See how much you could borrow and how low the monthly repayments could be with a Home Improvement Loan without affecting your credit score.

- Find your best secured loan deal

- Save loan quote – return any time

- Quote won’t affect credit score

- Easily complete whole process online

- Compare lowest rates & repayments

Your home is at risk if you do not keep up repayments on a mortgage or other loan secured on it.

A leading UK loan broker since 2005 – Trusted by 1,000s of people every year

Compare the UK’s best Home Improvement Loan deals…

With DirectQuote, our industry leading, secure online process makes it easy for you to tailor and compare the latest Home Improvement Loan deals available to you in minutes from all the leading UK lenders.

Unsure which home improvement loan option is right for you?

If you’re unsure which home improvement loan option is right for you – call today to speak with one of our loan experts or talk with us via our live advisor help chat.

How Do Home Improvement Loans Work?

1

Plan your project:

Define the scope, get quotes from contractors, and estimate total costs.

2

Choose loan amount:

Borrow what you need, considering both project costs and contingency funds.

3

Apply using property equity

Use your home’s value as security for better rates.

4

Receive funds

Get money upfront or in stages to pay contractors and suppliers.

5

Complete your project.

Transform your home while making manageable monthly payments.

Popular Home Improvement Projects

Kitchen Renovations

- New fitted kitchens:

£8,000-£30,000+ - Kitchen islands and extensions:

£15,000-£50,000+ - Appliance upgrades:

£3,000-£10,000

Bathroom Updates

- Complete bathroom refits:

£5,000-£15,000 - En-suite installations:

£8,000-£20,000 - Luxury bathroom suites:

£10,000-£40,000+

Extensions & Conversions

- Single-story extensions:

£15,000-£30,000 - Double-story extensions:

£30,000-£60,000 - Loft conversions:

£20,000-£50,000 - Basement conversions:

£25,000-£75,000

Home Improvement Loan Features

| Feature | Details |

| Loan amounts | £5,000-£500,000 |

| Interest rates | 3.9%-15.9% APR |

| Repayment terms | 2-25 years |

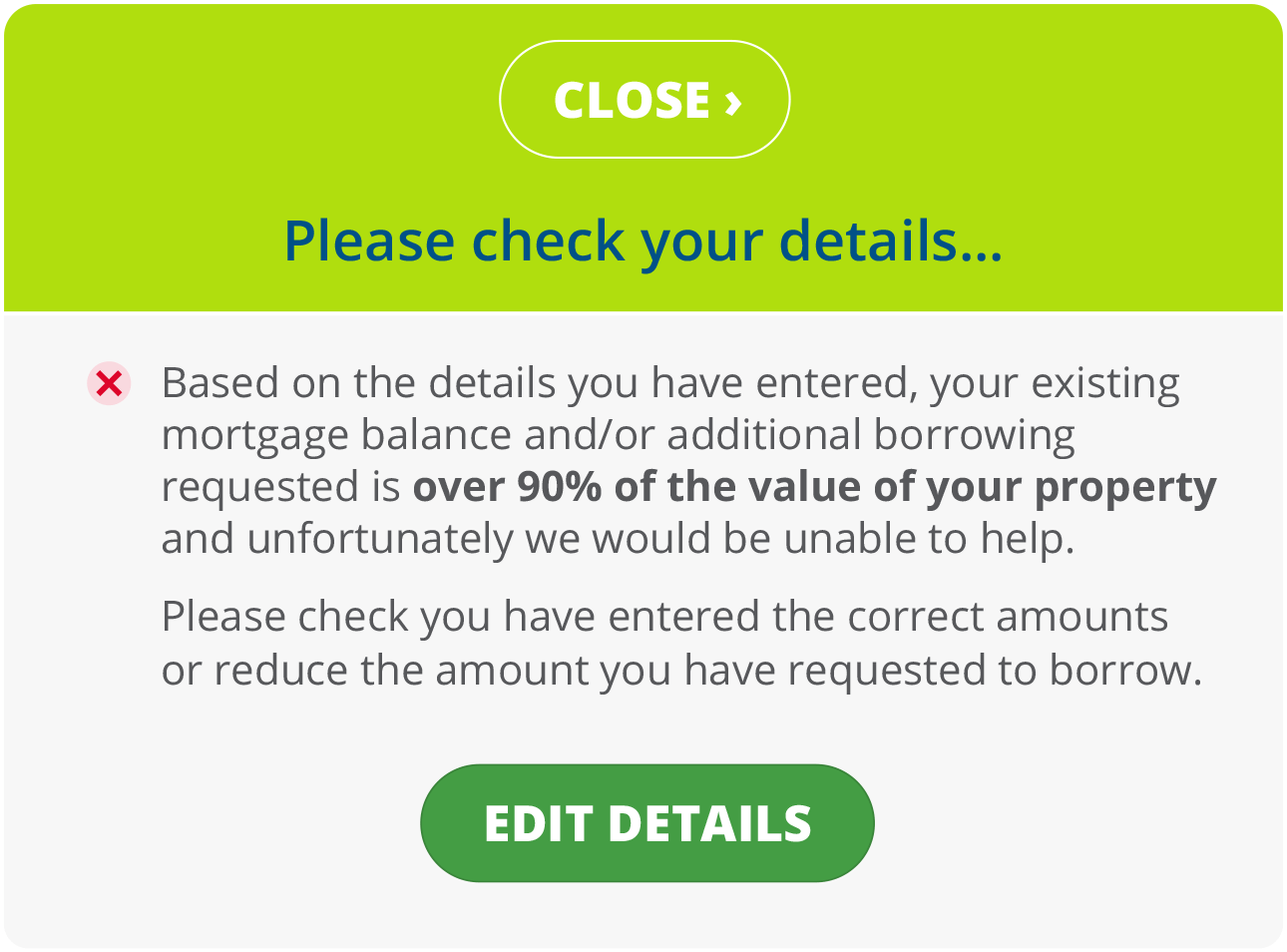

| Maximum LTV | Up to 85% of property value |

| Funds release | Lump sum or staged payments |

| Application process | Online application, phone support |

| Approval time | 24-48 hours decision |

| Completion | 2-4 weeks typical |

Return on Investment for Home Improvements

| Project Type | Cost Range | Value Added | ROI |

| Kitchen renovation | £15,000-£25,000 | £18,000-£28,000 | 70-85% |

| Bathroom upgrade | £8,000-£12,000 | £7,000-£11,000 | 65-75% |

| Loft conversion | £25,000-£40,000 | £30,000-£50,000 | 80-90% |

| Extension | £20,000-£35,000 | £25,000-£45,000 | 85-95% |

| Energy efficiency | £5,000-£15,000 | £8,000-£20,000 | 60-80% |

*ROI percentages are estimates and vary by location and property type.

Financing Options for Home Improvements

| Option | Pros | Cons | Best For |

| Secured loan | Low rates, high amounts | Property at risk | Major projects £15,000+ |

| Personal loan | No property risk | Higher rates, lower amounts | Smaller projects under £25,000 |

| Remortgage | Lowest rates available | Early repayment charges possible | Large projects, mortgage due for renewal |

| Credit cards | Immediate access | Very high interest rates | Small purchases, short-term funding |

| Savings | No interest costs | Depletes emergency funds | Those with sufficient cash reserves |

Tips for Successful Home Improvement Financing

Before You Borrow

- Get detailed quotes from multiple contractors

- Add 10-20% contingency for unexpected costs

- Research planning permission requirements

- Check if improvements need building regulations approval

During Your Project

- Keep all receipts and documentation

- Monitor progress and budget regularly

- Communicate changes to your lender if needed

- Consider staged payment releases to contractors

Frequently Asked Questions about Home Improvement Loans

Some lenders allow borrowing for contingencies, but avoid over-borrowing unnecessarily.

Not always, but having approvals in place can strengthen your application.

Yes, most lenders allow funds for both materials and labor costs.

Consider whether you can fund overruns from savings, or speak to your lender about additional borrowing.

Key takeaways

- Home improvement loans offer competitive rates for property enhancements

- Plan projects carefully and include contingency funds in your borrowing

- Consider the return on investment when choosing which improvements to make

- Shop around for the best rates and terms for your specific project

Fund Your Dream Home Project Get tailored home improvement finance advice

Speak to specialists who understand renovation funding.