Customer Overview

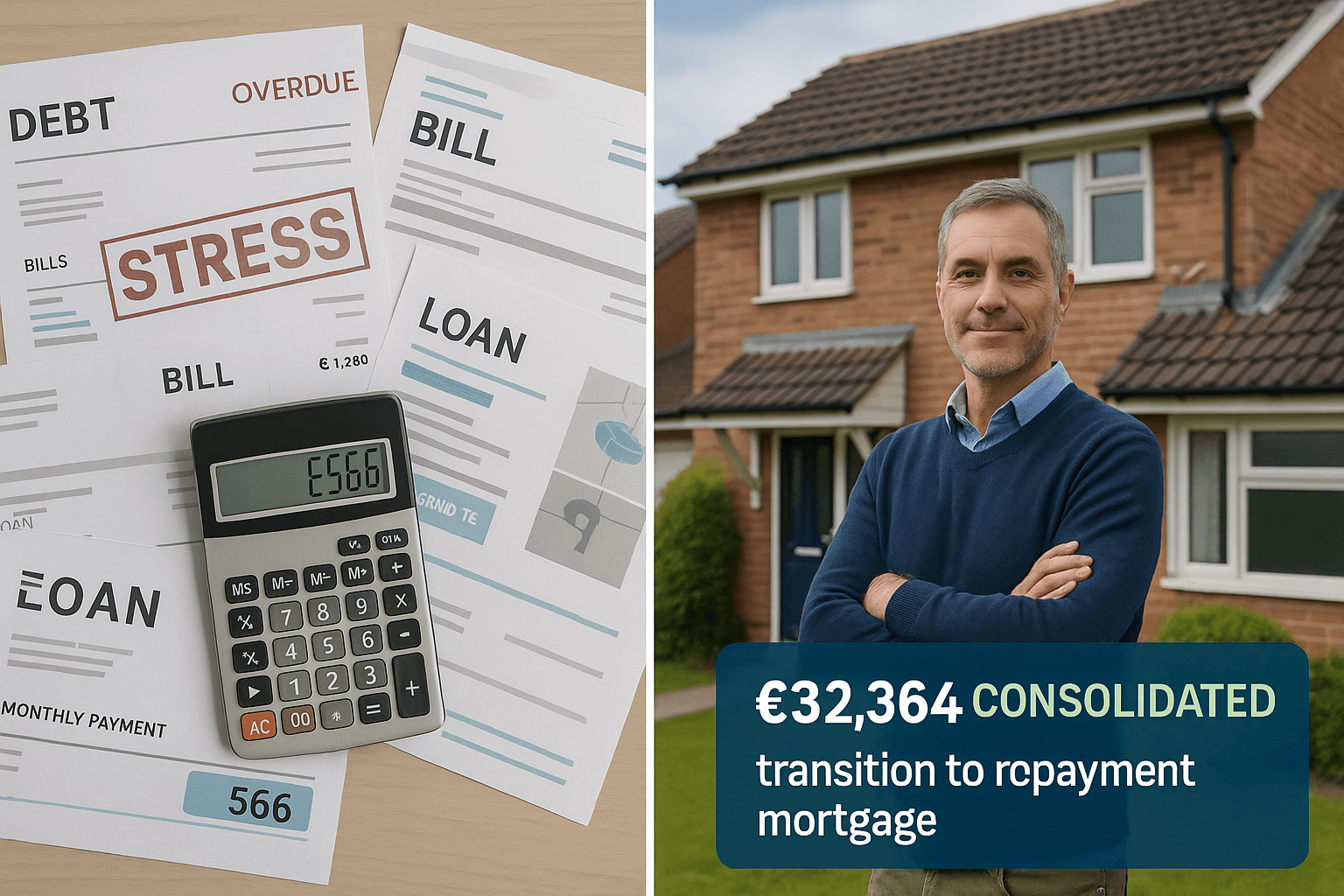

A middle-aged couple living in the UK, both employed in customer service roles, found themselves financially overwhelmed. Juggling over £51,000 in high-interest credit cards, unsecured loans, and finance agreements, their monthly outgoings far exceeded their income. They considered a debt consolidation remortgage 2025 strategy to regain control.

This imbalance led to ongoing financial stress with no ability to save and growing anxiety about winter utility bills and missed payments. Their goal was clear: relieve financial pressure, simplify repayments, and create a foundation to begin saving.

The Challenge: Overwhelming Debt and No Financial Breathing Room

Before seeking expert advice, the couple managed 14 different repayment commitments, with interest rates as high as 30%. Monthly payments totalling £1,660 drained their income, and balances barely decreased due to paying mostly interest. Many of these debts were projected to stretch out over the next 5 to 10 years. The need for a debt consolidation remortgage 2025 plan became more acute as they sought financial relief.

The couple had no savings, no spare income, and no option to cancel existing financial obligations. The idea of saving or even enjoying a night out seemed increasingly unrealistic amid rising living costs. They feared future rate hikes and winter energy bills could tip them over the edge.

The Solution: A Strategic Debt Consolidation Remortgage

After assessing their situation, we recommended a debt consolidation remortgage to combine £51,516 worth of high-balance, high-interest debts into their existing mortgage. This significantly reduced their number of monthly payments and overall financial strain, aligning with their goal of debt consolidation remortgage 2025. While securing unsecured debts over the mortgage term increases the total repayable amount, it drastically lightened their monthly commitments.

We transparently informed them about the long-term cost, estimating they’d pay £2.05 for every £1 borrowed if held for the full term – approximately £105,607.80 in total for the consolidated debt. However, they understood that the short-term gain in affordability and simplicity was vital to regaining control of their finances through a debt consolidation remortgage 2025 approach.

They also chose not to consolidate some smaller or shorter-term debts in line with our advice, preferring instead to handle those with their newly freed disposable income.

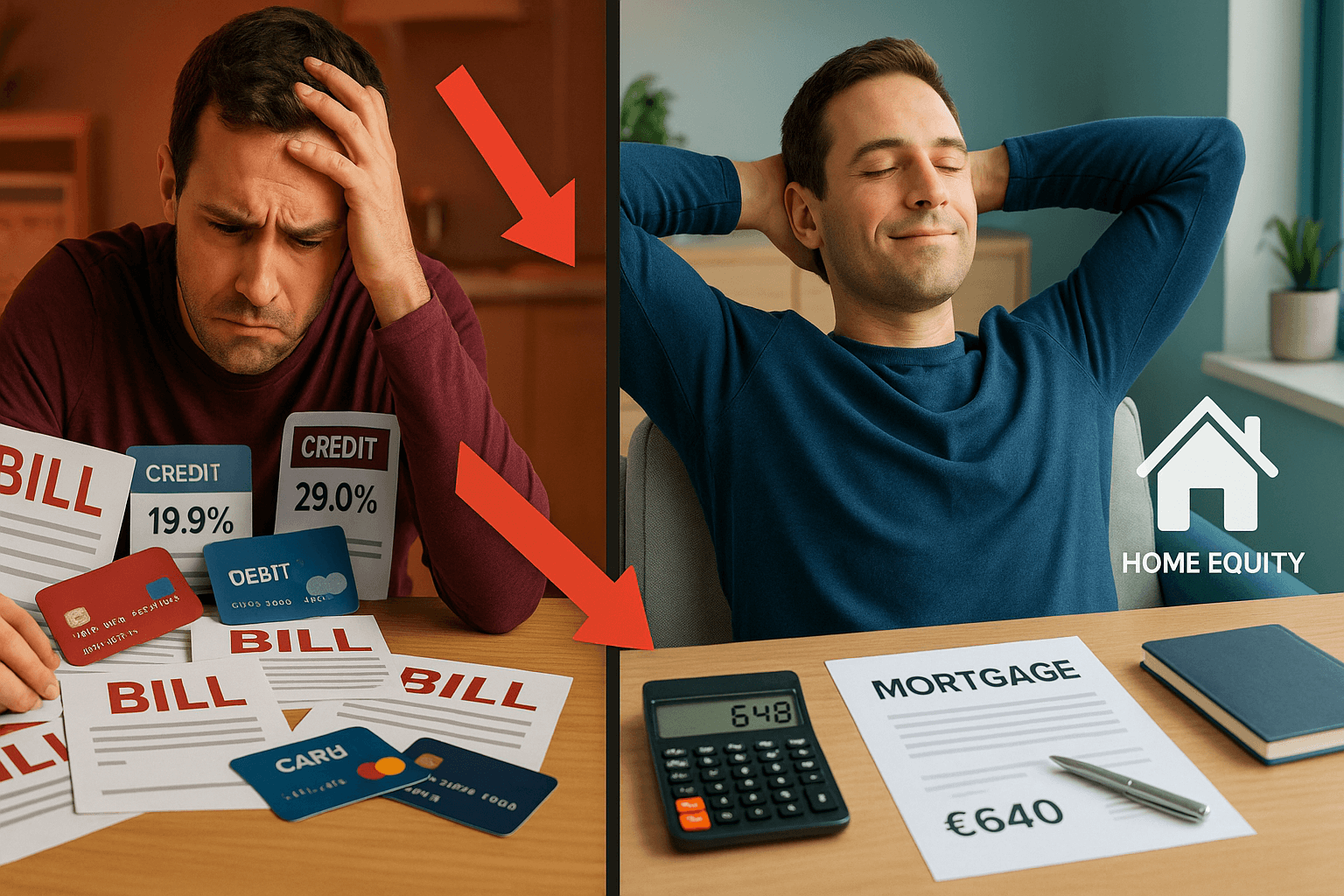

Results: Over £1,100 Increase in Monthly Disposable Income

- Monthly cash flow improved by approximately £1,143

- Stress significantly reduced by managing one affordable monthly mortgage payment instead of 14 different lenders

- Saved on high-interest credit card rates between 27%–30% annually

- Began setting up a savings pot for future expenses, reducing dependence on credit

The financial breathing room not only helped with essential spending, especially during the winter season, but also allowed the couple to start planning for the future—something they couldn’t do before.

“It felt like we were just keeping our heads above water. Now, with one manageable monthly payment and extra money left over each month, we’re finally starting a savings account and sleeping better at night.”

Frequently Asked Questions

How much can I save monthly by consolidating credit card debts into a mortgage?

In this case, the clients saved approximately £1,143 per month by consolidating their high-interest credit and personal loan repayments into their mortgage through a debt consolidation remortgage 2025 strategy. Actual savings depend on your debt amount, interest rates, and mortgage terms.

Can you remortgage to fund home improvements?

Yes, many homeowners choose to remortgage not only for debt consolidation but also to fund home improvements. However, it’s important to review the long-term cost implications with your mortgage advisor.

Does remortgaging affect my credit score?

Initially, your credit score may dip slightly due to the new credit activity. However, if managed correctly, remortgaging and reducing outstanding debt can improve your credit score over time.

What documents are required for a remortgage application?

You’ll typically need:

- Proof of income (payslips, tax returns)

- Recent bank statements

- Details of any current debts

- Proof of ID and address

Can I repay a fixed-rate mortgage early without penalties?

Most fixed-rate mortgage deals come with early repayment charges (ERCs). However, many lenders allow overpayments up to a certain percentage annually without penalties. Always check your lender’s terms or speak to an advisor.

Take Control of Your Finances Today

If you’re feeling overwhelmed by multiple debts and mounting monthly costs, a debt consolidation mortgage might offer the clean slate you need. While it’s important to understand the long-term implications, the short-term benefit of increased disposable income and reduced stress can be life-changing.

Contact us today to speak with a mortgage advisor and explore your options. Let us help you build a clearer financial future—starting with one affordable monthly payment.

Ready to apply or see your best options?

Find your best deals online in minutes or request a no-obligation callback from one of our expert advisors to talk through your options or just get honest advice.