Customer Overview

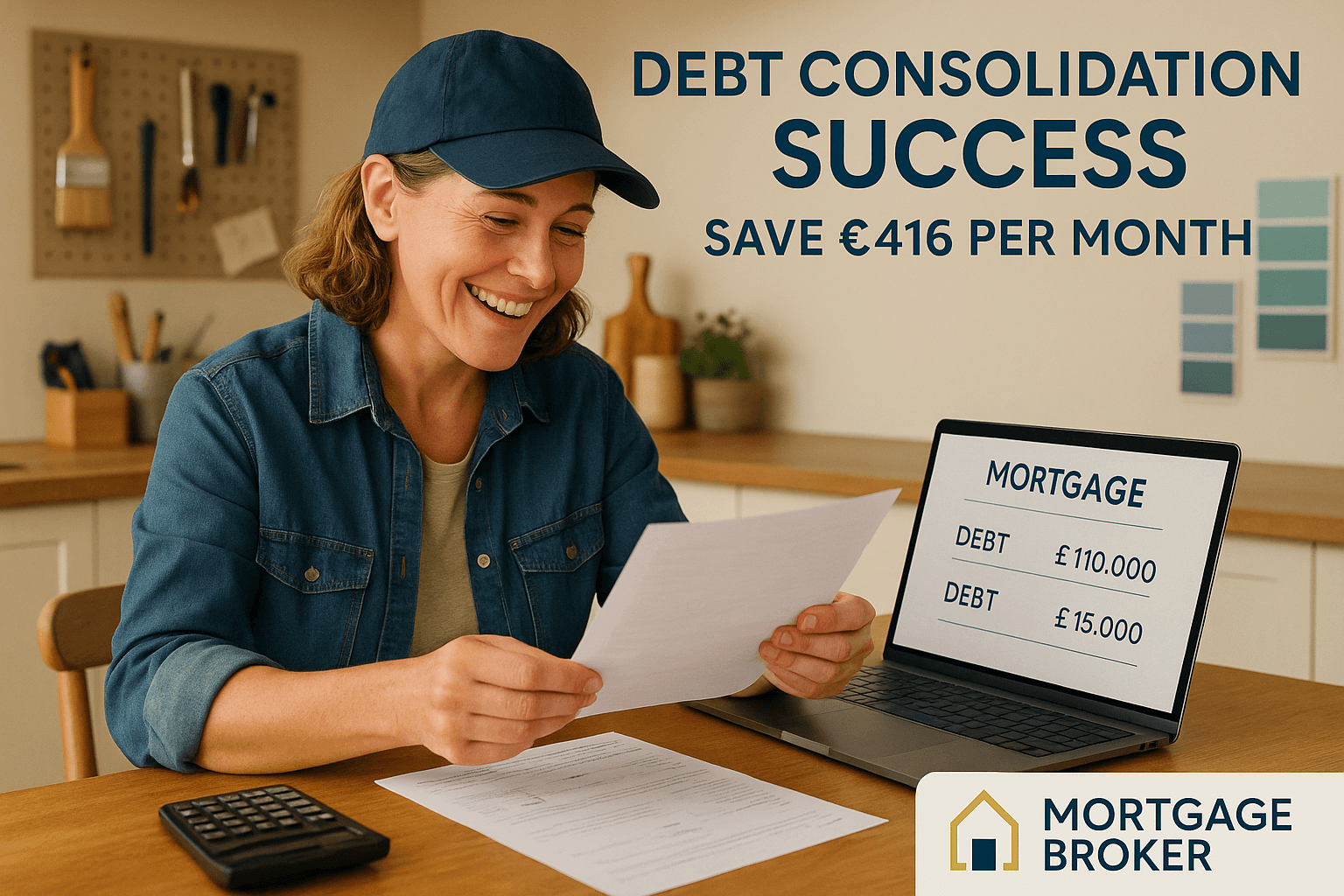

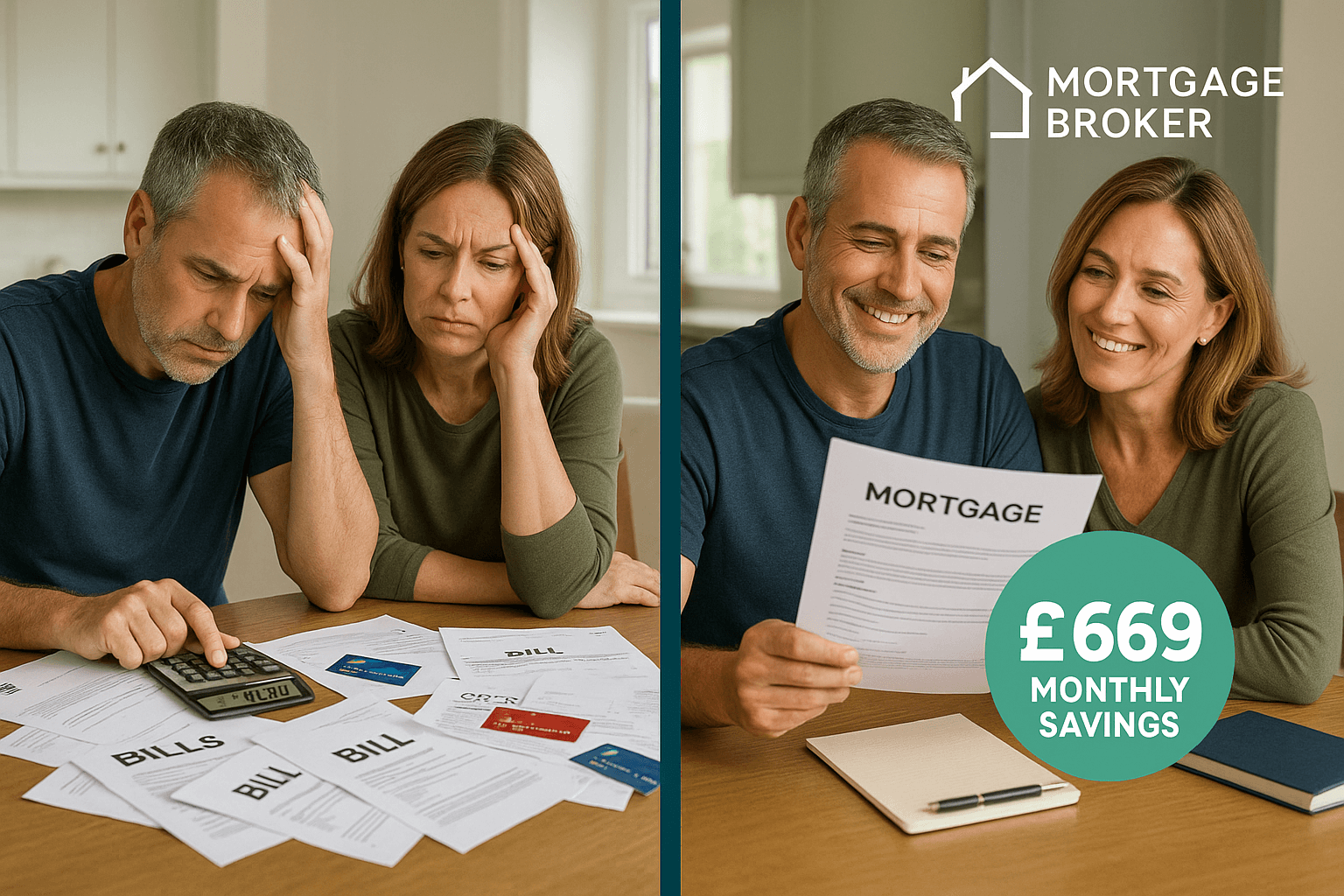

A woman in her 40s, working full-time in a professional role, residing in the UK, faced significant monthly financial pressures. Despite earning a regular income, her outgoings far exceeded her income due to a combination of high-interest debts and the impact of rising living costs. The burden of trying to meet numerous debt repayments each month was taking a toll on her mental health and overall financial well-being.

The Financial Challenge

The customer was juggling a range of debts totaling £37,347.00, consisting mainly of high-interest credit cards and one unsecured personal loan. Repayments of £1,101 per month with interest rates as high as 30% were leading to little-to-no reduction in the principal balances. In some cases, she was only able to cover the interest, making minimal progress in clearing the debt. A debt consolidation remortgage could be the answer to her predicament.

This high debt load had left her with little to no disposable income, creating ongoing financial stress and a risk of missed payments, which could have further harmed her credit profile and hindered future accessibility to competitive mortgage products.

The Debt Consolidation Remortgage Solution

To help reduce her financial burden, a debt consolidation remortgage was arranged. This involved consolidating all existing commitments into her mortgage, moving £37,347 of unsecured, high-interest debt into a long-term mortgage repayment plan at a significantly lower interest rate.

Key Features of the Solution

- Consolidated all debts into one affordable mortgage payment

- Fixed a lower interest rate compared to existing credit agreements

- Extended repayment over a mortgage term to spread costs evenly

- Freed up monthly income to reduce financial pressure

The customer was fully informed on the implications of this move—including the cost of paying interest over a longer term and turning unsecured debts into secured debts. Calculations showed she would pay approximately £66,104.19 to clear the debt through her mortgage, compared to £54,658 if she continued paying them separately, but would reduce financial stress and the risk of accumulating further debt.

The Results: Increased Disposable Income and Financial Stability

The combined result of consolidating all commitments into her mortgage led to an immediate improvement in her household budget. Her net disposable income increased by approximately £1,085.22 per month. Instead of barely covering interest fees across multiple accounts, she now has a singular, manageable mortgage payment with a clear debt-free timeline. This debt consolidation remortgage approach has proven valuable.

“I was getting overwhelmed by trying to stay on top of multiple payments. This remortgage gave me breathing room every month. I’ve started saving again and feel back in control of my finances.”

This approach has not only improved her day-to-day finances but is also laying the foundation for a more stable credit record. The expectation is that at the end of her fixed-rate deal, she will be in a position to transition back to a high-street lender with access to more favourable terms.

Frequently Asked Questions (FAQs)

How much can I save monthly by consolidating credit card debts into a mortgage?

In this case, the borrower saved approximately £1,085.22 per month in outgoings by consolidating multiple high-interest debts into a single mortgage payment. Exact savings vary based on your specific debts and interest rates.

Can you remortgage to pay off debt?

Yes, many homeowners remortgage to consolidate debt. By rolling unsecured credit cards or loans into your mortgage, you can reduce interest costs and simplify monthly payments. Considering debt consolidation remortgage options can be very beneficial.

Does remortgaging affect my credit score?

Initially, applying for a remortgage may cause a small dip in your credit score due to the credit check. However, consolidating debts and successfully managing a single payment may improve your score over time.

What documents are required for a remortgage application?

- Proof of identity (passport or driving license)

- Proof of income (payslips, bank statements)

- Mortgage statements

- Details of all debts you wish to consolidate

- Proof of address

Can I repay a fixed-rate mortgage early without penalties?

Most fixed-rate mortgages have early repayment charges (ERCs). The exact penalties vary by lender and product, so always review your mortgage terms or speak to your adviser.

Take Control Through Debt Consolidation Remortgaging

If you’re struggling to manage monthly repayments and would benefit from combining multiple debts into one lower-rate mortgage, we’re here to help. A structured debt consolidation strategy can relieve stress and improve your overall financial wellbeing—while putting you back on track for future mortgage eligibility.

Ready to explore your debt consolidation remortgage options? Use our remortgage calculator or speak with one of our advisers today to start your journey towards financial clarity.

Ready to apply or see your best options?

Find your best deals online in minutes or request a no-obligation callback from one of our expert advisors to talk through your options or just get honest advice.