Fair Treatment & Protection – We’re Here to Help

Everyone deserves fair treatment when seeking financial advice, regardless of their circumstances. We’re committed to identifying when customers may need additional support and ensuring we provide the right level of care and protection.

WHAT MAKES SOMEONE VULNERABLE?

Vulnerability can affect anyone at any time and can be temporary or permanent. You might be considered vulnerable if you have:

Health and Wellbeing Factors

- Physical disabilities or mobility issues

- Mental health conditions including anxiety, depression, or cognitive difficulties

- Serious illness affecting you or a close family member

- Age-related concerns that affect understanding or decision-making

- Addiction issues including gambling, alcohol, or substance dependencies

- Learning difficulties or cognitive impairments

Life Circumstances

- Recent bereavement or relationship breakdown

- Job loss or significant reduction in income

- Caring responsibilities for family members

- Social isolation or lack of support network

- Financial abuse or control by others

- Recent major life changes causing stress or confusion

Communication Barriers

- Language difficulties where English isn’t your first language

- Literacy or numeracy challenges

- Hearing or visual impairments

- Lack of digital skills or internet access

- Communication disorders

Financial Factors

- Low financial capability or confidence with money matters

- Limited experience with financial products

- Debt problems or history of financial difficulties

- Reliance on others for financial decisions

HOW WE SUPPORT VULNERABLE CUSTOMERS

Recognising Vulnerability

We train our staff to identify potential vulnerability indicators through:

- Listening carefully to what you tell us about your circumstances

- Observing signs that you might need additional support

- Creating a safe environment where you feel comfortable sharing concerns

- Regular check-ins throughout our relationship

Additional Support We Provide

Extended Time and Patience

- No rush or pressure to make quick decisions

- Multiple meetings if needed to explain concepts

- Breaking complex information into manageable parts

- Allowing time to discuss with family or friends

Clear Communication

- Plain English explanations without jargon

- Written summaries of key points

- Larger print documents if helpful

- Alternative communication methods when needed

Third-Party Support

- Welcome to bring a trusted friend, family member, or advocate

- Can communicate with appointed representatives

- Referrals to specialist support services

- Liaison with care coordinators or social workers

Enhanced Suitability Checks

- More detailed assessment of your needs and circumstances

- Greater focus on ensuring recommendations are truly suitable

- Additional consideration of future changes in circumstances

- Regular reviews to ensure ongoing suitability

YOUR RIGHTS AS A VULNERABLE CUSTOMER

What You Can Expect From Us

Respectful Treatment

- Dignity and respect at all times

- No discrimination based on your circumstances

- Patient, understanding approach

- Confidential handling of sensitive information

Tailored Service

- Adjustments to our usual processes when helpful

- Flexible appointment arrangements

- Communication in formats that work for you

- Recognition that one size doesn’t fit all

Protection and Safeguarding

- Enhanced checks that products are suitable for you

- Additional cooling-off time for major decisions

- Referrals to independent advice when appropriate

- Escalation of concerns when we identify potential harm

Ongoing Support

- Regular contact to check how you’re managing

- Proactive reviews of your arrangements

- Quick response if circumstances change

- Connection with relevant support services

What You Can Do

Tell Us About Your Circumstances

- Share any factors that might affect your understanding or decision-making

- Let us know if you need additional support or adjustments

- Inform us if your circumstances change

- Don’t worry about being judged – we’re here to help

Bring Support

- Feel free to bring someone you trust to meetings

- Ask family or friends to help review information

- Request that we include others in communications

- Use advocacy services if available

Take Your Time

- Don’t feel pressured to make quick decisions

- Ask for additional meetings if you need them

- Request written summaries to review at home

- Seek independent advice if unsure

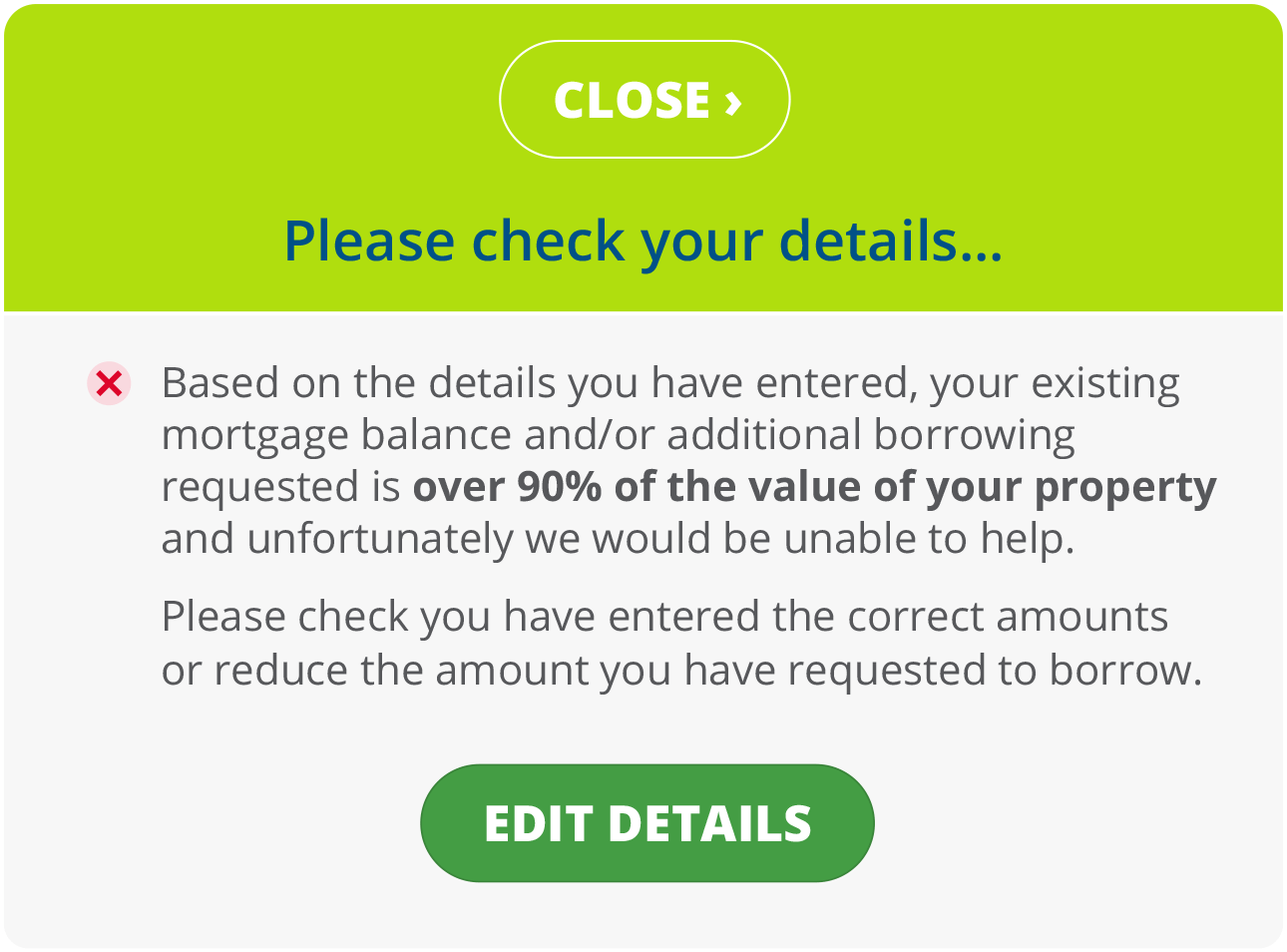

WHEN WE MIGHT NOT BE ABLE TO HELP

Protecting Your Interests

Sometimes the kindest thing we can do is recognise when we’re not the right firm for you, or when financial products aren’t suitable for your circumstances.

We May Decline to Proceed If:

- You lack the mental capacity to make informed decisions

- Family members appear to be pressuring or influencing you inappropriately

- The financial commitment would be clearly unaffordable

- You’re unable to understand the key risks despite our explanations

- There are signs of financial abuse or exploitation

This Isn’t Rejection – It’s Protection When we decline to proceed, we’ll:

- Explain our concerns clearly and respectfully

- Provide information about alternative support services

- Suggest other professionals who might be better placed to help

- Ensure you have access to independent advice

SUPPORT SERVICES WE CAN CONNECT YOU WITH

Financial Support and Advice

Money and Pensions Service

- Free, impartial guidance on money matters

- Website: moneyandpensionsservice.org.uk

- Phone: 0800 011 3797

Citizens Advice

- Free advice on debt, benefits, and financial problems

- Local face-to-face support available

- Website: citizensadvice.org.uk

- Phone: 0800 144 8848

Age UK

- Support specifically for older people

- Benefits advice and financial guidance

- Website: ageuk.org.uk

- Phone: 0800 678 1602

Mental Health and Wellbeing

Samaritans

- 24/7 confidential emotional support

- Phone: 116 123 (free from any phone)

- Website: samaritans.org

Mind

- Mental health information and support

- Local support groups and services

- Website: mind.org.uk

- Phone: 0300 123 3393

Anxiety UK

Support for anxiety disorders

Website: anxietyuk.org.uk

Phone: 03444 775 774

Addiction and Gambling Support

GamCare

- Free gambling support and counselling

- Website: gamcare.org.uk

- Phone: 0808 8020 133

Alcoholics Anonymous

- Support for alcohol addiction

- Website: alcoholics-anonymous.org.uk

- Phone: 0800 917 7650

Narcotics Anonymous

- Support for drug addiction

- Website: ukna.org

- Phone: 0300 999 1212

Domestic Abuse and Financial Control

National Domestic Abuse Helpline

- 24-hour support for domestic abuse

- Phone: 0808 2000 247

- Website: nationaldahelpline.org.uk

Surviving Economic Abuse

- Specialist support for financial abuse

Website: survivingeconomicabuse.org

Phone: 0808 801 0327

Benefits and Grants

Turn2us

- Benefits calculator and grants database

- Website: turn2us.org.uk

- Phone: 0808 802 2000

Disability Rights UK

- Benefits advice for disabled people

- Website: disabilityrightsuk.org

- Phone: 0330 995 0400

SPECIFIC CIRCUMSTANCES

If You’re Caring for Someone

Caring responsibilities can affect your financial planning and decision-making:

- We understand appointments may need to be flexible

- We can arrange for shorter, more frequent meetings

- We’ll consider the impact of caring costs on affordability

- We can provide information about carer benefits and support

If You’re Recently Bereaved

Losing someone close to you affects judgment and decision-making:

- We recommend avoiding major financial decisions immediately after bereavement

- We can help you understand any inherited financial responsibilities

- We’ll work with solicitors and estate administrators as needed

- We can signpost bereavement support services

If You Have Communication Needs

Everyone deserves to understand their financial options:

- Documents can be provided in large print or alternative formats

- We can arrange for BSL interpreters or language translation

- Information can be provided in audio format

- We’ll speak slowly and clearly, checking understanding regularly

If You’re Experiencing Financial Difficulties

Money worries can cloud judgment and increase vulnerability:

- We’ll always consider whether borrowing more is appropriate

- We’ll discuss alternatives like debt advice charities

- We understand the stress that financial problems cause

- We can help you access benefits and grants you might be entitled to

OUR TRAINING AND STANDARDS

Staff Training

All our staff receive regular training on:

- Identifying vulnerability indicators

- Adapting communication styles

- Recognising mental capacity issues

- Understanding different types of vulnerability

- Knowing when to refer to specialists

- Treating customers with dignity and respect

Regulatory Requirements

We’re bound by strict rules including:

- Consumer Duty – acting to deliver good outcomes for customers

- Treating Customers Fairly – fair treatment at all stages

- MCOB regulations – specific protections for mortgage customers

- FCA guidance – on supporting vulnerable consumers

Continuous Improvement

We regularly review our approach by:

- Gathering feedback from customers who’ve received additional support

- Training updates based on new research and guidance

- Working with charities and advocacy groups

- Monitoring outcomes to ensure we’re making a positive difference

COMPLAINTS AND CONCERNS

If You’re Not Happy

If you feel we haven’t provided appropriate support:

- Speak to your adviser first – many issues can be resolved quickly

- Ask to speak to our complaints manager

- We’ll investigate thoroughly and respond within required timeframes

- You can refer unresolved complaints to the Financial Ombudsman Service

Safeguarding Concerns

If you or someone you know is at risk:

- We have procedures to escalate serious concerns

- We can contact adult safeguarding services when appropriate

- We work with other professionals to protect vulnerable customers

- Your safety and wellbeing are our priority

REMEMBER

Being vulnerable doesn’t make you less capable or worthy of respect. It simply means you may need different or additional support to make informed financial decisions.

We’re here to help, not to judge.

If you think you might benefit from additional support, please let us know. The earlier we understand your circumstances, the better we can tailor our service to meet your needs.

This firm is authorised and regulated by the Financial Conduct Authority.

Consumer Duty Statement: We are committed to delivering good outcomes for all our customers, with enhanced protections for those in vulnerable circumstances.