Customer Overview

A homeowner in his early 50s, working in a professional role and living in the UK, was facing the challenge of managing rising debt alongside essential home improvements. With a long-term interest-only mortgage and two loans—one secured and one unsecured—he needed a financial strategy that could accommodate higher mortgage payments, repay his debts, and finance urgent property repairs.

The Challenge: Transitioning from Interest-Only and Managing Debt

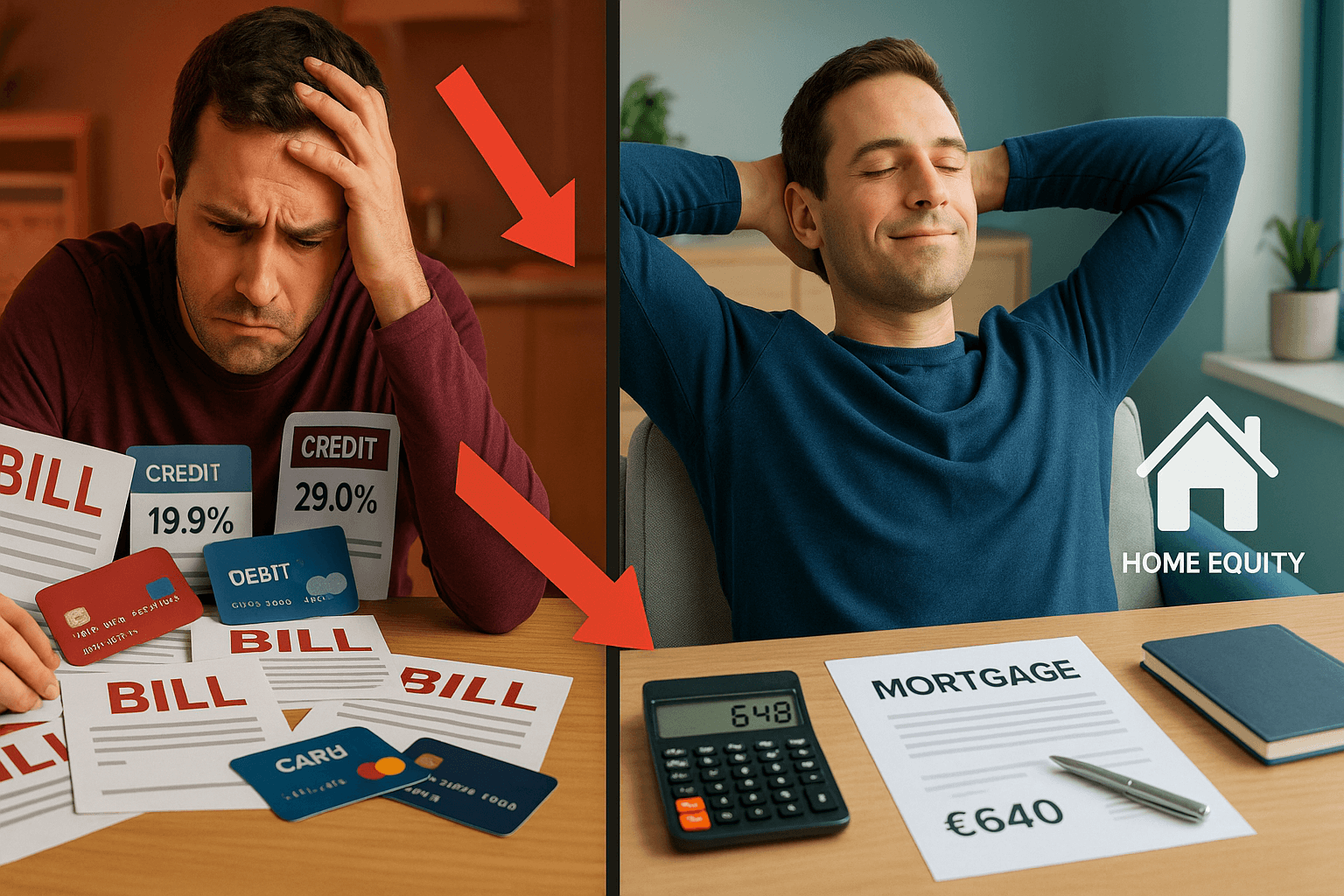

The customer’s primary goal was to switch from an interest-only mortgage to a repayment basis, ensuring that the full mortgage would be settled by the end of the term. However, this transition meant significantly higher monthly payments. At the same time, he was making repayments on a secured loan of £24,364 and an £8,000 unsecured retail finance loan. On top of these obligations, he required urgent funds to fix a leaking roof and address bathroom issues in 2025.

He did not want to exhaust his £6,000 savings for the repairs, preferring to reserve that amount for emergencies. With a combined monthly debt payment of £566 and increasing mortgage obligations, consolidating these debts through a remortgage became a critical step to restoring financial stability.

The Solution: Debt Consolidation Remortgage

Working with mortgage advisors, the customer opted for a debt consolidation remortgage in 2025. This solution allowed him to:

- Switch to a repayment mortgage from his previous interest-only plan

- Consolidate his secured and unsecured loans (£32,364 in total)

- Raise additional funds needed for essential home improvements

The consolidated debts increased the overall repayment cost due to interest over the mortgage term (with a repayment ratio of £1.40 for every £1 borrowed). The new debt over the mortgage lifespan totaled approximately £45,309.60, compared to £34,110 had they remained separate. Yet this strategy enabled a much more manageable monthly outlay, even in 2025.

Results: Improved Financial Flexibility and Security

Despite paying more over time, the homeowner was able to:

- Transition to a repayment mortgage—guaranteeing the loan will be cleared by the end of its term

- Free up monthly income to accommodate the new repayment plan

- Access funds to fix his leaking roof and make necessary bathroom repairs

- Secure a more stable financial future without compromising his lifestyle

Customer feedback:

“This remortgage was critical for me. It meant I could finally repay my mortgage properly and also get my roof sorted without dipping into all my savings. It’s a relief knowing everything is being paid off on schedule.”

FAQs About Debt Consolidation Mortgages

How much can I save monthly by consolidating credit card or loan debts into my mortgage?

While total long-term costs may increase due to extended loan terms, your monthly payments can reduce significantly, improving cash flow. In this case, existing monthly payments of £566 were rolled into the mortgage, making budgeting easier amid increased repayment mortgage costs.

Can I use a remortgage to fund home improvements?

Yes. A debt consolidation remortgage can be structured to raise additional capital. In this scenario, the customer included funding for urgent roof repairs and a bathroom upgrade in 2025.

Does remortgaging affect my credit score?

Initially, your credit score may dip slightly due to hard credit searches. However, consolidating debts into a timely repayment plan can end up improving your creditworthiness over time if you maintain regular payments.

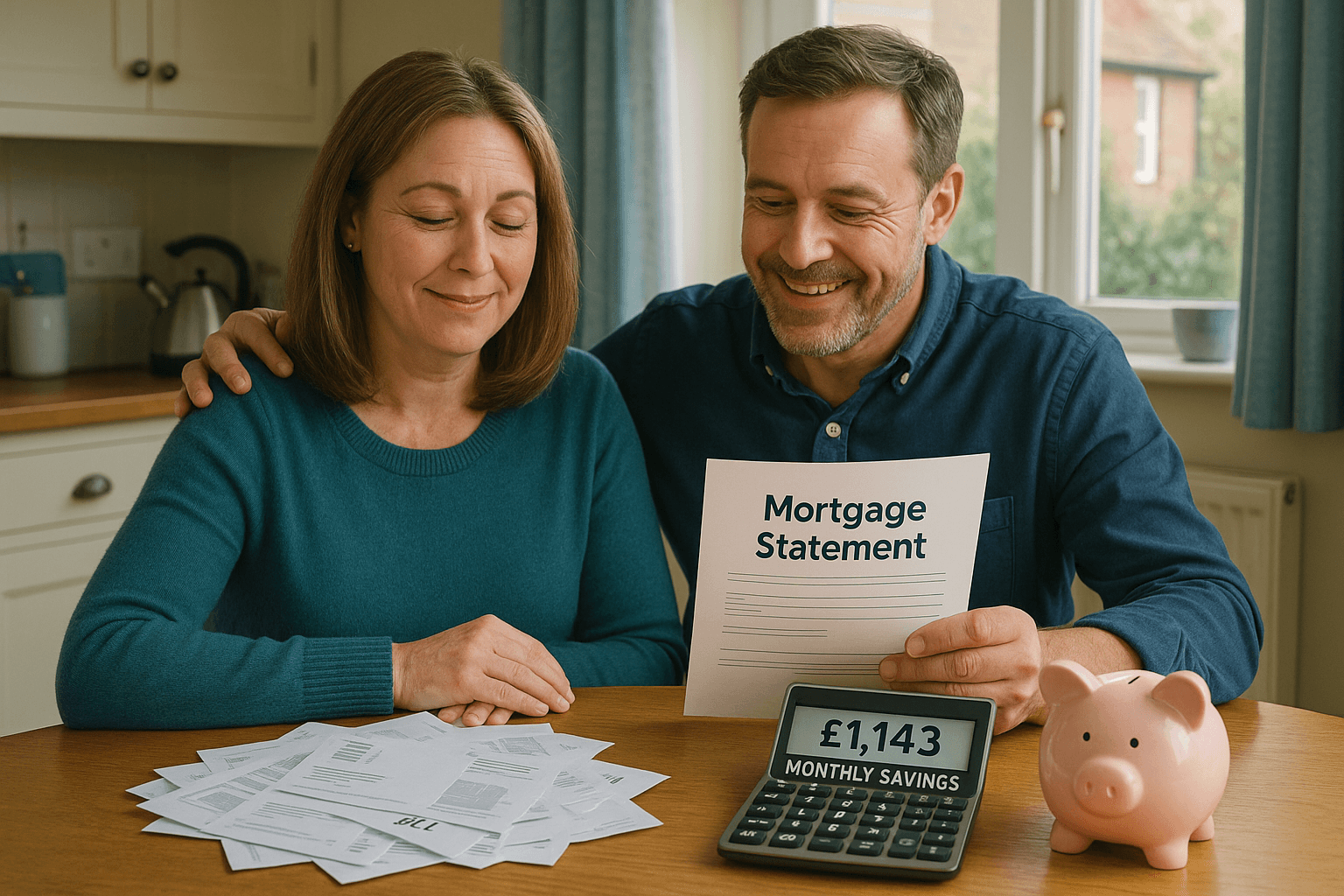

What documents are required for a remortgage application?

You’ll typically need:

- Proof of income (e.g., payslips or tax returns)

- Mortgage statement

- Identification documents

- Details of the debts to be consolidated

Can I repay a fixed-rate mortgage early without penalties?

Most fixed-rate mortgage products carry early repayment charges (ERCs) during the fixed period. It’s vital to check your specific lender’s terms or consult with a broker before proceeding with early repayment.

Find the Right Debt Consolidation Mortgage with Expert Help

If you’re considering whether a remortgage to clear debt could work for you, our expert advisors can guide you through your options while protecting your long-term financial interests. Whether it’s switching to a repayment basis, rolling in loan repayments, or funding essential home improvements—support is just a call or click away.

Take the first step toward financial clarity today. In 2025, a debt consolidation mortgage could present the perfect opportunity to put your financial plans into action. Contact our team for a no-obligation consultation and discover how a consolidation mortgage can help secure your future.

Ready to apply or see your best options?

Find your best deals online in minutes or request a no-obligation callback from one of our expert advisors to talk through your options or just get honest advice.