Introduction: Major Update from TSB for Residential Mortgage Applicants

TSB, one of the UK’s leading mortgage lenders, has announced a significant reduction in its residential mortgage “stress rate”—the figure used to assess borrowers’ ability to afford mortgage repayments. This change could allow homebuyers, movers, and first-time buyers to borrow up to £30,000 more than before, reflecting a more borrower-friendly approach in a changing market.

Key Updates to TSB’s Residential Mortgage Product Range

- Stress Rate Reduced: TSB has lowered the interest rate used for affordability assessments on residential mortgages by up to 2%.

- New Stress Rate: The revised stress rate now stands at 6.75% (or your product rate +1% if higher).

- Borrowing Power Increased: Many applicants could see their potential borrowing rise by as much as £30,000, depending on their circumstances.

- Applies to: All residential customers—first-time buyers, home movers, and remortgage applicants.

- Product Range Simplified: Existing First Time Buyer and Home Mover products have been consolidated into one House Purchase range with unchanged rates for easier selection.

Understanding the Stress Rate Change and Who Benefits

The stress rate is central to all mortgage affordability checks. Previously, a higher assumed rate limited how much you could borrow, as lenders had to ensure you could afford repayments – even if interest rates rise. By lowering this assessment rate, TSB is enabling more applicants to maximise their borrowing potential while staying within responsible lending guidelines.

- First-Time Buyers: Greater affordability makes stepping onto the ladder more achievable.

- Home Movers: Expand your search with a potentially higher budget.

- Remortgage Applicants: May find it easier to release equity for home improvements or debt consolidation.

- Self-Employed Applicants: Recently benefitted from an increased maximum loan-to-income (LTI) to 5.5x, further boosting borrowing capacity.

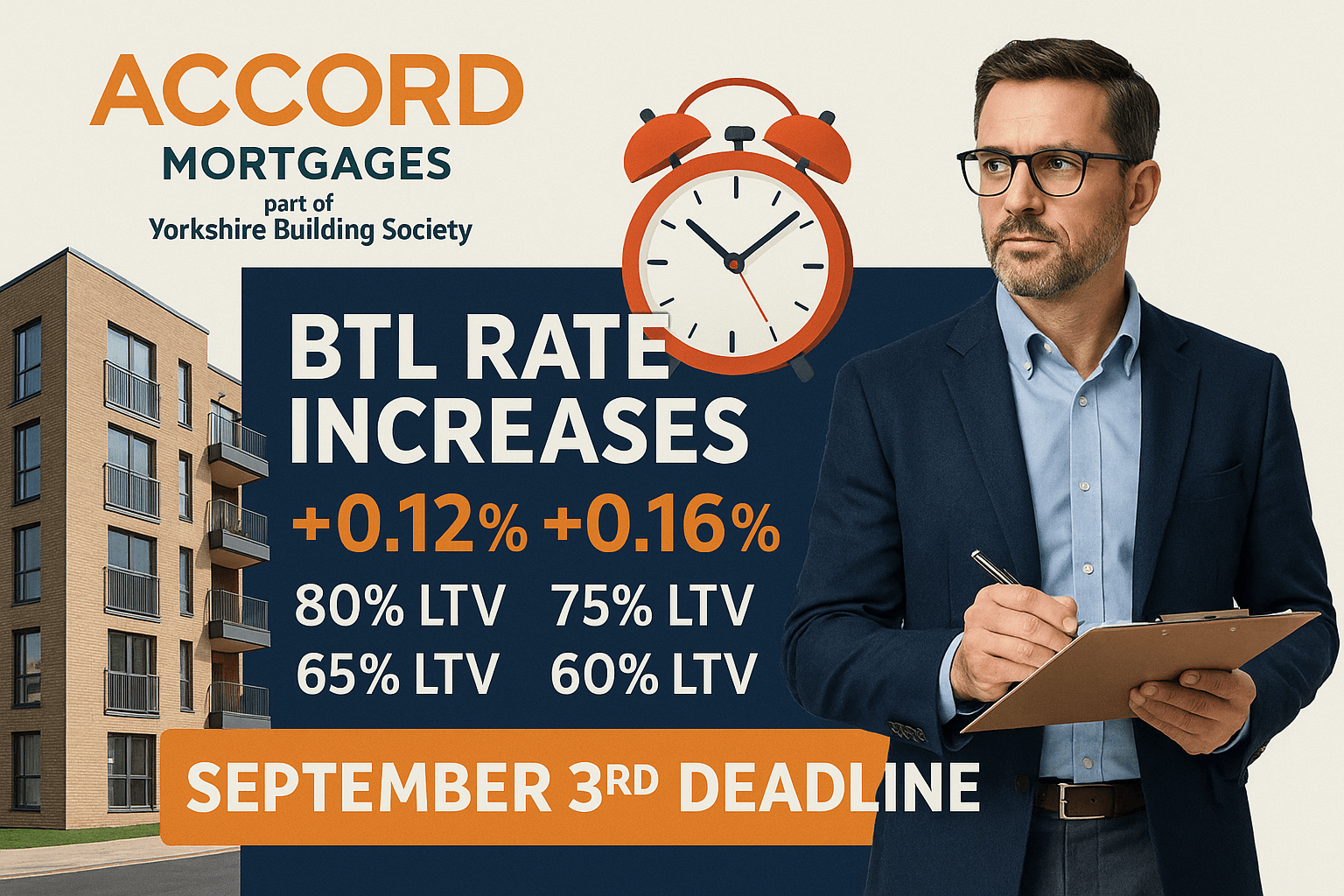

- Buy-to-Let Borrowers: Benefitted from stress rate reductions introduced in April 2025 (for BTL products).

What Does This Mean for Borrowers?

- Increased Borrowing Potential: More flexibility when buying, moving, or remortgaging.

- Simplified Choices: A single House Purchase range now serves both movers and first-time buyers.

- No Change in Product Rates: The actual mortgage interest rates remain competitive and attractive.

- Accessible Specialist Lending: Enhanced criteria for self-employed and specialist scenarios.

Why Consider TSB for Your Next Mortgage?

- Market-Responsive Criteria: With regular policy improvements—such as this stress-rate cut—TSB adapts quickly to market conditions and borrower needs.

- Strong Track Record: TSB is a well-established bank recognised for customer service and award-winning mortgage products.

- Flexible, Simple Products: Streamlined options for all residential buyers; clear documentation and support from a dedicated team.

- Innovative Policies: Recent boosts for self-employed and landlords reflect a modern, inclusive lending approach.

Next Steps: Get Expert Mortgage Advice

If you’re considering moving house, buying your first property, or remortgaging, now is an excellent time to explore your options with TSB. Contact our expert mortgage advisers for clear, independent guidance and to find out exactly how these new lending criteria could benefit you.

- Personalised calculations – see what you can borrow under the new rules.

- Access exclusive rates and products – including for complex or specialist cases.

- Help with paperwork and applications – from start to finish.

Contact us today for a no-obligation mortgage review and take the next confident step towards your property goals.

FAQs: TSB Stress Rate and Mortgage Criteria Updates

- Who can benefit from TSB’s new residential stress rate?

Any applicant for a TSB residential mortgage, including first-time buyers, home movers, and remortgage clients, can benefit from the reduced stress rate. - How does this stress rate reduction affect my potential borrowing?

The lower stress rate means many borrowers may be eligible for a higher loan amount—potentially up to £30,000 more, subject to personal circumstances. - Are there any changes to actual mortgage interest rates?

No – product interest rates remain unchanged at this time, but affordability criteria improvements may widen your choices. - Is this update suitable for self-employed or specialist borrowers?

Yes – the new stress rate applies to all, and self-employed applicants recently benefited from an LTI increase to 5.5x income. - How do I know if I qualify and how can I apply?

Speak with our qualified mortgage advisers for a free eligibility check and help with your TSB mortgage application or alternatives.

Ready to apply or see your best options?

Find your best deals online in minutes or request a no-obligation callback from one of our expert advisors to talk through your options or just get honest advice.