Mortgage & Loan Guides

Barclays Mortgage Rates Cut: 4.12% Fixed Deals August 2025

Barclays has unveiled a new round of mortgage rate reductions across several of its most...

West One Complex Borrower Mortgages: Foreign Nationals 2025

With approximately 9 million people now self-employed or working as...

Accord Mortgages Rate Cuts: Up to 0.40% Off August 2025

These changes involve both rate reductions and increases across a selection of fixed and tracker...

Tandem Bank Self-Employed Mortgages: £250k Loans 2025

This update simplifies paperwork, increases potential loan sizes, and brings self-employed criteria...

Leek Building Society: Fast 24hr Mortgage Decisions 2025

Whether you’re a first-time buyer, a homeowner looking to remortgage, or an investor seeking a buy-to-let...

Halifax First Time Buyer Boost: Borrow 5.5x Income 2025

Halifax is reaffirming its commitment to supporting new homeowners with its latest First Time Buyer...

Metro Bank HMO Mortgage Update: Flexible Buy-to-Let 2025

Metro Bank has announced a significant update to its HMO...

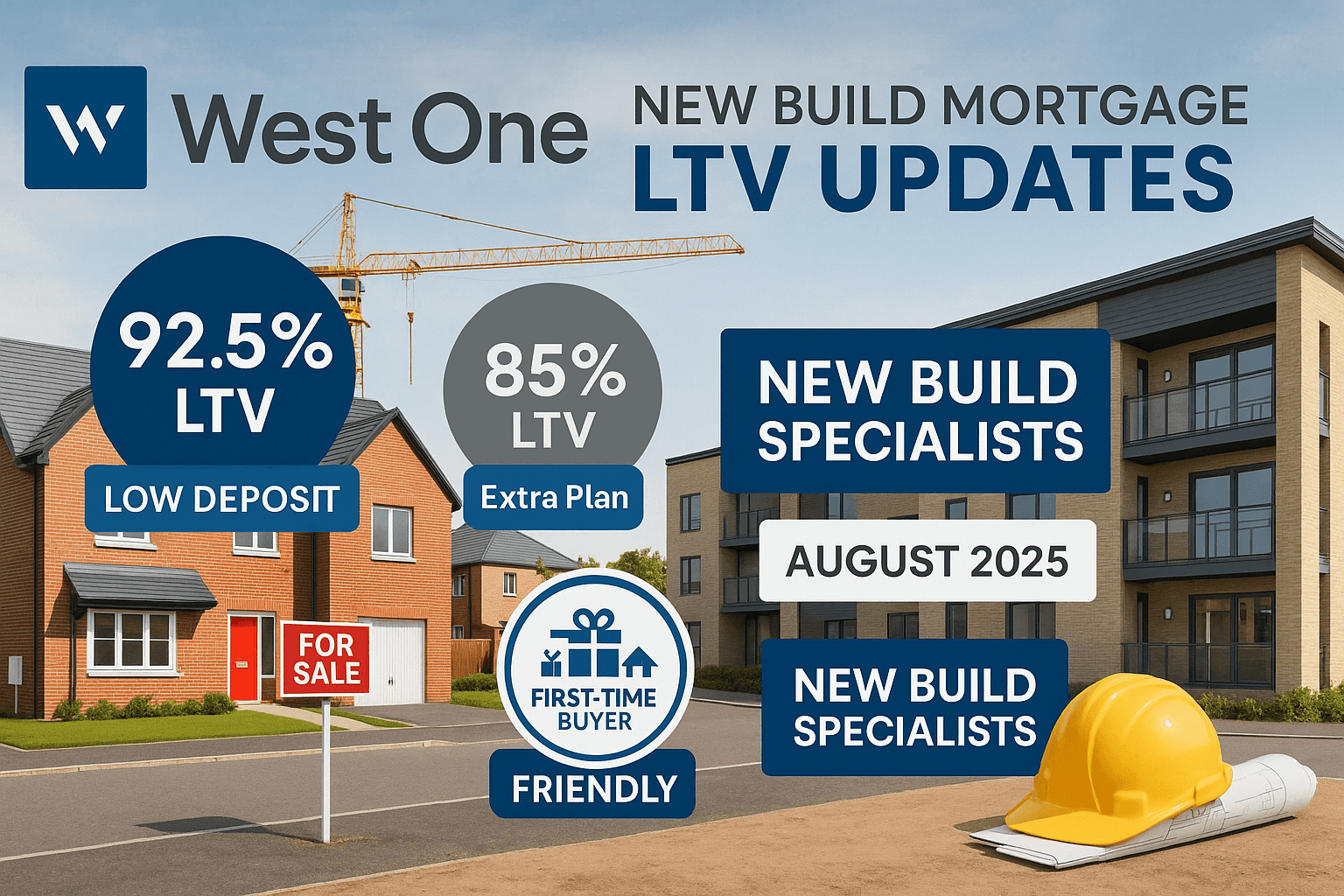

West One New Build Mortgage: 92.5% LTV Extra Plan August 2025

West One has updated its lending policy concerning new build...

Halifax HomePlus Survey August 2025: Digital Level 2 Reports

From Monday, 11 August, customers selecting a Level 2 survey and...

Equitable 2nd Charge Bridging Loans: No Lender Consent Required

MTL Trust has launched an innovative equitable 2nd charge bridging loan...