Customer Overview

A married couple in their 50s, both employed professionals from the Midlands, were approaching a critical transition in life—planning for retirement. With their fixed-rate mortgage term ending and existing debts from credit cards, loans, and a secured loan building up, they saw an opportunity to simplify finances and reduce monthly payments. The debt consolidation remortgage process seemed ideal for their situation.

The Challenge: Mounting Debt and Retirement Worries

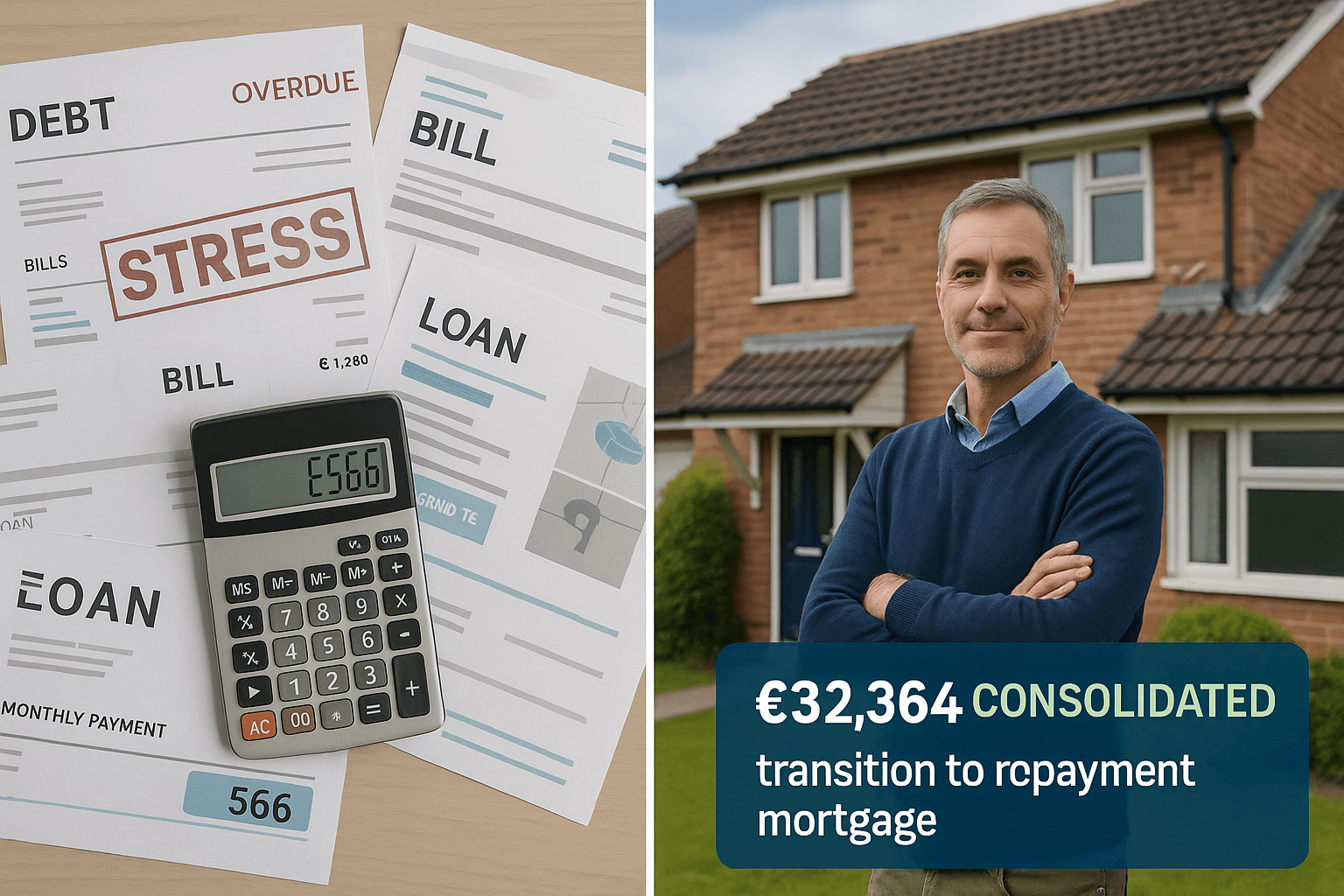

Our clients had accumulated over £104,000 in debt, spread across credit cards with high interest rates, unsecured loans, and a large secured loan. They were not in financial distress, but escalating repayment amounts were limiting their monthly savings potential and preventing them from building a future nest egg.

- Total debt to consolidate: £104,910

- Monthly repayments on loans and debts: £1,811

- Key contributors: high-interest credit cards (up to 65%), high secured loan balance

The current financial structure meant a high monthly outflow with little left to allocate for long-term savings. With retirement looming, this was no longer sustainable.

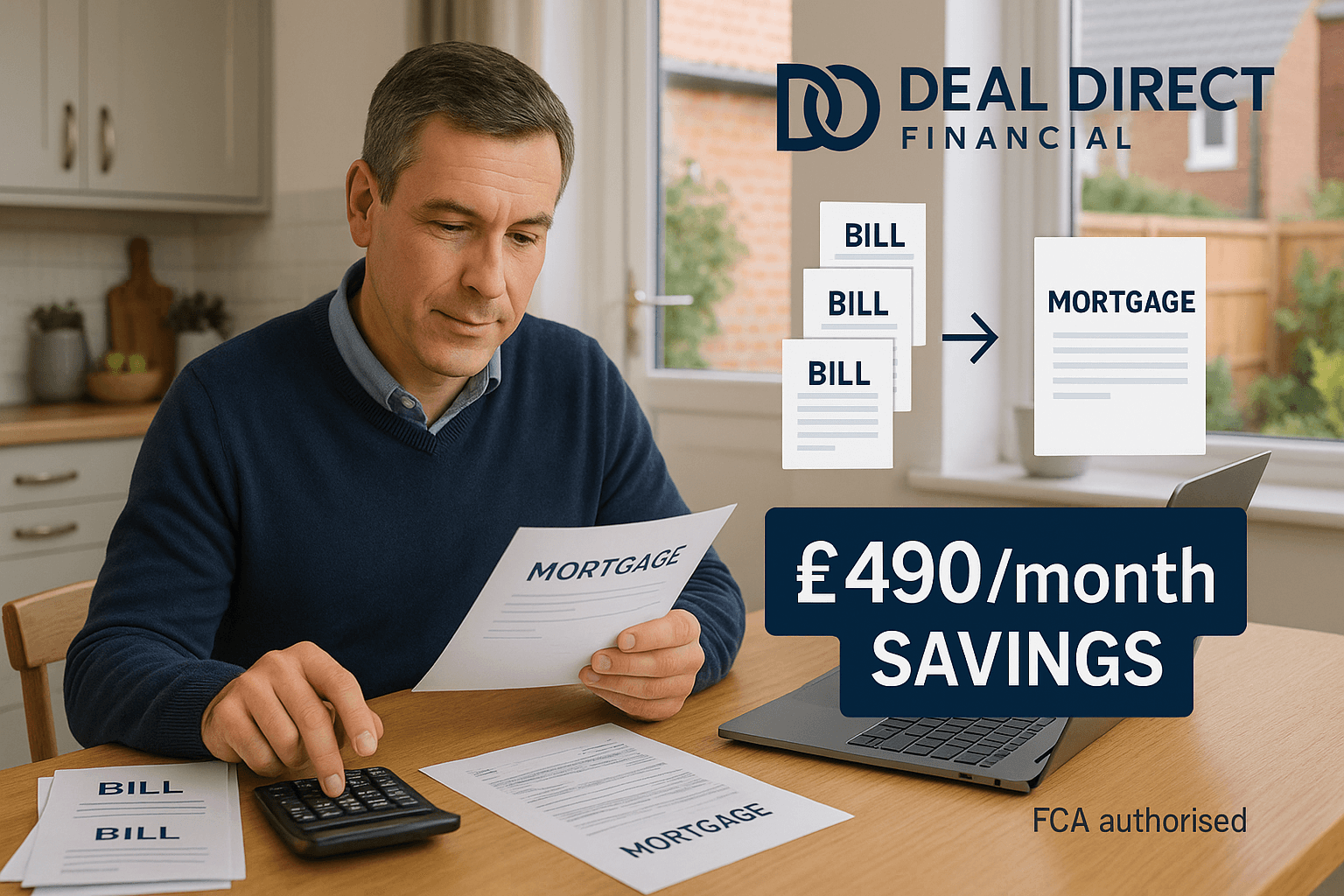

The Solution: A Debt Consolidation Remortgage

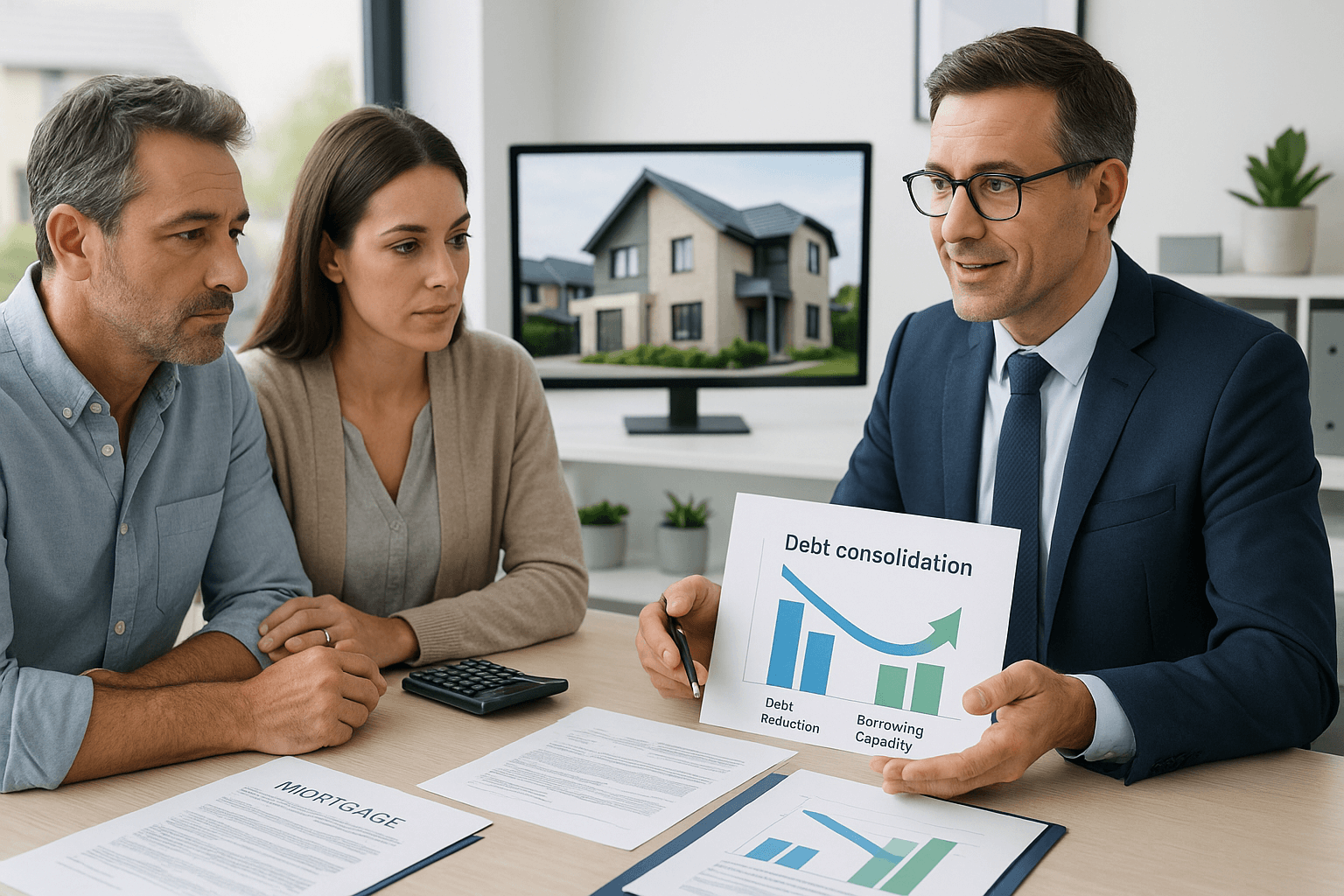

We advised our clients that this was the ideal time to remortgage to pay off debt, especially with their fixed-rate mortgage ending. By incorporating their existing mortgage and all unsecured commitments into one new mortgage deal, they could take advantage of significantly lower interest rates and free up monthly cash flow. Essentially, the solution was a tailored debt consolidation remortgage.

Key Features of the Remortgage:

- Debts consolidated into mortgage: £104,910

- Approximate cost over the term: £143,726

- Estimated interest paid per £1 borrowed: £1.37

- New monthly mortgage repayments: Significantly reduced compared to total previous loan payments

- Increased disposable income: Approx. £915.80 per month

Factors Considered in the Strategy:

- The couple’s existing mortgage term could accommodate the rolled-in debt

- They understood the long-term cost of interest but prioritised financial flexibility

- They no longer needed to support their daughter financially, reducing future risk of new debt

- The secured loan had been a short-term solution due to a previously impacted credit score

By consolidating high-interest credit cards and smaller loans into the mortgage, they gained peace of mind, a solid repayment end date, and a clear financial path to retirement.

Results Achieved

- Monthly cost savings: Increased disposable income by £915.80 each month

- Long-term savings: £5,533.30 over the life of the mortgage (assuming fixed payments)

- Psychological benefit: One manageable payment instead of multiple creditors

- Increased financial control: Clear debt-free target date at mortgage completion achieved through the debt consolidation remortgage process.

“The remortgage has put us in a better place. We can finally start saving and prepare for our retirement without the stress of juggling multiple high-interest payments.” — Our clients, 50s, Midlands

Frequently Asked Questions

How much can I save monthly by consolidating credit card debts into a mortgage?

It depends on your existing debt structure and interest rates. In this case, the clients saved approximately £915.80 per month, thanks to significantly lower mortgage interest compared to credit cards and loans.

Can you remortgage to fund home improvements?

Yes, remortgaging can be used to raise funds for home extensions, renovations, or repairs, as long as you have sufficient equity and affordability.

Does remortgaging affect my credit score?

Initially, a credit check might cause a small temporary dip, but in the long run, consolidating and reducing debts can improve your credit profile—especially if it helps avoid missed payments.

What documents are required for a remortgage application?

Typically, you’ll need ID, proof of income, bank statements, proof of current mortgage, and a credit report. Some lenders may request additional information.

Can I repay a fixed-rate mortgage early without penalties?

Most fixed-rate mortgages have early repayment charges (ERCs), so check your mortgage terms or speak to your adviser before making overpayments.

Plan for Your Future with Confidence

If you’re carrying multiple high-interest debts and want to simplify your finances while increasing your monthly cash flow, a debt consolidation mortgage could be the key. Whether you’re nearing retirement like Jackie and Jason or just looking for a fresh start, our expert advisers can guide you through your remortgage options, including strategies for debt consolidation remortgage.

Ready to reduce your monthly expenses and secure your financial future?

Contact us today to explore your debt consolidation remortgage options.

Ready to apply or see your best options?

Find your best deals online in minutes or request a no-obligation callback from one of our expert advisors to talk through your options or just get honest advice.