How Do Homeowner Loans Work?

1

Assess your equity:

Calculate how much your property is worth minus any outstanding mortgage.

2

Determine borrowing needs:

Decide how much you need and what you’ll use the funds for.

3

Submit your application:

Provide income proof, property details, and expenditure information.

4

Property valuation:

Lender arranges professional valuation of your property.

5

Funds released:

Upon approval, receive your loan amount typically within 2-4 weeks.

Homeowner Loan Features

| Loan Aspect | Details |

| Typical amounts | £5,000-£500,000 |

| Interest rates | 4.2%-19.9% APR |

| Repayment terms | 1-25 years |

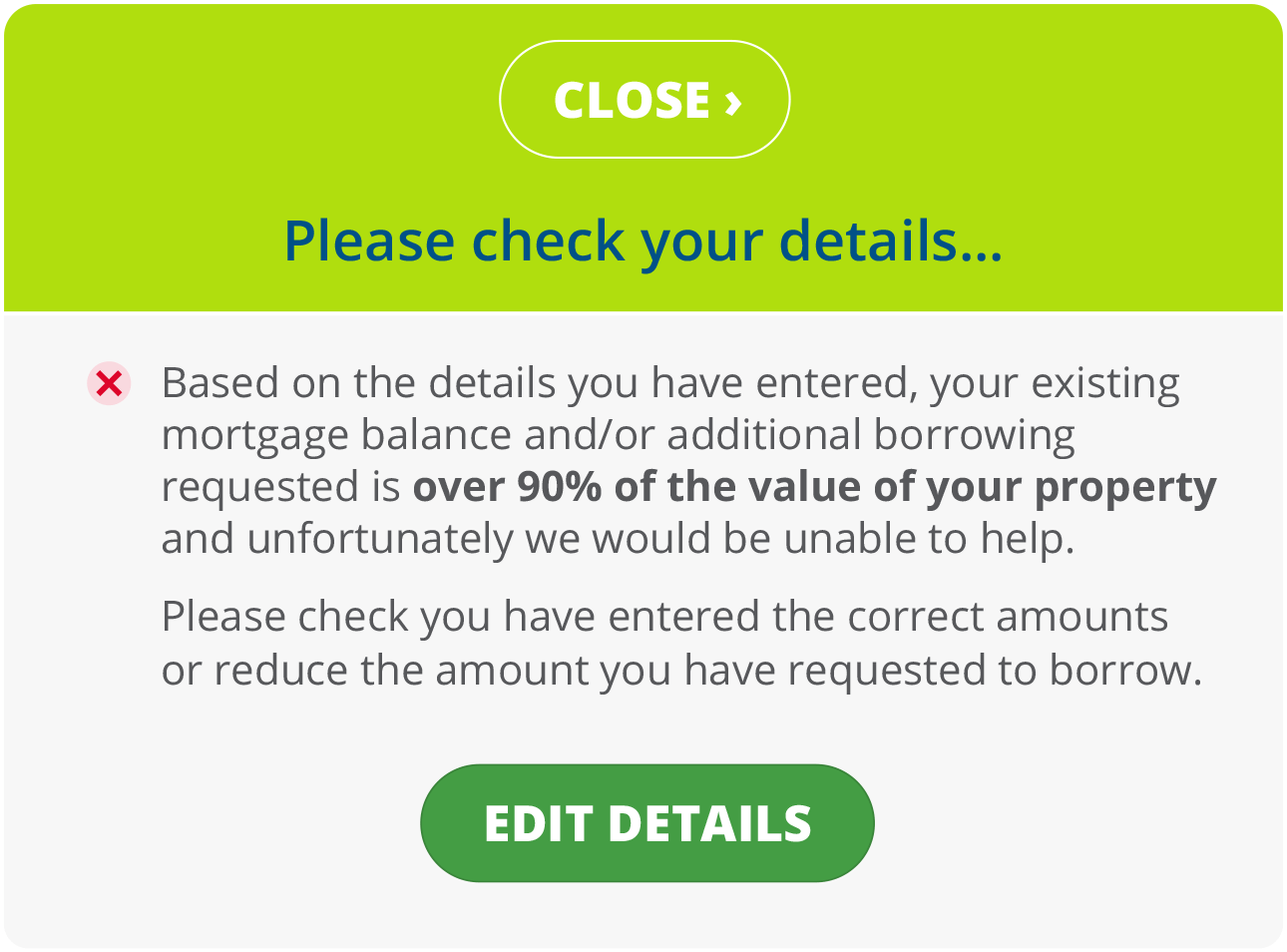

| Maximum LTV | Up to 80% including existing mortgage |

| Application time | 15-30 minutes online |

| Decision speed | Often same day |

| Completion time | 2-4 weeks average |

A leading UK loan broker since 2005 – Trusted by 1,000s of people every year

Compare the UK’s best Homeowner Loan deals…

With DirectQuote, our industry leading, secure online process makes it easy for you to tailor and compare the latest Homeowner deals available to you in minutes from all the leading UK lenders.

Popular Uses for Homeowner Loans

Home & Garden:

- Kitchen and bathroom renovations

- Extensions and conservatories

- Garden landscaping and outbuildings

- Energy efficiency improvements

Financial Management:

- Debt consolidation at lower rates

- Credit card and loan repayment

- Mortgage payment difficulties

- Unexpected emergency expenses

Lifestyle & Investment:

- Holiday home deposits

- Wedding and celebration costs

- Vehicle purchases

- Education and training fees

Homeowner Loan Example Scenario:

£50,000 loan over 10 years at 7.9% APR

| Monthly payment | Total repayable: | Total interest: |

| £607 | £72,840 | £22,840 |

Compare with credit cards at 22% APR:

| Monthly payment (minimum): | Total interest over 10 years: | Potential saving: |

| £1,110+ | £83,200+ | £60,360+ |

Homeowner Loan Costs Breakdown

| Fee Type | Typical Cost |

| Application fee | Usually free |

| Arrangement fee | 0-2% of loan amount |

| Property valuation | £150-£500 (often free) |

| Legal fees | £200-£600 |

| Broker commission | 0.5-1.5% (if used) |

| Early settlement fee | 1-2 months interest |

| Payment protection | Optional monthly premium |

Essential Homeowner Loan Tools

Homeowner Loans vs Other Borrowing Options

vs Personal Loans:

- Lower interest rates due to security

- Higher borrowing amounts available

- Longer repayment terms possible

- Property at risk if payments missed

vs Credit Cards:

- Much lower interest rates

- Fixed monthly payments

- Set repayment schedule

- Cannot access funds immediately

vs Remortgaging:

- Keep existing mortgage rate

- Faster process than remortgaging

- No early repayment charges on current mortgage

- Higher rates than mortgage rates

Unsure which Homeowner loan option is right for you?

If you’re unsure which Homeowner loan option is right for you – call today to speak with one of our loan experts or talk with us via our live advisor help chat.

Frequently Asked Questions about Homeowner Loans

No, having property as security means lenders are more flexible with credit histories.

Yes, though you’ll need to provide additional documentation like tax returns and accounts.

Lenders use current market values, so recent decreases could affect borrowing capacity.

Most lenders allow overpayments, helping you repay faster and save on interest.

Key takeaways

- Homeowner loans offer lower rates than unsecured borrowing

- Use property equity responsibly for worthwhile purposes

- Shop around for the best rates and terms for your situation

- Consider the risks to your property before borrowing

Unlock Your Property’s Potential Today

Speak to a homeowner loan specialist — get personalised quotes based on your equity and needs.