Anonymous Client Overview

A couple in their early 40s — one employed in a technical role and the other in part-time administrative work — based in the Midlands, UK, sought guidance on increasing their borrowing capacity for a buy-to-let (BTL) investment. Facing a hurdle due to outstanding credit card debts, they approached us to explore their remortgage and secured loan options for a debt consolidation mortgage 2025 to achieve their financial goals.

The Challenge: Maximise Buy-to-Let Funding Amid Debt Constraints

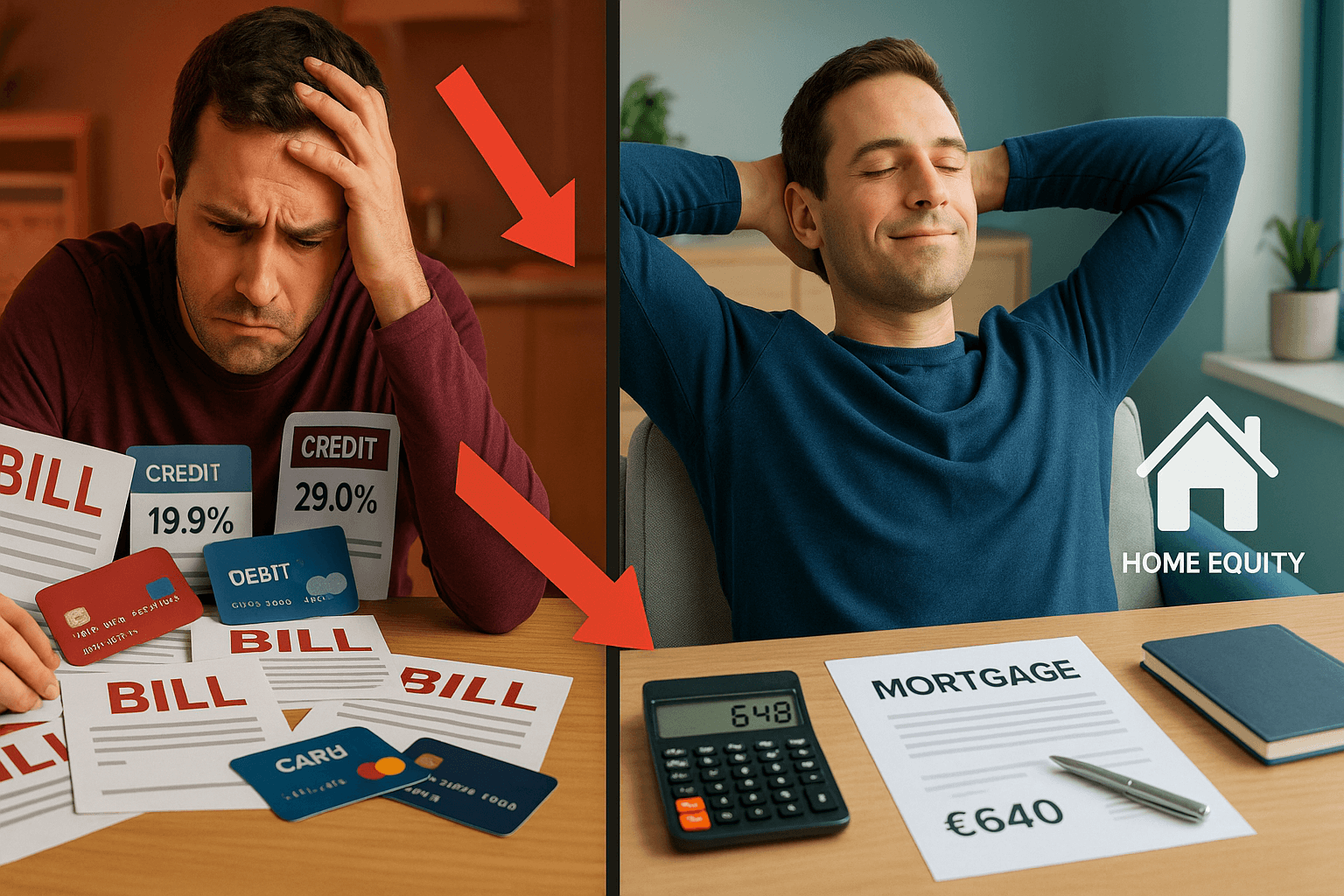

The clients had over £3,700 in credit card debt across two providers: JAJA Finance and NatWest. Though their current mortgage and outgoing payments were manageable, the unresolved credit card debts were significantly reducing the maximum borrowable amount for their BTL mortgage—by over £2,250. Consolidating their debts into a new secured loan was pivotal in unlocking the level of mortgage they needed. However, this approach came with important long-term financial implications regarding the debt consolidation mortgage 2025.

The debts were itemised as follows:

- JAJA Finance credit card: £3,033 at 26% interest with an estimated cost of £10,070 if left unsecured over its term.

- NatWest credit card: £700 at 12% interest, adding another £2,324 over the repayment period.

The clients needed to clear these debts — fully for JAJA and partially for NatWest — to qualify for the maximum mortgage amount offered by Pepper, their selected lender.

The Debt Consolidation Mortgage Solution

After evaluating several options, a remortgage inclusive of a secured loan component was structured. This debt consolidation mortgage 2025 solution allowed the clients to:

- Consolidate £3,733 into the mortgage balance.

- Clear the JAJA credit card completely and reduce the NatWest balance sufficiently for mortgage qualification.

- Increase borrowing potential by over £2,250 to cover the BTL deposit.

We reviewed the implications of consolidating debts with shorter remaining terms into a long-term mortgage — notably, the cost of interest over time. While the clients were advised against this due to added long-term repayment costs of approximately £4,063.56, they opted for consolidation to achieve their investment goals in line with their debt consolidation mortgage 2025 strategy.

Informed Decision-Making

Despite recommendations not to consolidate smaller or short-term balances, the clients considered the long-term financial trade-off acceptable in pursuit of property investment ambitions. They were provided with a breakdown showing that for every £1 borrowed, they’d repay around £3.32 over the life of their mortgage, totaling approximately £12,393.56 for the £3,733 consolidated.

The clients confirmed they were not financially struggling and possessed no savings suitable for clearing the cards independently. Consolidating the debts was the only viable option to unlock the desired BTL financing.

Successful Outcomes

By consolidating the debts, the clients achieved the following outcomes:

- Enhanced borrowing power: An increase exceeding £2,250 towards their BTL deposit.

- Streamlined repayments: Credit card debts integrated into a single monthly mortgage payment.

- Investment enabled: Key property investment objectives made possible through financial restructuring.

Client Feedback: “We were advised of the long-term costs, but this was the only way to make our investment work. We understand the risks but feel confident with the decision.”

Frequently Asked Questions

How much can I save monthly by consolidating credit card debts into a mortgage?

This depends on your individual debts and interest rates. In this case, the clients streamlined £126 of monthly credit repayments into their mortgage but ultimately will pay more over time due to longer interest terms.

Can you remortgage to fund home improvements or investments?

Yes. A remortgage can release equity for various purposes including BTL investments, renovations, or debt consolidation — provided affordability criteria are met.

Does remortgaging affect my credit score?

Initially, yes — there may be a temporary dip due to credit checks and new financial arrangements. However, consistent repayments will typically have a positive effect over time.

What documents are required for a remortgage application?

Typically you’ll need proof of ID, income (payslips or SA302s), current mortgage statements, bank statements, and property information.

Can I repay a fixed-rate mortgage early without penalties?

Most fixed-rate mortgages have early repayment charges (ERCs). Always check your lender’s terms before making early payments.

Is a Debt Consolidation Mortgage Right for You?

For these Midlands-based clients, consolidating credit card debt into their mortgage created a path to investment growth. However, the decision came with long-term costs that weren’t taken lightly. If you’re considering a debt consolidation mortgage 2025 or a remortgage to clear debt, professional financial advice can help you weigh the pros and cons effectively.

Looking to Increase Your Borrowing Power?

Contact us today to explore your remortgage and debt consolidation options. We can help you navigate affordability, lender criteria, and long-term financial outcomes to secure the best strategy for your goals with a debt consolidation mortgage 2025 perspective.

Ready to apply or see your best options?

Find your best deals online in minutes or request a no-obligation callback from one of our expert advisors to talk through your options or just get honest advice.