Mounting monthly credit payments and high interest rates can quickly spiral into unmanageable stress. For one UK homeowner, consolidating their debts into their mortgage provided the relief they desperately needed. In this case study, we explore how a tailored debt consolidation mortgage helped transform financial pressure into financial clarity and stability, illustrating the impact of a debt consolidation mortgage case.

Customer Overview

The client, a woman in her mid-30s employed in the education sector, owns a home in the South of England. She had steadily accumulated a number of high-interest credit commitments stemming from home improvements and increasing living costs. With outgoings exceeding her income, she was under significant financial pressure trying to keep up with multiple monthly payments in such a debt consolidation mortgage case.

The Challenge: High-Interest Debts and Financial Strain

This homeowner had accumulated over £48,000 in high-interest debts across various lenders, including credit cards and unsecured loans. Her repayments exceeded £1,100 monthly, and most of her payments were barely touching the capital due to soaring interest rates.

With her equity-rich property offering potential support, she explored options to restructure her debt to:

- Reduce monthly financial commitments

- Relieve stress from juggling multiple repayments

- Secure a more manageable and long-term repayment strategy through her mortgage

Breakdown of Debts Included in the Consolidation

- Credit Cards: £5,638 at 29%–30% APR (Halifax and MBNA)

- Unsecured Loans: £42,561 across Zopa, NatWest, and Nationwide with interest rates from 10% to 19%

- Total Debts: £48,199

- Monthly Repayments: £1,100+

The Solution: A Debt Consolidation Remortgage

Working closely with a mortgage adviser, the client opted to remortgage to consolidate debt into a single, manageable monthly payment. By leveraging approximately £59,000 of available equity in her home, she was able to roll all her high-interest loans into a new mortgage deal with a considerably lower interest rate.

This strategic mortgage refinance meant that all debts became part of one secure repayment structure, stretched across the term of the mortgage at affordable monthly installments. It effectively represented a debt consolidation mortgage case in action.

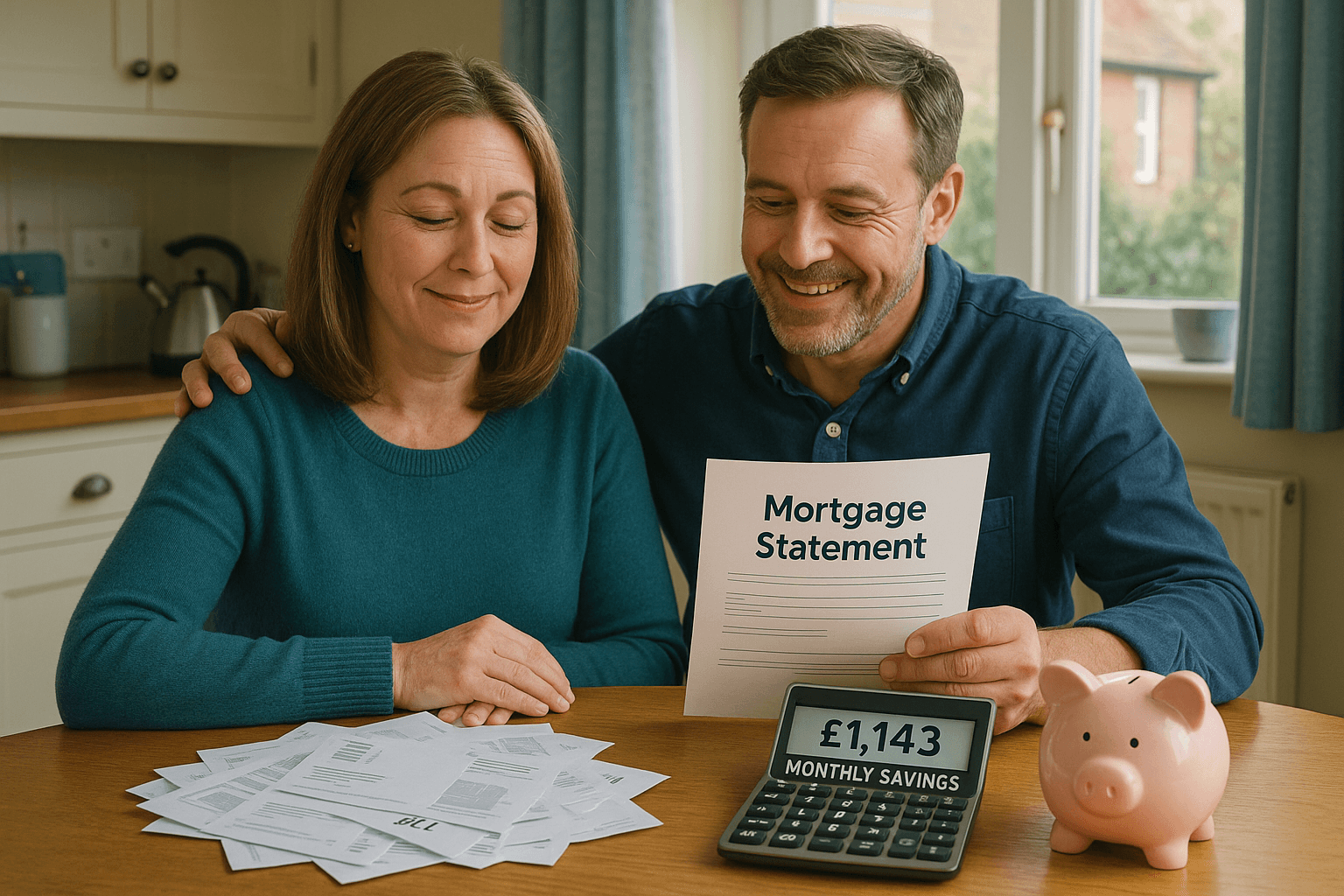

Key Benefits of the Debt Consolidation Mortgage

- Lower Monthly Repayment: Net monthly disposable income increased by approximately £640.40

- Streamlined Finances: One consolidated monthly mortgage payment instead of multiple lender payments

- Interest Savings: Over the full term, the consolidated debt would cost £15,500.23 less, assuming no further rate increases

- Reduced Stress: Clear repayment plan with manageable installments

The Outcome: Financial Relief and Greater Security

Although consolidating stretched the repayment over the full mortgage term — resulting in more interest paid over time — it provided the homeowner with invaluable peace of mind and additional breathing space in her monthly budget.

Now that her finances are more manageable, she’s committed to building savings with her extra disposable income — decreasing the chance of falling back into debt in the future. Her case exemplifies how managing a debt consolidation mortgage case can lead to long-term financial benefits.

“I was constantly juggling payments to avoid missing deadlines, and it had become overwhelming. This solution gave me room to breathe and a real plan to finally pay off what I owe.”

Frequently Asked Questions

How much can I save monthly by consolidating credit card debts into a mortgage?

In this real-life case, the homeowner saw a reduction of approximately £640.40 per month in financial outgoings. Savings depend on your interest rates, balances, and mortgage terms.

Does remortgaging to consolidate debts increase overall repayment?

Yes, because you’re spreading the repayments over a longer period, your total repayment might be higher. However, monthly affordability improves drastically, which may outweigh the long-term cost.

Can I remortgage to pay off all forms of unsecured debt?

Yes, you can consolidate most unsecured debts — including credit cards, personal loans, and store cards — as long as there is sufficient equity in your home and your income supports the mortgage affordability.

Will this affect my credit score?

Initially, your credit score may not change much. However, reducing your credit utilisation and maintaining regular payments on the new mortgage can improve your score over time.

What documents are needed to begin the remortgage process?

Typically, you’ll need proof of income (payslips), bank statements, ID, documentation of current debts, and your current mortgage statement.

Take the First Step Toward Financial Freedom

If you’re struggling with mounting monthly debt repayments and own your home, a debt consolidation remortgage could help transform your financial situation. Speak with one of our expert advisers today to explore your options, calculate your potential savings, and start building a worry-free future.

Ready to regain control of your finances? Contact us now for a free, no-obligation consultation.

Ready to apply or see your best options?

Find your best deals online in minutes or request a no-obligation callback from one of our expert advisors to talk through your options or just get honest advice.