Customer Overview

A married couple in their late 30s, both working full-time in the Midlands area, sought a financial solution to streamline their monthly outgoings via debt consolidation and remortgage options. With no significant financial hardship and solid employment stability, their goal was to proactively improve their financial position by consolidating debts and clearing a lingering Help to Buy loan.

The Challenge: Managing Multiple Financial Commitments

Over the years, the couple accumulated various financial obligations, including:

- Numerous high-interest credit cards

- A large Help to Buy equity loan

- Several unsecured loans and one secured loan, some with high monthly repayments

- A need for essential home improvements (window and door replacements)

Although the couple weren’t in financial distress, they expressed a desire to:

- Reduce the mental burden of managing multiple repayments

- Consolidate £56,464.00 of existing debt into a single mortgage payment, possibly through a debt consolidation remortgage.

- Clear the Help to Buy loan to avoid future increases as property values rise

- Tidy up their finances and start fresh

They had previously investigated secured loans but were hindered by the existing Help to Buy charge on their property. Additional borrowing was not an option with their current lender, making a remortgage the best available path forward.

The Solution: A Debt Consolidation Remortgage

We structured a tailored debt consolidation remortgage strategy to achieve the couple’s objectives. Here’s how the plan worked:

- Help to Buy Loan Cleared: The remortgage paid off the outstanding equity loan, giving the couple full ownership and preventing future value-linked increases.

- Debt Consolidation: A total of £56,464.00 across various unsecured and secured debts was rolled into the mortgage, creating one manageable monthly payment as part of a debt consolidation remortgage plan.

- Home Improvement Costs Covered: Instead of adding to their unsecured debt, the couple financed new windows and doors through their mortgage.

- Reduced Term: They opted to slightly reduce their mortgage term to 23 years, aiming to save thousands in interest in the long run.

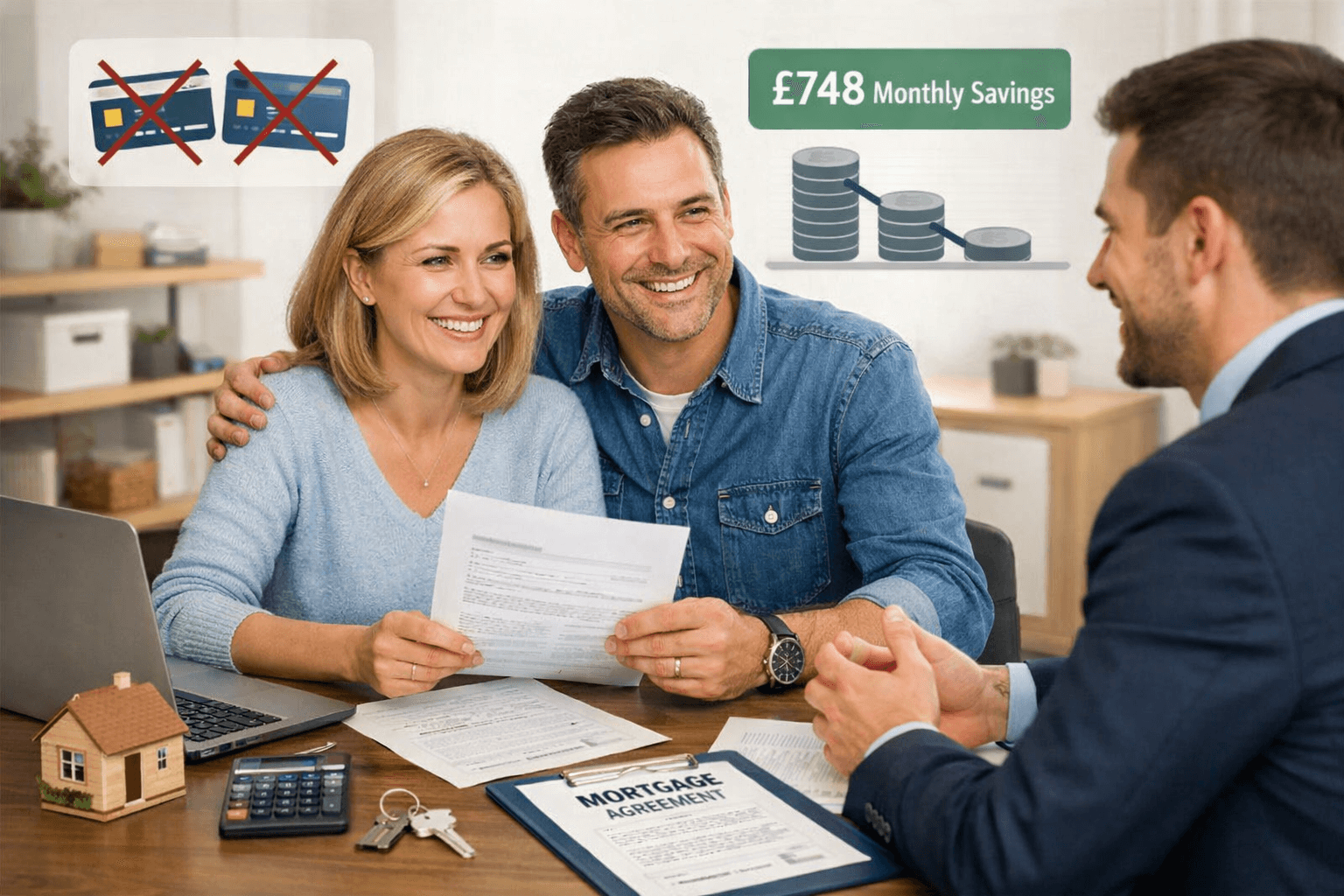

The Outcome: Increased Flexibility and Reduced Outgoings

- Net Monthly Income Boost: With all debts consolidated, their disposable income increased by approximately £690.83 per month thanks to the remortgage strategy.

- Simplified Finances: Rather than managing multiple creditors and billing cycles, they now have a single, predictable mortgage payment through their debt consolidation remortgage.

- Proactive Financial Planning: The couple plans to use their increased disposable income to build savings and make mortgage overpayments.

- Long-Term Interest Costs: While the overall repayment cost increased due to spreading the debt over the mortgage term, the structured plan ensures lower monthly outgoings and better financial management.

“We’re not struggling, but this remortgage has helped us tidy everything up. We finally cleared the Help to Buy, reduced our rates, and don’t have to juggle so many payments anymore. It feels like a fresh start.” – Midlands couple

Frequently Asked Questions

Can you remortgage to consolidate debt?

Yes, many homeowners consolidate multiple debts—such as credit cards, unsecured loans, and equity loans—into one mortgage payment. This often lowers monthly repayments and simplifies budgeting through schemes like debt consolidation remortgages.

Does remortgaging to consolidate debt save money?

It can reduce monthly payments, but you may pay more interest long-term since the debt is repaid over a longer period. In this case, the couple saved nearly £690/month but will pay approximately £10,441 more over the full term.

What’s required to remortgage and consolidate debt?

You’ll need documents like proof of income, credit statements, mortgage balance, and evidence of debts to consolidate. A debt consolidation remortgage requires lenders to assess your overall financial profile when deciding on the application.

Will remortgaging affect my credit score?

Initially, applying for a remortgage may cause a small dip in your score due to a hard credit check, but long-term it can improve your credit by lowering utilization and reducing missed payments risk.

Can I make overpayments on a new mortgage?

Depending on your lender and mortgage type, yes. Many allow you to repay up to 10% of your balance annually without penalties, which is what this couple plans to do as their disposable income increases.

Take Control of Your Financial Future

If you’re managing multiple repayments, a remortgage to pay off debt might be the smart and proactive way to simplify your finances and free up monthly income, offering a structured debt consolidation remortgage option. Whether you want to clear a Help to Buy loan, combine high-interest debts, or fund important home upgrades, our expert team is here to help.

Get in touch today to find out how we can create a debt consolidation remortgage solution tailored to your goals.

Ready to apply or see your best options?

Find your best deals online in minutes or request a no-obligation callback from one of our expert advisors to talk through your options or just get honest advice.