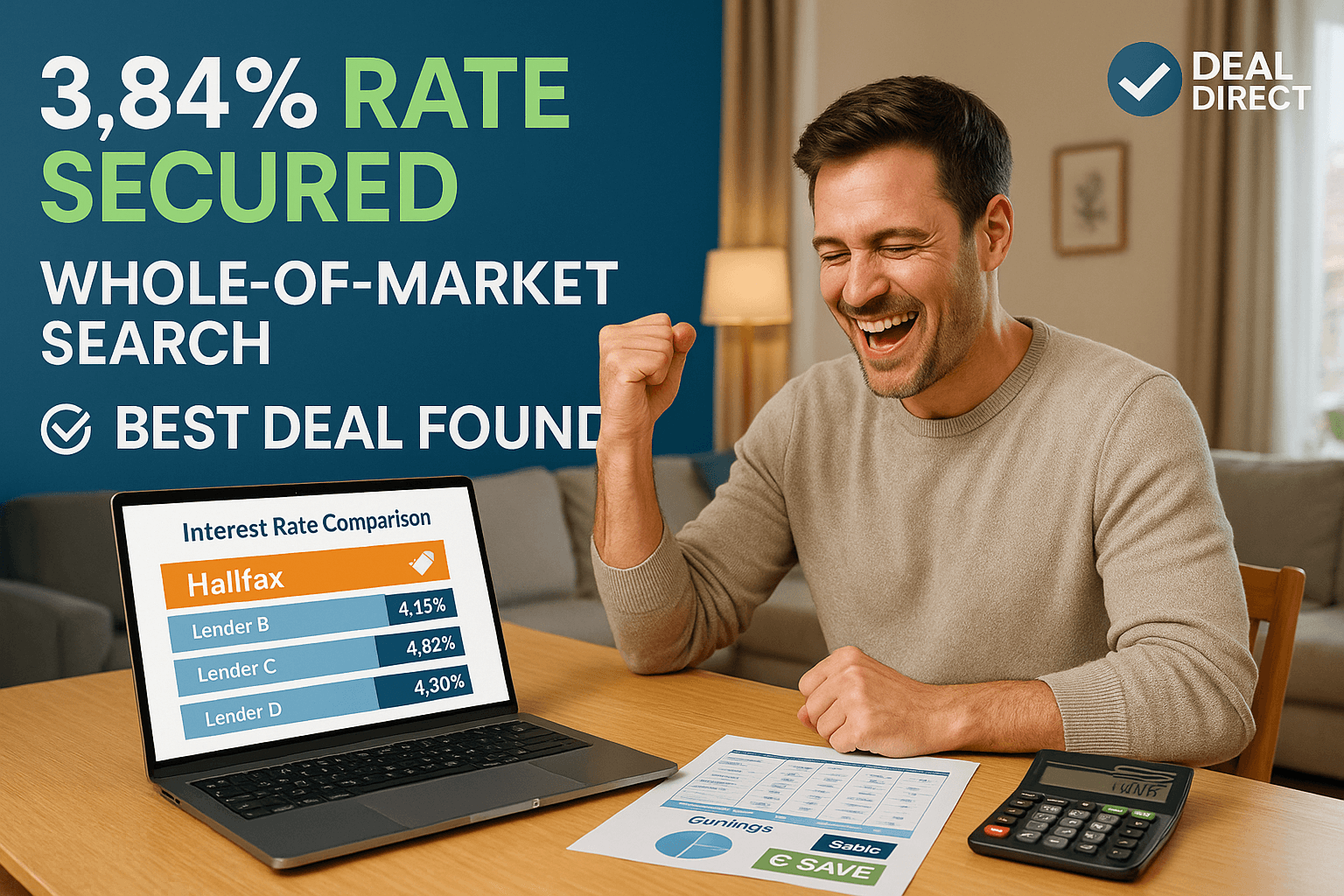

Best Remortgage Rates: 3.84% Halifax Deal via Expert Search

With a keen focus on finding the lowest interest rate, they proactively compared offers from multiple...

Help to Buy + £91K Debt: London Consolidation Success

Main Challenges: Multiple Debts, Complex Payments, and Help to Buy Repayment...

Digital Remortgage for Home Improvements: Busy Tradesman Win

Like many homeowners, managing both daily life and major...

Debt Consolidation Remortgage: Real Customer Success Guide

The Customer’s Challenge: Managing Multiple High-Interest Debts...

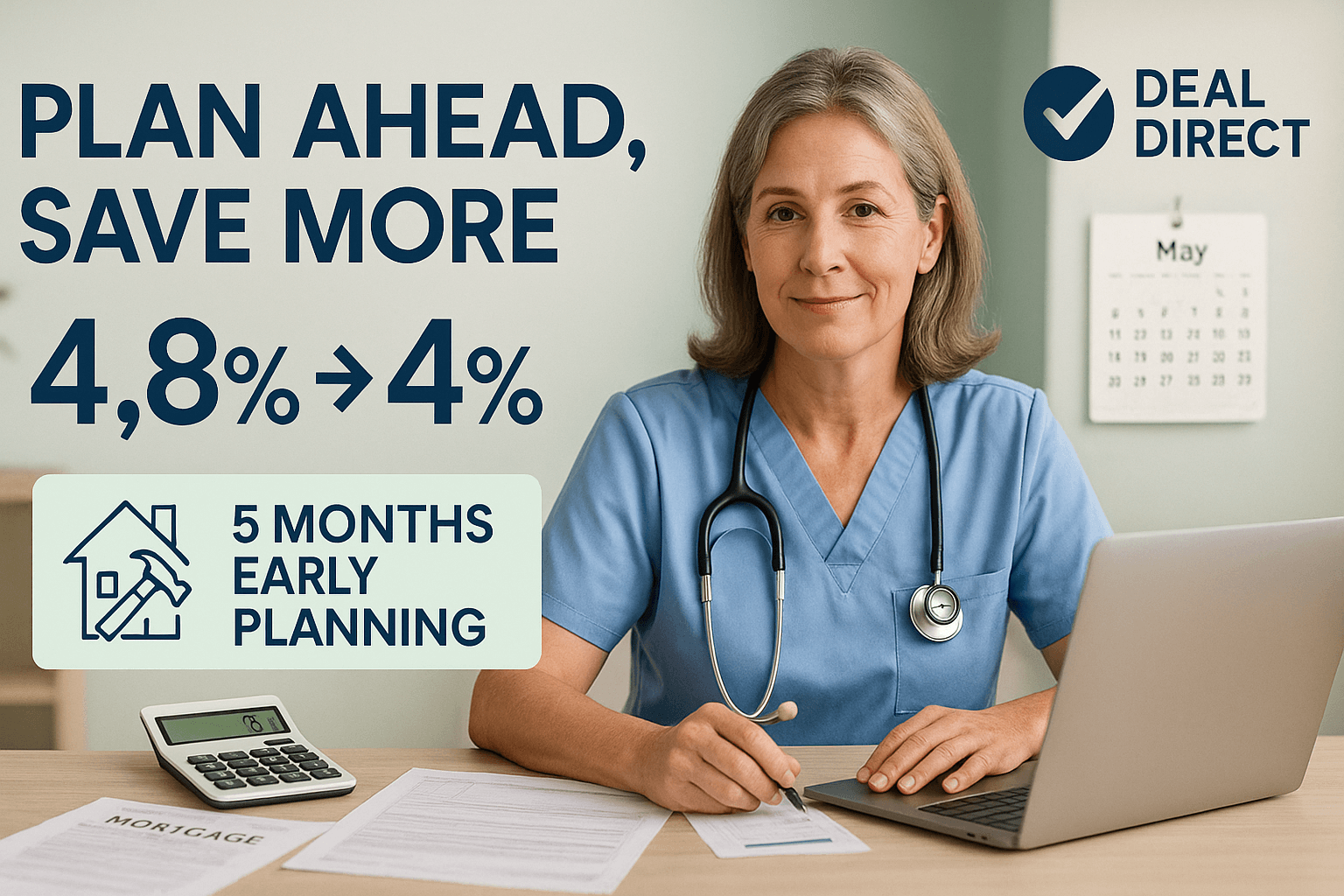

Smart Remortgage Planning: 4.8% to 4% Rate Drop Case Study

Finding the Best Remortgage Rate Without Unnecessary Hassle...

Self-Employed Landlord: £336K Debt Consolidation Success

Main Challenges: Seeking Debt Consolidation and Mortgage Flexibility. The client faced several complex...

Birmingham Family Cuts Debt 83K: Consolidation Remortgage Win

The Challenge: Managing High Monthly Debt Repayments...

Deal Direct 5% Deposit Mortgages 2025

Our Mortgage Solution: Flexible Options With Just 5% Deposit. At Deal Direct, we specialise in helping...

HSBC Cuts Mortgage Rates: Residential & BTL – August 2025

The new lower rates apply across products aimed at first-time...

TSB Cuts Mortgage Rates by Up to 0.30% – August 2025

These changes apply across a variety of fixed-rate and shared ownership products, aiming to...

Kensington BTL Rates Cut: 4.84% 5yr Fixed | Landlord Deals

These changes deliver more value and flexibility to landlords, including...

Secured Loans Debt Consolidation 2025

Facing a need to consolidate a car loan and other small debts amounting to about £15,000, this client sought...