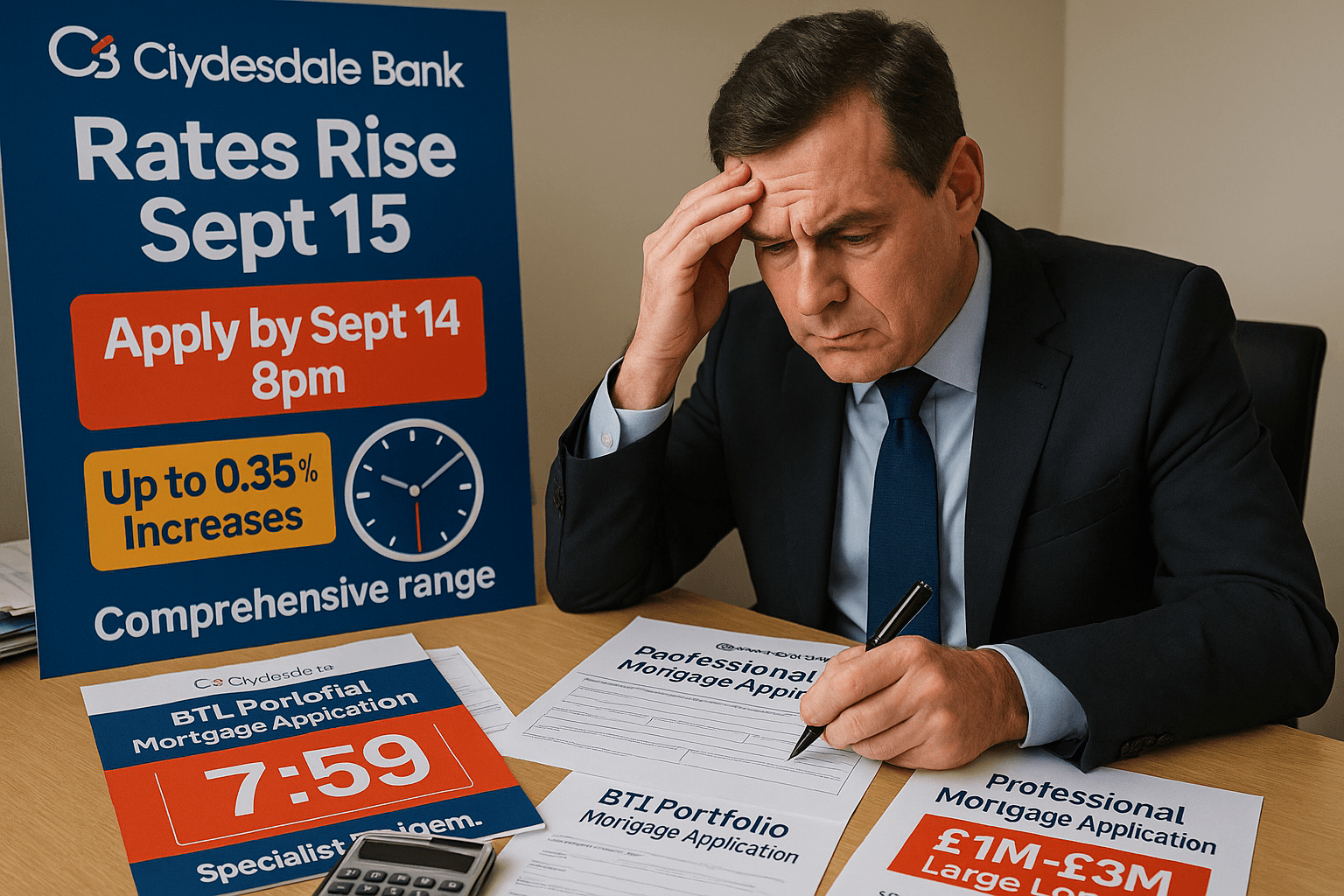

The Principality Building Society has announced updates to its Product Transfer mortgage range, effective from 9am, Monday 21st July 2025.

These changes, including several rate reductions across residential and buy to let segments, present new opportunities for existing borrowers considering a product switch or early remortgage.

What’s Changing with Principality’s Product Transfer Mortgages?

From 21st July 2025, Principality’s refreshed product transfer range will come into effect, replacing the previous range available until 5pm on Sunday 20th July 2025. The most eye-catching aspect of this update is notable rate decreases on a selection of fixed-rate products, giving existing borrowers the chance to lock in lower payments for new fixed terms.

Residential Mortgage Rate Updates

- 2 & 3-year fixed at 65% and 75% LTV: Rates cut by 0.10%

- 5-year fixed at 65% LTV: Rate reduced by 0.05%

- 2-year fixed at 85% LTV: Rate cut by 0.10%

- 3-year fixed at 85% LTV: Rate reduced by 0.05%

- 5-year fixed at 75% LTV: Rate increased by 0.05%

Buy to Let Mortgage Rate Updates

- 2-year fixed at 60% LTV: Rate cut by 0.10%

- 5-year fixed at 60% LTV: Rate increased by 0.05%

Holiday Let Mortgage Rate Updates

- 2-year fixed at 60% LTV: Rate cut by 0.10%

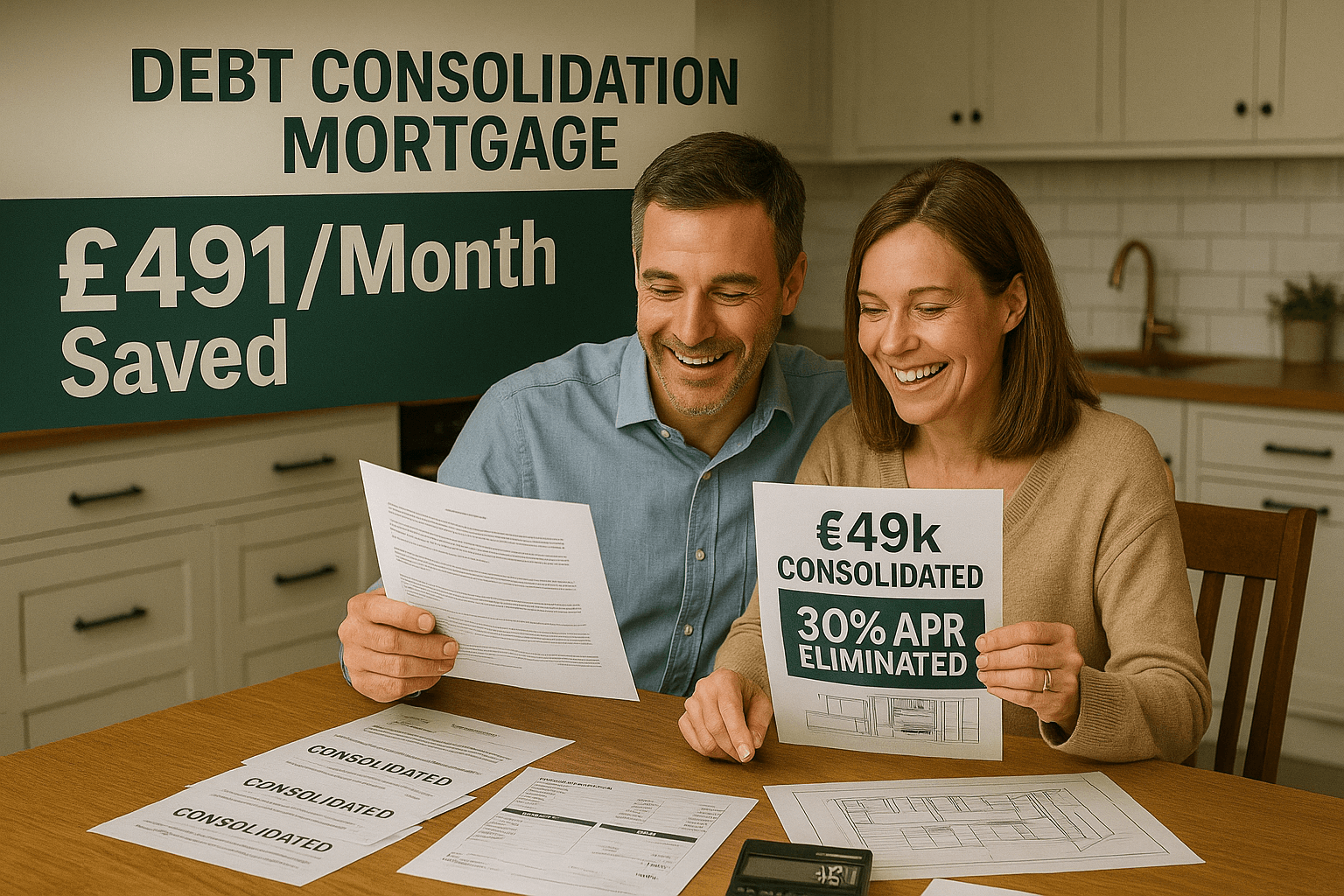

What Do These Rate Changes Mean for Borrowers?

These updates translate to lower monthly payments and potential long-term savings for borrowers eligible for the new lower fixed rates. The most significant decreases apply to short and medium-term fixed deals at lower to mid-range loan-to-value (LTV) ratios, which can benefit:

- Homeowners approaching the end of their current fixed rate

- Buy to let landlords looking to retain existing properties on favourable terms

- Holiday let property owners seeking to secure stable returns

However, borrowers considering certain 5-year deals—particularly at 75% LTV for residential and 60% LTV for buy to let—should take note of the small rate increases, which may impact longer-term affordability calculations.

Who Benefits Most from These Changes?

- Existing Principality mortgage customers who want to switch to a new fixed rate before their current deal ends

- Low and mid-LTV borrowers, especially at 65% and 75% LTV, who stand to gain from reduced rates

- Buy to let and holiday let landlords with competitive equity, using product transfers to avoid remortgage costs and stress

Why Choose Principality for Your Product Transfer?

- Lower rates: Rate reductions make Principality’s transfer offers among the most attractive for existing customers in July 2025

- Straightforward criteria: Product transfers typically avoid the need for new affordability assessments, speeding up the switch

- Local expertise: Principality’s intermediary network and support team help ensure your transfer is smooth and efficient

- Trusted provider: As a leading UK building society, Principality offers stability and a commitment to personal service

How to Take Advantage of the New Product Transfer Rates

Acting quickly is key: The current product transfer range will be withdrawn after 20th July 2025, so speaking with a qualified mortgage broker now ensures you can access the best deal for your circumstances. Contact our expert team for tailored mortgage advice and to find the right Principality product transfer option for you.

Looking to review your mortgage or considering a product transfer with Principality? Get in touch today for a personalised quote and options tailored to your needs.

Frequently Asked Questions

- Who qualifies for Principality product transfer rates?

Existing Principality Building Society mortgage holders approaching the end of their fixed-rate deal or seeking a switch may be eligible. Terms may vary by product and LTV ratio. - How do the rate reductions affect my monthly repayments?

Reduced rates can mean lower monthly payments and overall interest savings, depending on your loan size, LTV, and deal length. - Are there affordability checks for product transfers?

Most product transfers with Principality avoid full new affordability assessments, which helps speed up the process for existing customers. - Can landlords and holiday let owners benefit from the new rates?

Yes, updated buy to let and holiday let rates are available for eligible landlords switching to a new Principality fixed deal. - How do I apply for a product transfer with Principality?

Contact our mortgage advice team for guidance. We’ll review your eligibility and handle the application process on your behalf.

Ready to apply or see your best options?

Find your best deals online in minutes or request a no-obligation callback from one of our expert advisors to talk through your options or just get honest advice.