How remortgaging to clear debt is helping UK homeowners regain financial freedom

Zane, a UK homeowner in his early forties and working in a professional role, recently explored options around remortgaging to clear debt online.

Like many others, he found himself considering how remortgaging could potentially ease financial constraints associated with existing debts and better manage monthly expenses.

Customer’s Challenges:

Struggling with debt and uncertainty

Many homeowners in the UK share Zane’s experience; they’re exploring various mortgage solutions to manage their budget effectively, control debts, or fund home improvements. Common financial challenges such customers face include:

- Persistent high-interest debts (credit cards, unsecured personal loans)

- Difficulty juggling multiple repayments

- Uncertainty about remortgage processes and benefits

- Confusion over the most suitable solution for their individual circumstance

Solution Provided:

Debt Consolidation Remortgage

One valuable option offered to homeowners like Zane is a debt consolidation remortgage.

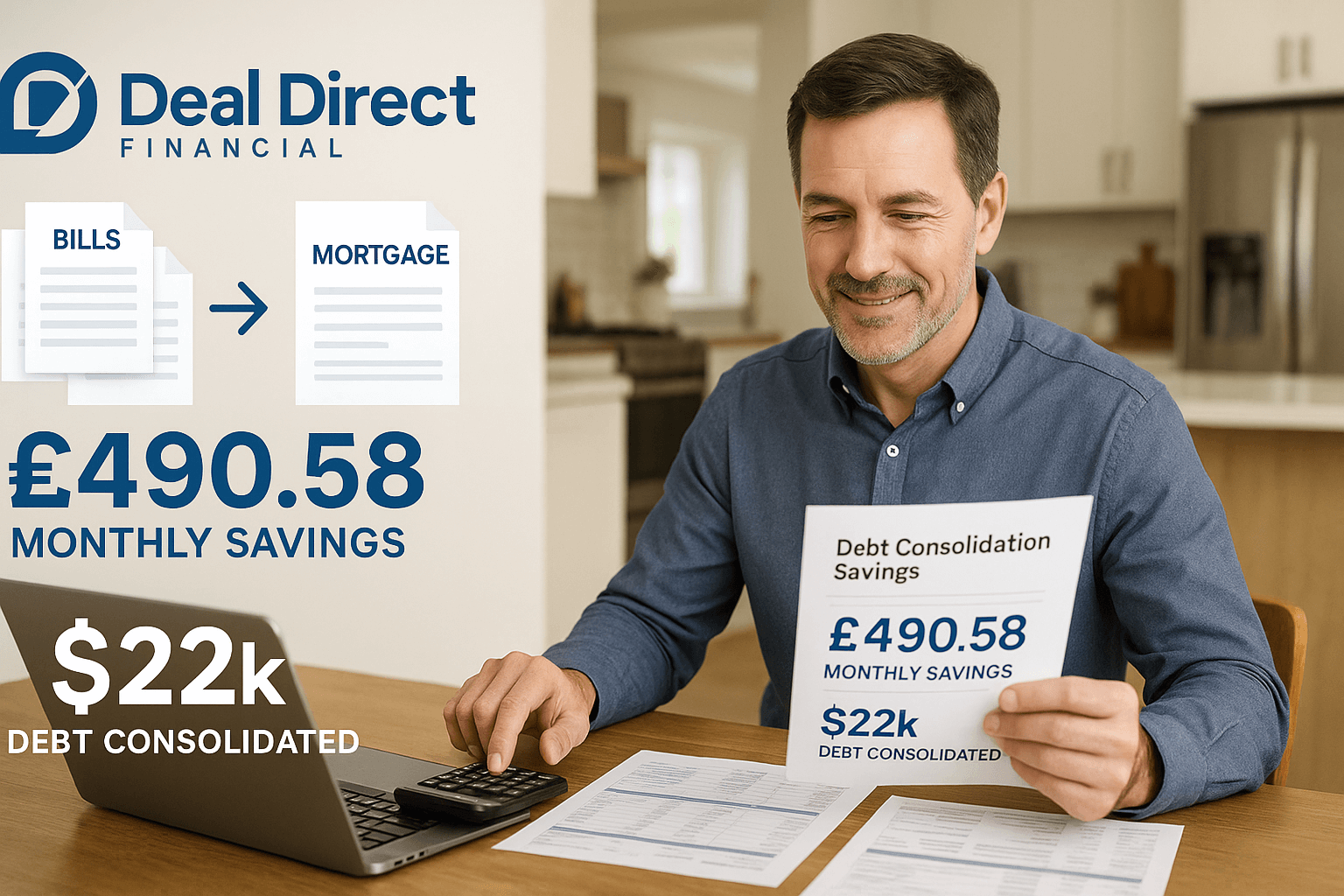

This type of remortgage allows homeowners to release equity from their homes, using that equity to pay off existing high-interest debts.

Typically, mortgage rates tend to be lower than average unsecured debt interest rates, providing a potential for immediate savings and financial simplification.

Let’s break down exactly how this works:

- Equity Release: Homeowners release equity (difference between mortgage amount owed and current property value).

- Debt Consolidation: The funds obtained are carefully used to clear various debts and loans.

- One Single Monthly Payment: Instead of juggling multiple debts, homeowners pay off a single secured repayment at an affordable rate.

- Long-Term Savings: Streamlines finances, reducing the total interest cost over time due to generally lower remortgage rates compared to personal loans or credit card debts.

See for yourself how much difference it could make to you by remortgaging to clear your credit debt.

Beneficial outcomes:

Financial freedom and monthly savings…

Choosing a debt consolidation remortgage can offer several significant benefits:

- Monthly savings due to lower interest rates, improving cash flow

- Greater financial clarity and reduced financial stress with fewer monthly payments

- Improved credit profile over time by successfully eliminating unsecured debts

- Accessing funds to finance home improvements, increasing overall property value

Real-Life Experience…

“I was initially overwhelmed when looking into remortgage options, unsure about exactly what I wanted. Even though initially hesitant, understanding how a remortgage could consolidate debts and simplify monthly payments made all the difference. The outcome was far better than I expected.”

Frequently Asked Questions about Debt Consolidation Remortgages

Yes. Many UK homeowners choose this option to consolidate costly debts such as credit cards and loans into one easier-to-manage repayment.

Exact savings vary per individual case, but typically, consolidating high-interest unsecured debts via a remortgage can significantly reduce monthly repayments, often amounting to hundreds of pounds per month.

Definitely. Many homeowners blend debt consolidation and home improvement funding together within their remortgage solutions.

Remortgaging itself does not negatively impact your credit score significantly.

It may even improve your score by allowing debt consolidation and regular affordable repayments—which positively affect your credit history.

Typically, you will need proof of identity, income verification (payslips), bank statements, current mortgage statement, and details of outstanding debts.